Clearwire 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

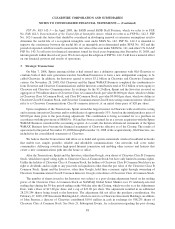

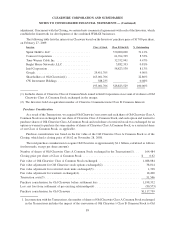

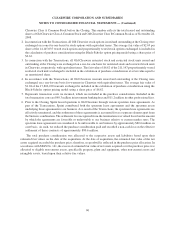

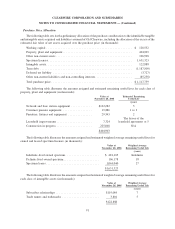

t

oan

di

nc

l

u

di

ng t

h

e

d

ate o

f

t

h

e Transact

i

ons. We recor

d

e

dd

e

f

erre

d

tax assets re

l

ate

d

to t

h

e pre-c

l

os

i

ng net operat

i

ng

l

oss an

d

tax cre

di

t carry

f

orwar

d

san

d

recor

d

e

d

ava

l

uat

i

on a

ll

owance aga

i

nst our

d

e

f

erre

d

tax assets, net o

f

certa

i

n

s

chedulable deferred tax liabilities. The net deferred tax liabilities re

p

orted in these financial statements

p

rior to the

C

l

os

i

ng are re

l

ate

d

to FCC

li

censes recor

d

e

d

as

i

n

d

e

fi

n

i

te-

li

ve

d

spectrum

i

ntang

ibl

es, w

hi

c

h

are not amort

i

ze

df

or

b

oo

k

purposes. T

h

ec

h

ange to t

h

e

d

e

f

erre

d

tax pos

i

t

i

on as a resu

l

to

f

t

h

eC

l

os

i

ng was re

fl

ecte

d

as part o

f

t

he

accountin

g

for the acquisition of Old Clearwire and was recorded in equit

y

. The net operatin

g

loss and tax credit

c

arryforwards associated with the Sprint WiMAX Business prior to the Closing were not transferred to either

C

l

earw

i

re Commun

i

cat

i

ons or C

l

earw

i

re,

b

ut

i

nstea

d

were reta

i

ne

dby

Spr

i

nt.

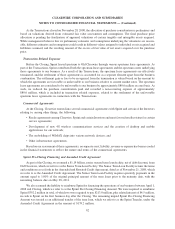

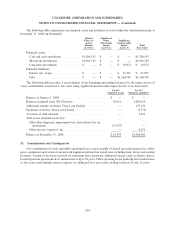

Th

e

i

ncome tax prov

i

s

i

on cons

i

sts o

f

t

h

e

f

o

ll

ow

i

ng

f

or t

h

e years en

d

e

d

Decem

b

er 31, 2008 an

d

2007 (

in

t

housands)

:

2008 200

7

Y

ear Ended

D

ecember

31,

C

urrent taxes

:

I

n

te

rn

at

i

o

n

a

l.................................................. $ 325 $

—

F

ede

r

a

l

......................................................

——

S

tate........................................................

——

T

ota

l

current taxes............................................

3

2

5—

D

e

f

erre

d

taxes

:

I

n

te

rn

at

i

o

n

a

l..................................................

(

87

)

—

Fede

r

a

l

......................................................

5

1,686 13,74

5

S

tate

........................................................

9,

6

83 2,

6

17

T

ota

ld

e

f

erre

d

taxes

...........................................

6

1

,

282 1

6,

3

6

2

I

ncome tax provisio

n

.

.........................................

$

61

,

607

$

16

,

36

2

Th

e Spr

i

nt W

i

MAX Bus

i

ness

i

ncurre

d

s

ig

n

ifi

cant

d

e

f

erre

d

tax

li

a

bili

t

i

es re

l

ate

d

to t

h

e

i

n

d

e

fi

n

i

te-

li

ve

d

s

pectrum licenses. Since certain of these spectrum licenses acquired were recorded as indefinite-lived intangible

assets for book purposes, they are not subject to amortization and therefore we could not estimate the amount of

f

uture per

i

o

d

reversa

l

s,

if

an

y

,o

f

t

h

e

d

e

f

erre

d

tax

li

a

bili

t

i

es re

l

ate

d

to t

h

ose spectrum

li

censes. As a resu

l

t, t

he

valuation allowance was increased accordin

g

l

y

and we continued to amortize acquired spectrum licenses for federa

l

i

ncome tax

p

ur

p

oses. This difference between book and tax amortization resulted in a deferred income tax

p

rovisio

n

p

r

i

or to t

h

eC

l

os

i

n

g

.

98

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)