Clearwire 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As t

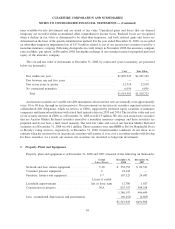

h

e Transact

i

ons c

l

ose

d

on Novem

b

er 28, 2008, t

h

ea

ll

ocat

i

on o

f

purc

h

ase cons

id

erat

i

on

i

s pre

li

m

i

nary an

d

b

ase

d

on va

l

uat

i

ons

d

er

i

ve

df

rom est

i

mate

df

a

i

rva

l

ue assessments an

d

assumpt

i

ons. T

h

e

fi

na

l

purc

h

ase pr

i

c

e

allocation is pendin

g

the finalization of appraisal valuations of certain tan

g

ible and intan

g

ible assets acquired.

Whil

e management

b

e

li

eves t

h

at

i

ts pre

li

m

i

nary est

i

mates an

d

assumpt

i

ons un

d

er

l

y

i

ng t

h

eva

l

uat

i

ons are reason-

a

bl

e,

diff

erent est

i

mates an

d

assumpt

i

ons cou

ld

resu

l

t

i

n

diff

erent va

l

ues ass

i

gne

d

to

i

n

di

v

id

ua

l

assets acqu

i

re

d

an

d

liabilities assumed, and the resultin

g

amount of the excess of fair value of net assets acquired over the purchas

e

p

rice.

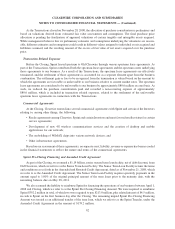

T

ransaction Re

l

ate

d

Ex

p

ense

s

B

efore the Closin

g

, Sprint leased spectrum to Old Clearwire throu

g

h various spectrum lease a

g

reements. As

p

art of the Transactions, Sprint contributed both the spectrum lease a

g

reements and the spectrum assets underl

y

in

g

th

ose agreements to our

b

us

i

ness. As a resu

l

to

f

t

h

e Transact

i

ons, t

h

e spectrum

l

ease agreements are e

ff

ect

i

ve

ly

t

erminated, and the settlement of those a

g

reements is accounted for as a separate element apart from the busines

s

c

ombination. The settlement

g

ain or loss to be reco

g

nized from the termination is valued based on the amount b

y

whi

c

h

t

h

e agreements are

f

avora

bl

eorun

f

avora

bl

e to our

b

us

i

ness re

l

at

i

ve to current mar

k

et rates. T

h

e spectrum

lease a

g

reements are considered to be unfavorable to our business b

y

approximatel

y

$80.6 million on a net basis. A

s

s

uch, we reduced the purchase consideration paid and recorded a non-recurrin

g

expense of approximatel

y

$

80.6 million, which is included in transaction related expenses, related to the settlement of the unfavorabl

e

s

pectrum

l

ease a

g

reements

i

n connect

i

on w

i

t

h

t

h

e Transact

i

ons.

C

ommercia

l

A

g

reements

At the Closing, Clearwire entered into several commercial agreements with Sprint and certain of the Investors

r

e

l

at

i

n

g

to, amon

g

ot

h

er t

hi

n

g

s, t

h

e

f

o

ll

ow

i

n

g

:

• Resa

l

e agreements among C

l

earw

i

re, Spr

i

nt an

d

certa

i

n Investors an

d

most

f

avore

d

rese

ll

er status

f

or certa

in

s

erv

i

ce a

g

reements

;

•Deve

l

opment o

f

new 4G w

i

re

l

ess commun

i

cat

i

ons serv

i

ces an

d

t

h

e creat

i

on o

fd

es

k

top an

d

mo

bil

e

a

pp

lications for our network

;

•T

h

eem

b

e

ddi

ng o

f

W

i

MAX c

hi

ps

i

nto var

i

ous networ

kd

ev

i

ces; an

d

• Other infrastructure agreements.

B

ased on our assessment of these a

g

reements, no separate asset, liabilit

y

, revenue or expense has been recorde

d

i

n the financial statements to reflect the nature and terms of the commercial agreements

.

S

p

rint Pre-C

l

osing Financing an

d

Amen

d

e

d

Cre

d

it Agreement

As part of the Closin

g

, we assumed a $1.19 billion, senior secured term loan facilit

y

, net of debt discount, from

O

ld Clearwire, which we refer to as the Senior Term Loan Facility. The Senior Term Loan Facility retains the term

s

an

d

con

di

t

i

ons as set

f

ort

hi

nt

h

e Amen

d

e

d

an

d

Restate

d

Cre

di

tA

g

reement,

d

ate

d

as o

f

Novem

b

er 21, 2008, w

hi

c

h

w

ere

f

er to as t

h

e Amen

d

e

d

Cre

di

tA

g

reement. T

h

e Sen

i

or Term Loan Fac

ili

t

y

requ

i

res quarter

ly

pa

y

ments

i

nt

h

e

amount equal to 1.00% of the ori

g

inal principal amount of the term loans prior to the maturit

y

date, with th

e

r

ema

i

n

i

ng

b

a

l

ance

d

ue on May 28, 2011

.

We also assumed the liability to reimburse Sprint for financing the operations of our business between April 1,

2

008 and Closing, which we refer to as the Sprint Pre-Closing Financing Amount. We were required to reimburse

S

print $392.2 million in total, of which we were required to pa

y

$213.0 million, plus related interest of $4.5 million,

i

n cash to Sprint on the first business da

y

after the Closin

g

. The remainin

g

unpaid Sprint Pre-Closin

g

Financin

g

A

mount was treated as an additional tranche of the term loan, which we refer to as the S

p

rint Tranche, under th

e

A

mended Credit A

g

reement in the amount of

$

179.2 million

.

9

2

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)