Clearwire 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

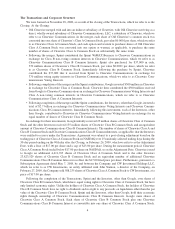

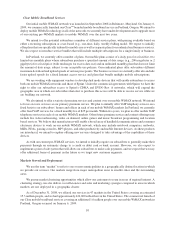

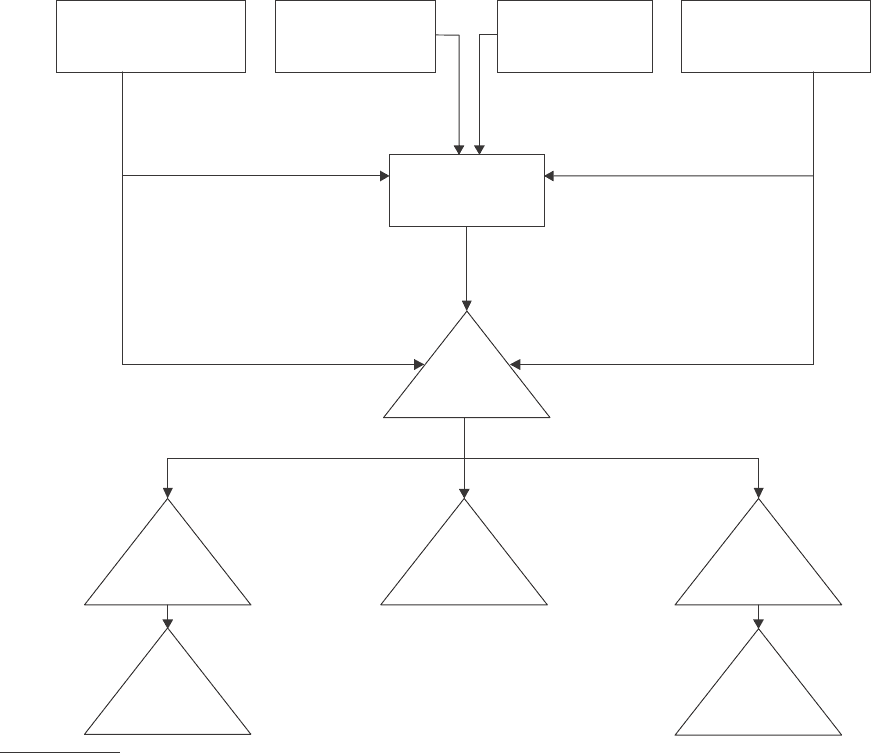

Th

e

f

o

ll

ow

i

ng

i

sa

di

agram

ill

ustrat

i

ng t

h

e structure o

f

C

l

earw

i

re,

i

ts su

b

s

idi

ar

i

es an

di

ts stoc

kh

o

ld

ers as o

f

F

ebruar

y

28, 2009

:

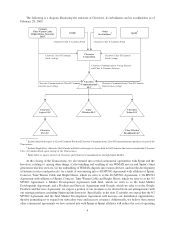

Other

Stockholders2

Comcast

Time Warner Cable

Bright House Networks

Intel1

Sprint3

Clearwire

Communications

LLC

Clearwire

Corporation

Clearwire Class A Common Stock

Clearwire Class B Common

Stock (voting)

Clearwire Communications Class B Common

Interests (non-voting)

Clearwire Communications Class B Common

Interests (non-voting)

Clearwire Class B Common

Stock (voting)

Google

Clearwire Class A Common Stock

Clearwire Communications Voting Interests

and Class A Common Interests

Clearwire

US LLC

Clear Wireless

Broadband LLC

Clearwire

Xohm LLC

Clearwire

Legacy LLC

Clear

Wireless LLC

1

Inc

l

u

d

es Inte

l

w

i

t

h

respect to C

l

ass B Common Stoc

k

an

d

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests purc

h

ase

d

as part o

f

t

h

e

Transactions

.

2

Includes Ea

g

le River, Motorola, Bell Canada and Intel (with respect to shares held in Old Clearwire that were converted into Clearwire

Class A Common Stock upon closin

g

of the Transactions).

3

Sprint holds its equit

y

interests in Clearwire and Clearwire Communications throu

g

h Sprint HoldCo

.

At the closing of the Transactions, we also entered into several commercial agreements with Sprint and th

e

Investors, re

l

at

i

n

g

to, amon

g

ot

h

er t

hi

n

g

s, (

i

)t

h

e

b

un

dli

n

g

an

d

rese

lli

n

g

o

f

our W

i

MAX serv

i

ce an

d

Spr

i

nt’s t

hi

r

d

g

enerat

i

on w

i

re

l

ess serv

i

ces, (

ii

)t

h

eem

b

e

ddi

n

g

o

f

W

i

MAX c

hi

psets

i

nto var

i

ous

d

ev

i

ces, an

d

(

iii

)t

h

e

d

eve

l

opment

of Internet services and protocols. As a result of our entering into a 4G MVNO Agreement with affiliates of Sprint

,

Comcast, T

i

me Warner Ca

bl

ean

d

Br

igh

t House, w

hi

c

h

we re

f

er to as t

h

e 4G MVNO A

g

reement, a 3G MVNO

Ag

reement w

i

t

h

a

ffili

ates o

f

Spr

i

nt, Comcast, T

i

me Warner Ca

bl

ean

d

Br

igh

t House, w

hi

c

h

we re

f

er to as t

h

e3

G

M

VNO A

g

reement, a Market Development A

g

reement with Intel, which we refer to as the Intel Market

D

eve

l

opment Agreement, an

d

a Pro

d

ucts an

d

Serv

i

ces Agreement w

i

t

h

Goog

l

e, w

hi

c

h

we re

f

er to as t

h

e Goog

l

e

P

ro

d

ucts an

d

Serv

i

ces A

g

reement, we expect a port

i

on o

f

our revenues to

b

e

d

er

i

ve

df

rom our arran

g

ements w

i

t

h

our strate

g

ic partners, includin

g

Sprint and the Investors. Specificall

y

, in the next 12 months, we expect that the 4G

M

VNO Agreement an

d

t

h

e Inte

l

Mar

k

et Deve

l

opment Agreement w

ill i

ncrease our

di

str

ib

ut

i

on opportun

i

t

i

es,

th

ere

b

y perm

i

tt

i

ng us to expan

d

our su

b

scr

ib

er

b

ase an

di

ncrease revenues. A

ddi

t

i

ona

ll

y, we

b

e

li

eve t

h

at certa

in

other commercial a

g

reements we have entered into with Sprint or Sprint affiliates will reduce the cost of operatin

g

6