Clearwire 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

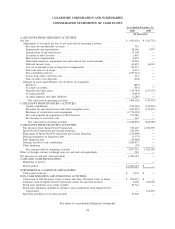

offset by

$

213.0 million paid to to Sprint for partial reimbursement of the pre-closing financing, a

$

50.0 million deb

t

financin

g

fee and a $3.6 million pa

y

ment on our Senior Term Loan Facilit

y.

Net cash provided by financing activities was

$

1.0 billion for the year ended December 31, 2007. This was du

e

t

oa

d

vances

f

rom Spr

i

nt.

C

ontractual Obli

g

ation

s

T

he contractual obli

g

ations presented in the table below represent our estimates of future pa

y

ments under fixed

c

ontractua

l

o

bli

gat

i

ons an

d

comm

i

tments as o

f

Decem

b

er 31, 2008. C

h

anges

i

n our

b

us

i

ness nee

d

sor

i

nterest rates

,

as well as actions b

y

third parties and other factors, ma

y

cause these estimates to chan

g

e. Because these estimate

s

are complex and necessaril

y

sub

j

ective, our actual pa

y

ments in future periods are likel

y

to var

y

from thos

e

p

resente

di

nt

h

eta

bl

e. T

h

e

f

o

ll

ow

i

ng ta

bl

e summar

i

zes our contractua

l

o

bli

gat

i

ons

i

nc

l

u

di

ng pr

i

nc

i

pa

l

an

di

nterest

p

a

y

ments under our debt obli

g

ations, pa

y

ments under our spectrum lease obli

g

ations, and other contractual

obli

g

ations as of December 31, 2008 (in thousands):

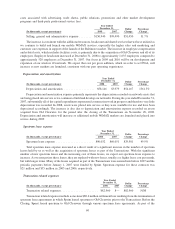

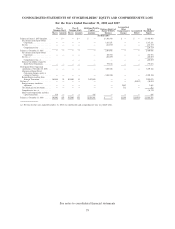

Contractual Obligations Total

Less Tha

n

1 Year 1 - 3 Years 3 - 5 Years

O

ver 5 Year

s

Lon

g

-term debt obli

g

ations . . . $ 1,490,838 $ 14,292 $1,476,546 $ — $

—

I

nterest pa

y

ments

(1)

........

4

01

,

665 125

,

007 276

,

658 — —

O

perating lease obligations . . . 2,868,823 119,390 238,357 237,862 2,273,214

S

pectrum

l

ease o

bli

gat

i

on

s

.

..

.

5,

020

,

998 149

,

833 248

,

876 268

,

393 4

,

3

5

3

,

89

6

O

ther contractual

obligations(2

)

.

...........

5

41

,

822 246

,

3

5

7 169

,

483 34

,

460 91

,5

22

Tota

l

....................

$10,324,146 $654,879 $2,409,920 $540,715 $6,718,632

(1) Our

i

nterest payment o

bli

gat

i

ons are est

i

mate

df

or a

ll

years us

i

ng an

i

nterest rate o

f

approx

i

mate

l

y 14.73%,

based on our expected interest rate throu

g

h the term of the loan

.

(2) Inc

l

u

d

es agreements to purc

h

ase equ

i

pment an

di

nsta

ll

at

i

on serv

i

ces,

b

ac

kh

au

l

an

d

ot

h

er goo

d

san

d

serv

i

ce

s

f

rom supp

li

ers w

i

t

h

ta

k

e-or-pa

y

o

blig

at

i

ons

.

We

d

o not

h

ave any o

bli

gat

i

ons t

h

at meet t

h

e

d

e

fi

n

i

t

i

on o

f

an o

ff

-

b

a

l

ance-s

h

eet arrangement t

h

at

h

ave or are

r

easona

bly lik

e

ly

to

h

ave a mater

i

a

l

e

ff

ect on our

fi

nanc

i

a

l

statements

.

Recent Account

i

ng Pronouncement

s

S

FAS No. 141(R)

—

In Decem

b

er 2007, t

h

eF

i

nanc

i

a

l

Account

i

ng Stan

d

ar

d

s Boar

d

,w

hi

c

h

we re

f

er to as t

he

F

ASB,

i

ssue

d

SFAS No. 141

(

rev

i

se

d

2007

),

B

usiness Com

b

inations,w

hi

c

h

we re

f

er to as SFAS No. 141

(

R

)

.In

S

FAS No. 141(R), t

h

e FASB reta

i

ne

d

t

h

e

f

un

d

amenta

l

re

q

u

i

rements o

f

SFAS No. 141 to account

f

or a

ll b

us

i

ness

combinations using the acquisition method (formerly the purchase method) and for an acquiring entity to be

identified in all business combinations. The new standard requires the acquiring entity in a business combination to

r

eco

g

n

i

ze a

ll

(an

d

on

ly

)t

h

e assets acqu

i

re

d

an

dli

a

bili

t

i

es assume

di

nt

h

e Transact

i

ons; esta

bli

s

h

es t

h

e acqu

i

s

i

t

i

on

date fair value as the measurement ob

j

ective for all assets acquired and liabilities assumed; requires transaction

costs to be ex

p

ensed as incurred; and re

q

uires the ac

q

uirer to disclose to investors and other users all of th

e

i

n

f

ormat

i

on t

h

e

y

nee

d

to eva

l

uate an

d

un

d

erstan

d

t

h

e nature an

dfi

nanc

i

a

l

e

ff

ect o

f

t

h

e

b

us

i

ness com

bi

nat

i

on.

S

FAS No. 141(R) is effective for annual periods be

g

innin

g

on or after December 1

5

, 2008. Accordin

g

l

y

,an

y

b

usiness combinations we en

g

a

g

e in will be recorded and disclosed followin

g

existin

g

U.S. GAAP until Januar

y

1

,

2

009. We expect SFAS No. 141(R) w

ill h

ave an

i

mpact on our conso

lid

ate

dfi

nanc

i

a

l

statements w

h

en e

ff

ect

i

ve,

b

ut

t

he nature and ma

g

nitude of the specific effects will depend upon the nature, terms and size of the acquisitions w

e

consummate after the effective date

.

S

FAS No. 1

60

— In December 2007, the FASB issued SFAS No. 1

6

0

,

N

oncontro

ll

ing Interests in Conso

l

i

d

ate

d

Financial

S

tatements, which we refer to as SFAS No. 160. SFAS No. 160 amends Accounting Research

Bulletin No.

5

1

,

C

onsolidated Financial

S

tatement

s

, and requires all entities to report non-controlling (minority)

i

nterests

i

nsu

b

s

idi

ar

i

es w

i

t

hi

n equ

i

t

yi

nt

h

e conso

lid

ate

dfi

nanc

i

a

l

statements,

b

ut separate

f

rom t

h

e parent

7

0