Clearwire 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.T

he Transactions and Cor

p

orate

S

tructur

e

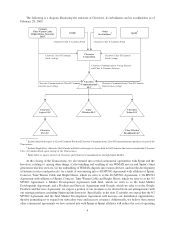

We were formed on November 28, 2008, as a result of the closin

g

of the Transactions, which we refer to as the

Closin

g

. At the Closin

g

:

•O

ld

C

l

earw

i

re mer

g

e

d

w

i

t

h

an

di

nto an

i

n

di

rect su

b

s

idi

ar

y

o

f

C

l

earw

i

re, w

i

t

h

O

ld

C

l

earw

i

re surv

i

v

i

n

g

as a

di

rect, w

h

o

lly

-owne

d

su

b

s

idi

ar

y

o

f

C

l

earw

i

re Commun

i

cat

i

ons, LLC, a su

b

s

idi

ar

y

o

f

C

l

earw

i

re, w

hi

c

h

w

e

refer to as Clearwire Communications. In the mer

g

er, each share of Old Clearwire’s common stock was

c

onverted into one share of Clearwire’s Class A Common Stock, par value

$

0.0001 per share, which we refe

r

to as Clearwire Class A Common Stock, and each o

p

tion and warrant to

p

urchase shares of Old Clearwir

e

C

lass A Common Stock was converted into one o

p

tion or warrant, as a

pp

licable, to

p

urchase the same

n

um

b

er o

f

s

h

ares o

f

C

l

earw

i

re C

l

ass A Common Stoc

k

on su

b

stant

i

a

ll

yt

h

e same terms.

•Fo

ll

ow

i

n

g

t

h

e mer

g

er, Spr

i

nt contr

ib

ute

d

t

h

e Spr

i

nt W

i

MAX Bus

i

ness to C

l

earw

i

re Commun

i

cat

i

ons

in

e

xchange for Class B non-voting common interests in Clearwire Communications, which we refer to as

C

learwire Communications Class B Common Interests. Sprint also purchased, for

$

37,000 in cash

,

3

70 million shares of Clearwire’s Class B Common Stock, par value

$

0.0001 per share, which we refe

r

to as Clearwire Class B Common Stock. Immediatel

y

followin

g

the purchase b

y

Sprint, Clearwir

e

c

ontributed the

$

37,000 that it received from Sprint to Clearwire Communications in exchange fo

r

3

70 m

illi

on vot

i

ng equ

i

ty

i

nterests

i

nC

l

earw

i

re Commun

i

cat

i

ons, w

hi

c

h

we re

f

er to as C

l

earw

i

re Com-

m

unications Votin

g

Interests

.

• Following completion of the merger and the Sprint contributions, Google invested

$

500 million in Clearwir

e

i

n exchan

g

e for Clearwire Class A Common Stock. Clearwire then contributed the $500 million received

from Goo

g

le to Clearwire Communications in exchan

g

e for Clearwire Communications Votin

g

Interests an

d

Cl

ass A non-vot

i

ng common

i

nterests

i

nC

l

earw

i

re Commun

i

cat

i

ons, w

hi

c

h

we re

f

er to as C

l

earw

i

r

e

C

ommun

i

cat

i

ons

Cl

ass A

C

ommon Interests

.

• Following completion of the merger and the Sprint contributions, the Investors, other than Google, invested a

total of

$

2.7 billion in exchange for Clearwire Communications Voting Interests and Clearwire Commu

-

ni

cat

i

ons C

l

ass B Common Interests. Imme

di

ate

ly f

o

ll

ow

i

n

g

t

hi

s

i

nvestment, eac

h

o

f

t

h

e Investors, ot

h

e

r

than Goo

g

le, contributed to Clearwire its Clearwire Communications Votin

g

Interests in exchan

g

e for an

eq

ual number of shares of Clearwire Class B Common Stock.

I

n exchan

g

e for their investments, Goo

g

le initiall

y

received 25 million shares of Clearwire Class A Common

S

tock and the other Investors received 135 million shares of Clearwire Class B Common Stock and an e

q

uivalent

amount of Clearwire Communications Class B Common Interests. The number of shares of Clearwire Class A an

d

C

l

ass B Common Stoc

k

an

d

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests, as app

li

ca

bl

e, t

h

at t

h

e Investor

s

were ent

i

t

l

e

d

to rece

i

ve un

d

er t

h

e Transact

i

ons. A

g

reement was su

bj

ect to a post-c

l

os

i

n

g

a

dj

ustment

b

ase

d

on t

h

e

t

radin

g

price of Clearwire Class A Common Stock on NASDAQ over 1

5

randoml

y

-selected tradin

g

da

y

s durin

g

th

e

3

0-day period ending on the 90th day after the Closing, or February 2

6

, 2009, which we refer to as the Adjustment

D

ate, with a floor of

$

17.00 per share and a cap of

$

23.00 per share. Durin

g

the measurement period, Clearwir

e

Class A Common Stock traded below $17.00 per share on NASDAQ, so on the Ad

j

ustment Date, Clearwire issue

d

t

o Google an additional 4,411,765 shares of Clearwire Class A Common Stock and to the other Investors

23,823,529 shares of Clearwire Class B Common Stock and an e

q

uivalent number of additional Clearwir

e

Communications Class B Common Interests to reflect the $17.00 final

p

rice

p

er share. Furthermore,

p

ursuant to a

S

u

b

scr

i

pt

i

on Agreement

d

ate

d

May 7, 2008,

b

yan

db

etween t

h

e Company an

d

CW Investment Ho

ldi

ngs LLC,

w

hi

c

h

we re

f

er to as CW Investments, an ent

i

t

y

a

ffili

ate

d

w

i

t

h

Jo

h

n Stanton, a

di

rector o

f

t

h

e Compan

y

,on

Februar

y

27, 2009, the Compan

y

sold 588,235 shares of Clearwire Class A Common Stock to CW Investments, at

a

p

rice of

$

17.00

p

er share

.

Fo

ll

ow

i

ng t

h

e comp

l

et

i

on o

f

t

h

e Transact

i

ons, Spr

i

nt an

d

t

h

e Investors, ot

h

er t

h

an Goog

l

e, own s

h

ares o

f

Clearwire Class B Common Stock, which have equal votin

g

ri

g

hts to Clearwire Class A Common Stock, but hav

e

on

l

y

li

m

i

te

d

econom

i

cr

i

g

h

ts. Un

lik

et

h

e

h

o

ld

ers o

f

C

l

earw

i

re C

l

ass A Common Stoc

k

,t

h

e

h

o

ld

ers o

f

C

l

earw

i

r

e

C

l

ass B Common Stoc

kh

ave no r

i

g

h

tto

di

v

id

en

d

san

d

no r

i

g

h

t to any procee

d

son

li

qu

id

at

i

on ot

h

er t

h

an t

h

e par

value of the Clearwire Class B Common Stock. Sprint and the Investors, other than Goo

g

le, hold their economic

r

ights through ownership of Clearwire Communications Class B Common Interests. Google owns shares of

C

l

earw

i

re C

l

ass A Common Stoc

k

. Eac

h

s

h

are o

f

C

l

earw

i

re C

l

ass B Common Stoc

k

p

l

us one C

l

earw

i

r

e

C

ommun

i

cat

i

ons

Cl

ass B

C

ommon Interest

i

s con

v

ert

ibl

e

i

nto one s

h

are o

fCl

ear

wi

re

Cl

ass A

C

ommon

S

toc

k

.

4