Clearwire 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

i

npr

i

c

i

ng t

h

e secur

i

ty. T

h

ese

i

nterna

ll

y

d

er

i

ve

d

va

l

ues are compare

d

w

i

t

h

non-

bi

n

di

ng va

l

ues rece

i

ve

df

rom

b

ro

k

ers

or ot

h

er

i

n

d

epen

d

ent sources, as ava

il

a

bl

e.

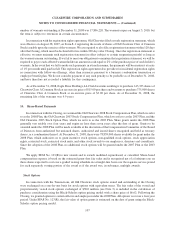

T

he following table is a description of the pricing assumptions used for instruments measured and recorded a

t

f

a

i

rva

l

ue,

i

nc

l

u

di

n

g

t

h

e

g

enera

l

c

l

ass

ifi

cat

i

on o

f

suc

hi

nstruments pursuant to t

h

eva

l

uat

i

on

hi

erarc

hy

.A

fi

nanc

i

a

l

i

nstrument’s cate

g

orization within the valuation hierarch

y

is based upon the lowest level of input that is si

g

nifican

t

t

o the fair value measurement

.

Fi

nanc

i

al Instrument H

i

erarchy Pr

i

c

i

n

g

Assumpt

i

ons

C

as

h

an

d

cas

h

equ

i

va

l

ents Leve

l

1 Mar

k

et quote

s

I

nvestment: U.S. Treasur

i

es Leve

l

1 Mar

k

et quote

s

I

nvestment: Money market mutual funds Level 1 Market quote

s

I

nvestment: Auction rate securities Level 3 Discount of forecasted cash flows adjuste

d

for default/loss

p

robabilities and estimat

e

o

ffi

na

l

matur

i

ty

D

ebt Instrument: Senior Term Loan

Facilit

y

Level 3 Discount of forecasted cash flows adjuste

d

for default/loss probabilities and estimat

e

o

ffi

na

l

matur

i

ty

D

erivative: Interest rate swaps Level 3 Discount of forecasted cash flows adjuste

d

for risk of non- performance

Investment

S

ecuritie

s

Where

q

uoted

p

rices for identical securities are available in an active market, securities are classified in

L

eve

l

1o

f

t

h

eva

l

uat

i

on

hi

erarc

h

y. Leve

l

1 secur

i

t

i

es

i

nc

l

u

d

e U.S. Treasur

i

es an

d

money mar

k

et mutua

lf

un

d

s

f

o

r

whi

c

h

t

h

ere are quote

d

pr

i

ces

i

n act

i

ve mar

k

ets. In certa

i

n cases w

h

ere t

h

ere

i

s

li

m

i

te

d

act

i

v

i

ty or

l

ess transparency

around in

p

uts to the valuation, investment securities are classified within Level 2 or Level 3 of the valuatio

n

hierarchy

.

D

er

i

vat

i

ve

s

Th

e two

d

er

i

vat

i

ve contracts assume

db

yus

i

nt

h

e Transact

i

ons are “p

l

a

i

nvan

ill

a swaps.” Der

i

vat

i

ves ar

e

c

lassified in Level 3 of the valuation hierarch

y

. To estimate fair value, we use an income approach whereb

y

w

e

e

st

i

mate net cas

hfl

ows an

ddi

scount t

h

e cas

hfl

ows at a r

i

s

k

-a

dj

uste

d

rate. T

h

e

i

nputs

i

nc

l

u

d

et

h

e contractua

l

term

s

o

f

t

h

e

d

er

i

vat

i

ves,

i

nc

l

u

di

n

g

t

h

e per

i

o

d

to matur

i

t

y

,pa

y

ment

f

requenc

y

an

dd

a

y

-count convent

i

ons, an

d

mar

k

et-

based parameters such as interest rate forward curves and interest rate volatilit

y

. A level of sub

j

ectivit

y

is used t

o

e

st

i

mate t

h

er

i

s

k

o

f

our non-per

f

ormance or t

h

at o

f

our counterpart

i

es.

Deb

tIn

s

tr

u

m

e

nt

s

We have $1.41 billion of principal outstandin

g

on our Senior Term Loan Facilit

y

, with a carr

y

in

g

value and an

approximate fair value of $1.36 billion. This liabilit

y

is classified in Level 3 of the valuation hierarch

y

. The Senio

r

Term Loan Fac

ili

ty

i

s not pu

bli

c

l

y tra

d

e

d

. To est

i

mate

f

a

i

rva

l

ue o

f

t

h

e Sen

i

or Term Loan Fac

ili

ty, we use an

i

ncom

e

approach whereb

y

we estimate contractual cash flows and discount the cash flows at a risk-ad

j

usted rate. The inputs

i

nclude the contractual terms of the Senior Term Loan Facilit

y

and market-based parameters such as interest rate

f

orwar

d

curves. A

l

eve

l

o

f

su

bj

ect

i

v

i

ty an

dj

u

d

gment

i

s use

d

to est

i

mate cre

di

t sprea

d

.

T

he Amended Credit A

g

reement was rene

g

otiated and restated on November 21, 2008 b

y

Old Clearwire prio

r

t

o the Closin

g

, with chan

g

es to the economic terms that mana

g

ement believes are consistent with expectations o

f

i

nvestors as mar

k

et part

i

c

i

pants

i

nt

h

e current mar

k

et env

i

ronment.

10

3

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)