Clearwire 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

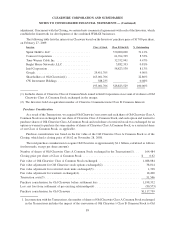

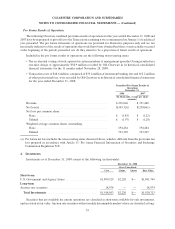

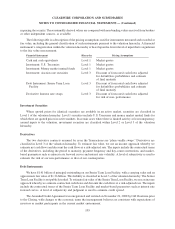

C

omponents o

fd

e

f

erre

d

tax assets an

dli

a

bili

t

i

es as o

f

Decem

b

er 31, 2008 an

d

2007 were as

f

o

ll

ows (

i

n

th

ousan

d

s

):

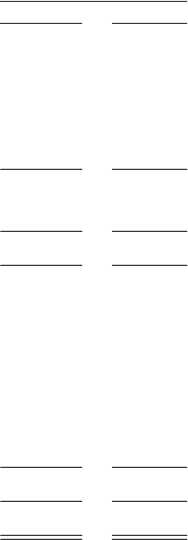

2008 200

7

December

31,

N

oncurrent deferred tax assets

:

Net operatin

g

loss carr

y

forward ............................... $590,767 $118,95

0

C

apital loss carr

y

forward

....................................

6

,187 —

T

ax cre

di

t carr

yf

orwar

d

..................................... —

63

7

O

t

h

er assets

..............................................

3

,

519 —

T

ota

ld

e

f

erre

d

tax asset

s

.

......................................

6

00

,

473 119

,

587

V

aluation allowance

.

.........................................

(

349,001

)(

98,697

)

N

et deferred tax asset

s

........................................

2

5

1,472 20,89

0

N

oncurrent deferred tax liabilities

:

In

v

estment

i

n

Cl

ear

wi

re

C

ommun

i

cat

i

ons LL

C

....................

221

,

3

7

3—

S

pectrum asset

s

...........................................

1

4

,

943 679

,

222

O

ther intangibles ..........................................

1

9

,

113 —

P

ropert

y

, equipment and other lon

g

-term assets

....................

—

15

,

5

6

5

R

esearch and ex

p

erimentation ex

p

enses

.

......................... —

4,

559

O

the

r

................................................... 207 7

66

T

ota

ld

e

f

erre

d

tax

li

a

bili

t

i

es

....................................

255

,

636 700

,

112

Net

d

e

f

erre

d

tax

li

a

bili

t

i

es

.

....................................

$

4

,

164

$

679

,

222

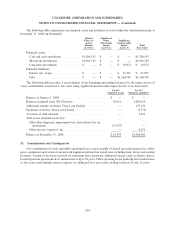

P

ursuant to t

h

e Transact

i

ons, t

h

e assets o

f

O

ld

C

l

earw

i

re an

di

ts su

b

s

idi

ar

i

es were com

bi

ne

d

w

i

t

h

t

h

es

p

ectrum

a

n

d

certa

i

not

h

er assets o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness. In con

j

unct

i

on w

i

t

h

t

h

e acqu

i

s

i

t

i

on o

f

O

ld

C

l

earw

i

re

by

t

he

Sprint WiMAX Business, these assets along with the

$

3.2 billion of capital from the Investors were contributed t

o

Cl

earw

i

re Commun

i

cat

i

ons. C

l

earw

i

re

i

st

h

eso

l

e

h

o

ld

er o

f

vot

i

n

gi

nterests

i

nC

l

earw

i

re Commun

i

cat

i

ons. As suc

h,

Cl

earw

i

re contro

l

s 100% o

f

t

h

e

d

ec

i

s

i

on ma

ki

n

g

o

f

C

l

earw

i

re Commun

i

cat

i

ons an

d

conso

lid

ates 100% o

fi

ts

op

erations. Clearwire Communications is treated as a

p

artnershi

p

for U.S. federal income tax

p

ur

p

oses and

th

ere

f

ore

d

oes not pay

i

ncome tax

i

nt

h

e U.S. an

d

any current an

dd

e

f

erre

d

tax consequences ar

i

se at t

h

e partner

l

eve

l

,

i

nc

l

u

di

n

g

C

l

earw

i

re. Ot

h

er t

h

an

b

a

l

ances assoc

i

ate

d

w

i

t

h

t

h

e non-U.S. operat

i

ons, t

h

eon

ly

temporar

y

d

ifference for Clearwire after the Closin

g

is the basis difference associated with our investment in the partnership.

C

onsequent

l

y, we recor

d

e

d

a

d

e

f

erre

d

tax

li

a

bili

ty

f

or t

h

e

diff

erence

b

etween t

h

e

fi

nanc

i

a

l

statement carry

i

ng va

l

u

e

a

n

d

t

h

e tax

b

as

i

s

w

e

h

o

ld i

n our

i

nterest

i

n

Cl

ear

wi

re

C

ommun

i

cat

i

ons as o

f

t

h

e

d

ate o

f

t

h

e Transact

i

ons.

A

s of December 31, 2008, we had U.S federal tax net operating loss carryforwards of approximatel

y

$

1.3 billion. A portion of the net operatin

g

loss carr

y

forward is sub

j

ect to certain annual limitations impose

d

under Section 382 of the Internal Revenue Code of 1986. The net operatin

g

loss carr

y

forwards be

g

in to expire i

n

2

021. We had

$

328.2 million of tax net operating loss carryforwards in foreign jurisdictions as of December 31

,

2

008. Of the

$

328.2 million of tax net operating loss carryforwards in foreign jurisdictions,

$

195.4 million have no

statutor

y

expiration dates, $111.8 million be

g

ins to expire in 2015, and the remainder of $21.0 million be

g

ins t

o

exp

i

re

i

n 2010

.

W

e have recorded a valuation allowance a

g

ainst our deferred tax assets to the extent that we determined that it

is more likely than not that these items will either expire before we are able to realize their benefits or that futur

e

d

e

d

uct

ibili

ty

i

s uncerta

i

n. As

i

tre

l

ates to t

h

e U.S. tax

j

ur

i

s

di

ct

i

on, we

d

eterm

i

ne

d

t

h

at our temporary taxa

ble

99

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued

)