Clearwire 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Th

e owne

dli

censes

i

nt

h

eUn

i

te

d

States an

di

nternat

i

ona

lly

t

h

at

h

ave a trac

k

recor

d

o

f

renewa

l

are accounte

d

for as intan

g

ible assets with indefinite lives in accordance with the provisions of SFAS No. 142. In accordance with

S

FAS No. 142,

i

ntang

ibl

e assets w

i

t

hi

n

d

e

fi

n

i

te use

f

u

lli

ves are not amort

i

ze

db

ut must

b

e assesse

df

or

i

mpa

i

rmen

t

annua

ll

y or more

f

requent

l

y

if

an event

i

n

di

cates t

h

at t

h

e asset m

i

g

h

t

b

e

i

mpa

i

re

d.

O

wne

dli

censes

i

nternat

i

ona

ll

yt

h

at

d

o not

h

ave a trac

k

recor

d

o

f

renewa

l

are accounte

df

or as

l

ong-

li

ve

d

asset

s

and are assessed for impairment whenever events or chan

g

es in circumstances indicate that the carr

y

in

g

amount of

an asset ma

y

not be recoverable, as required b

y

SFAS No. 144.

We account for the spectrum lease arran

g

ements as executor

y

contracts which are similar to operatin

g

leases

.

F

or leases containing scheduled rent escalation clauses we record minimum rental payments on a straight-line basi

s

over t

h

e terms o

f

t

h

e

l

eases,

i

nc

l

u

di

ng t

h

e renewa

l

per

i

o

d

s as appropr

i

ate. For

l

eases

i

nvo

l

v

i

ng s

i

gn

ifi

cant up-

f

ron

t

p

a

y

ments, we account for such pa

y

ments as prepaid spectrum lease costs

.

De

f

erre

d

Tax Asset Va

l

uation A

ll

owanc

e

A valuation allowance is provided for deferred tax assets if it is more likely than not that these items will either

e

xp

i

re

b

e

f

ore we are a

bl

e to rea

li

ze t

h

e

i

r

b

ene

fi

t, or t

h

at

f

uture

d

e

d

uct

ibili

t

yi

s uncerta

i

n. In accor

d

ance w

i

t

h

S

FAS No. 109, Accounting

f

or Income Taxes, we record net deferred tax assets to the extent we believe these assets

w

ill more likely than not be realized. In making such determination, we consider all available positive and negativ

e

ev

id

ence,

i

nc

l

u

di

ng our

li

m

i

te

d

operat

i

ng

hi

story, sc

h

e

d

u

l

e

d

reversa

l

so

fd

e

f

erre

d

tax

li

a

bili

t

i

es, pro

j

ecte

df

utur

e

t

axable income/loss, tax plannin

g

strate

g

ies and recent financial performance. As it relates to the U.S. tax

j

urisdiction, we determined that our temporar

y

taxable difference associated with our investment in Clearwir

e

Commun

i

cat

i

ons LLC w

ill

reverse w

i

t

hi

nt

h

e reversa

l

per

i

o

d

so

fi

ts

d

e

f

erre

d

tax assets an

d

accor

di

ng

l

y represent

s

r

elevant future taxable income. We have recorded a valuation allowance for net deferred tax assets, which wa

s

approximatel

y

$349.0 million and $98.7 million as of December 31, 2008 and 2007, respectivel

y

.

I

n

ves

tm

e

nt

s

S

FAS No. 115

,

Accounting for Certain Investments in De

b

tan

d

Equity Securitie

s

,

and SAB No. 59

,

N

on

-

c

urrent Mar

k

eta

bl

e Equity Securities, prov

id

egu

id

ance on

d

eterm

i

n

i

ng w

h

en an

i

nvestment

i

sot

h

er-t

h

an-tem

-

p

oraril

y

impaired. We classif

y

marketable debt and equit

y

securities that are available for current operations as

sh

ort-term ava

il

a

bl

e-

f

or-sa

l

e

i

nvestments, w

hi

c

h

are state

d

at

f

a

i

rva

l

ue. Unrea

li

ze

d

ga

i

ns an

dl

osses are recor

d

e

d

wi

t

hi

n accumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncome (

l

oss). Losses are reco

g

n

i

ze

d

w

h

en a

d

ec

li

ne

i

n

f

a

i

rva

l

ue

i

s

determined to be other-than-temporar

y

. Realized

g

ains and losses are determined on the basis of the specifi

c

i

dentification method. We review our short-term and long-term investments on an ongoing basis for indicators of

ot

h

er-t

h

an-temporar

yi

mpa

i

rment, an

d

t

hi

s

d

eterm

i

nat

i

on requ

i

res s

ig

n

ifi

cant

j

u

dg

ment.

We

h

ave an

i

nvestment port

f

o

li

o compr

i

se

d

o

f

U.S. treasur

i

es an

d

auct

i

on rate secur

i

t

i

es. T

h

eva

l

ue o

f

t

h

ese

s

ecurities is sub

j

ect to market volatilit

y

for the period we hold these investments and until their sale or maturit

y

.We

r

eco

g

nize realized losses when declines in the fair value of our investments below their cost basis are

j

ud

g

ed to b

e

ot

h

er-t

h

an-temporary. In

d

eterm

i

n

i

ng w

h

et

h

er a

d

ec

li

ne

i

n

f

a

i

rva

l

ue

i

sot

h

er-t

h

an-temporary, we cons

id

er var

i

ou

s

f

actors

i

nc

l

u

di

n

g

mar

k

et pr

i

ce (w

h

en ava

il

a

bl

e),

i

nvestment rat

i

n

g

s, t

h

e

fi

nanc

i

a

l

con

di

t

i

on an

d

near-term prospect

s

of the issuer, the len

g

th of time and the extent to which the fair value has been less than our cost basis, and our inten

t

an

d

a

bili

ty to

h

o

ld

t

h

e

i

nvestment unt

il

matur

i

ty or

f

or a per

i

o

d

o

f

t

i

me su

ffi

c

i

ent to a

ll

ow

f

or any ant

i

c

i

pate

d

r

ecover

yi

n mar

k

et va

l

ue. We ma

k

es

ig

n

ifi

cant

j

u

dg

ments

i

n cons

id

er

i

n

g

t

h

ese

f

actors. I

fi

t

i

s

j

u

dg

e

d

t

h

at a

d

ec

li

ne

i

n

f

a

i

rva

l

ue

i

sot

h

er-t

h

an-temporar

y

,t

h

e

i

nvestment

i

sva

l

ue

d

at t

h

e current est

i

mate

df

a

i

rva

l

ue an

d

a rea

li

ze

dl

oss

eq

ual to the decline is reflected in the consolidated statement of o

p

erations

.

55

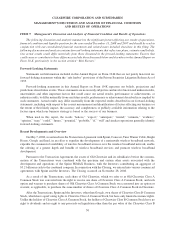

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

MANAGEMENT’

S

DI

S

CU

SS

ION AND ANALY

S

I

S

OF FINANCIAL CONDITION

A

ND RESULTS OF OPERATIONS — (Continued

)