Clearwire 2008 Annual Report Download - page 62

Download and view the complete annual report

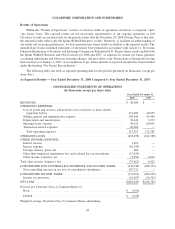

Please find page 62 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

MANAGEMENT’

S

DI

S

CU

SS

ION AND ANALY

S

I

S

OF FINANCIAL CONDITION

AND RE

SU

LT

SO

F

O

PERATI

O

N

S

ITEM 7

.

M

anagement’s Discussion and Analysis of Financial Condition and Results of Operations

The

f

ollowing discussion and analysis summarizes the signi

f

icant

f

actors a

ff

ecting our results o

f

operations,

f

inancia

l

con

d

ition an

dl

i

q

ui

d

ity position for t

h

e years en

d

e

d

Decem

b

er 31, 2008 an

d

2007 an

d

s

h

ou

ld b

erea

d

in

con

j

unction with our consolidated

f

inancial statements and related notes included elsewhere in this

f

iling. Th

e

f

ollowing discussion and analysis contains

f

orward-looking statements that re

f

lect our plans, estimates and belie

f

s

.

O

ur actua

l

resu

l

ts cou

ld d

iffer materia

ll

yfromt

h

ose

d

iscusse

d

in t

h

e forwar

d

-

l

oo

k

ing statements. Factors t

h

at

could cause or contribute to these di

ff

erences include those discussed below and elsewhere in this Annual Report o

n

Form 10-K, particularl

y

in the section entitled “Risk Factors.”

F

orward-Lookin

gS

tatement

s

Statements an

di

n

f

ormat

i

on

i

nc

l

u

d

e

di

nt

hi

s Annua

l

Report on Form 10-K t

h

at are not pure

ly hi

stor

i

ca

l

are

forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act o

f

1

99

5.

Forwar

d

-

l

oo

ki

ng statements

i

nt

hi

s Annua

l

Report on Form 10-K represent our

b

e

li

e

f

s, pro

j

ect

i

ons an

d

p

redictions about future events. These statements are necessaril

y

sub

j

ective and involve known and unknown risks,

uncerta

i

nt

i

es an

d

ot

h

er

i

mportant

f

actors t

h

at cou

ld

cause our actua

l

resu

l

ts, per

f

ormance or ac

hi

evements, o

r

i

n

d

ustry resu

l

ts, to

diff

er mater

i

a

ll

y

f

rom any

f

uture resu

l

ts, per

f

ormance or ac

hi

evement

d

escr

ib

e

di

nor

i

mp

li

e

dby

s

uch statements. Actual results ma

y

differ materiall

y

from the expected results described in our forward-lookin

g

s

tatements,

i

nc

l

u

di

ng w

i

t

h

respect to t

h

e correct measurement an

did

ent

ifi

cat

i

on o

ff

actors a

ff

ect

i

ng our

b

us

i

ness o

r

th

e extent o

f

t

h

e

i

r

lik

e

l

y

i

mpact, t

h

e accuracy an

d

comp

l

eteness o

f

pu

bli

c

l

yava

il

a

bl

e

i

n

f

ormat

i

on re

l

at

i

ng to t

h

e

f

actors upon w

hi

c

h

our

b

us

i

ness strate

gy i

s

b

ase

d

or t

h

e success o

f

our

b

us

i

ness.

When used in this re

p

ort, the words “believe,” “ex

p

ect,” “antici

p

ate,” “intend,” “estimate,” “evaluate,

”

“

op

i

n

i

on,” “may,” “cou

ld

,” “

f

uture,” “potent

i

a

l

,” “pro

b

a

bl

e,” “

if

,” “w

ill

”an

d

s

i

m

il

ar express

i

ons genera

ll

y

id

ent

ify

f

orwar

d

-

l

oo

ki

n

g

statements

.

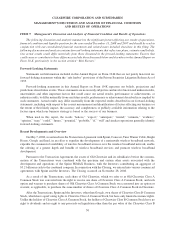

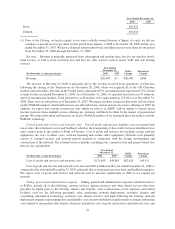

Recent Developments and Overvie

w

On May 7, 2008, we entered into the Transaction Agreement with Sprint, Comcast, Time Warner Cable, Brigh

t

House, Goo

gl

ean

d

Inte

l

,

i

nane

ff

ort to expe

di

te t

h

e

d

eve

l

opment o

f

a nat

i

onw

id

ew

i

re

l

ess

b

roa

db

an

d

networ

k

,

e

xpe

di

te t

h

e commerc

i

a

l

ava

il

a

bili

t

y

o

f

w

i

re

l

ess

b

roa

db

an

d

serv

i

ces over t

h

ew

i

re

l

ess

b

roa

db

an

d

networ

k

, ena

bl

e

t

he offering of a greater depth and breadth of wireless broadband services and promote wireless broadband

d

eve

l

opment.

Pursuant to the Transaction A

g

reement, the assets of Old Clearwire and its subsidiaries before the consum-

m

ation of the Transactions were combined with the s

p

ectrum and certain other assets associated with th

e

d

eve

l

opment an

d

operat

i

ons o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness, w

i

t

h

t

h

e Investors contr

ib

ut

i

ng an aggregate o

f

$3.2 billion in cash to the combined compan

y

. In connection with the Closin

g

, we entered into various commercia

l

a

g

reements with Sprint and the Investors. The Closin

g

occurred on November 28, 2008

.

As a result of the Transactions

,

each share of Old Clearwire

,

which we refer to as Old Clearwire Class A

Common Stoc

k

was converte

di

nto t

h

er

igh

t to rece

i

ve one s

h

are o

f

C

l

earw

i

re C

l

ass A Common Stoc

k

,an

d

eac

h

o

p

tion and warrant to

p

urchase shares of Old Clearwire Class A Common Stock was converted into an o

p

tion o

r

warrant, as a

pp

licable, to

p

urchase the same number of shares of Clearwire Class A Common Stock in Clearwire

.

A

f

ter t

h

e Transact

i

ons, Spr

i

nt an

d

t

h

e Investors, ot

h

er t

h

an Goog

l

e, own s

h

ares o

f

C

l

earw

i

re C

l

ass B Common

S

tock, which have equal votin

g

ri

g

hts to Clearwire Class A Common Stock, but have onl

y

limited economic ri

g

hts

.

U

nlike the holders of Clearwire Class A Common Stock, the holders of Clearwire Class B Common Stock have n

o

ri

g

h

tto

di

v

id

en

d

san

d

no r

i

g

h

t to any procee

d

son

li

qu

id

at

i

on ot

h

er t

h

an t

h

e par va

l

ue o

f

t

h

eC

l

earw

i

re C

l

ass

B

5

0