Clearwire 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

diff

erence assoc

i

ate

d

w

i

t

h

our

i

nvestment

i

nC

l

earw

i

re Commun

i

cat

i

ons w

ill

reverse w

i

t

hi

nt

h

e carry

f

orwar

d

p

er

i

o

d

o

f

t

h

e net operat

i

ng

l

osses an

d

accor

di

ng

l

y represents re

l

evant

f

uture taxa

bl

e

i

ncome.

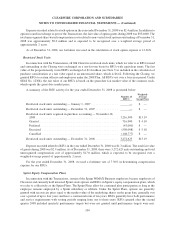

T

he income tax rate computed usin

g

the federal statutor

y

rates is reconciled to the reported effective incom

e

t

ax rate as

f

o

ll

o

w

s

:

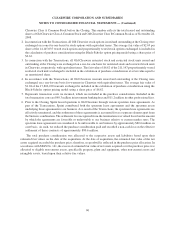

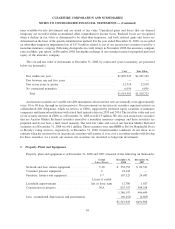

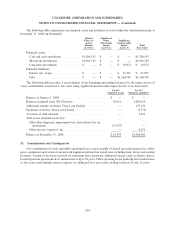

2008 2007

Yea

r

E

n

ded

December 31

,

Fe

d

era

l

statutor

yi

ncome tax rate

.......................................

35

.

0

%

35

.

0%

State

i

ncome taxes

(

net o

ff

e

d

era

lb

ene

fi

t

)

................................

(

1.5

)(

0.8

)

O

t

h

er

,

net

.

.......................................................

0

.2

0

.

2

V

aluation allowanc

e

.

...............................................

.

(5

0.3

)(

42.2

)

Effective income tax rate

.............................................

(16.6)% (7.8)

%

We file income tax returns for Clearwire and our subsidiaries in the U.S. Federal

j

urisdiction and various stat

e

an

df

ore

i

gn

j

ur

i

s

di

ct

i

ons. As o

f

Decem

b

er 31, 2008, t

h

e tax returns

f

or O

ld

C

l

earw

i

re

f

or t

h

e years 2003 t

h

roug

h

2

007 rema

i

n open to exam

i

nat

i

on

by

t

h

e Interna

l

Revenue Serv

i

ce an

d

var

i

ous state tax aut

h

or

i

t

i

es. In a

ddi

t

i

on, O

ld

C

l

earw

i

re acqu

i

re

d

U.S. an

df

ore

ig

n ent

i

t

i

es w

hi

c

h

operate

d

pr

i

or to 2003. Most o

f

t

h

e acqu

i

re

d

ent

i

t

i

es

g

enerate

d

losses for income tax purposes and certain tax returns remain open to examination by U.S. and foreign ta

x

aut

h

or

i

t

i

es

f

or tax

y

ears as

f

ar

b

ac

k

as 1998

.

O

ur po

li

c

yi

s to reco

g

n

i

ze an

yi

nterest re

l

ate

d

to unreco

g

n

i

ze

d

tax

b

ene

fi

ts

i

n

i

nterest expense or

i

nteres

t

income. We recognize penalties as additional income tax expense. As December 31, 2008, we had no uncertain tax

p

os

i

t

i

ons an

d

t

h

ere

f

ore accrue

d

no

i

nterest or pena

l

t

i

es re

l

ate

d

to uncerta

i

n tax pos

i

t

i

ons.

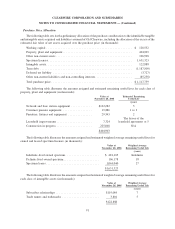

10

. Lon

g

-term debt

Long-term

d

e

b

t at Decem

b

er 31, 2008 cons

i

ste

d

o

f

t

h

e

f

o

ll

ow

i

ng (

i

nt

h

ousan

d

s)

:

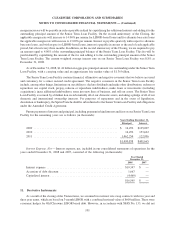

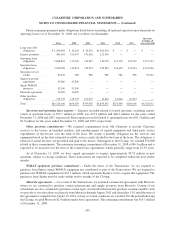

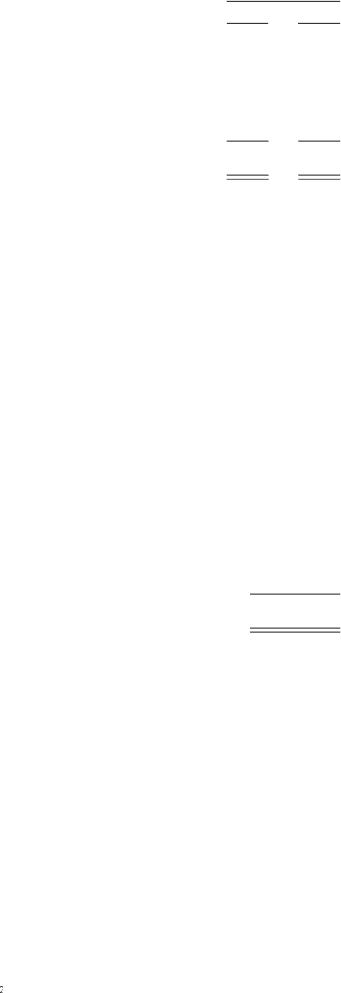

S

en

i

or Term Loan Fac

ili

ty,

d

ue

i

n 2011, 1% o

f

pr

i

nc

i

pa

ld

ue annua

ll

y; res

id

ua

l

a

t

m

atur

i

t

y

.

.

........................................................

$

1

,

364

,

79

0

Less: current port

i

on..................................................

(

14,292

)

T

otal long-term deb

t

..................................................

$

1

,

350

,

498

S

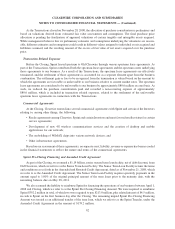

enior Term Loan Facilit

y

—

In con

j

unction with the Transactions, we assumed from Old Clearwire the Senio

r

Term Loan Facilit

y

, which had a balance as of the Closin

g

of $1.19 billion, net of discount. Concurrent with th

e

assumption of the Senior Term Loan Facility, we made a payment of

$

50.0 million for certain financing fees whic

h

r

epresented an obli

g

ation of Old Clearwire. Further, based on our assessment of the fair value of the Senior Term

L

oan Facilit

y

at the date of the Transactions, we recorded a $50.0 million discount a

g

ainst the principal balance. As

o

f December 31

,

2008

,

we have recorded

$

1.7 million for the accretion of debt discount. The Senior Term Loan

F

acilit

y

retains the terms and conditions as set forth in the Amended Credit A

g

reement. In addition, on December 1,

2

008, we elected to add the Sprint Tranche under the Amended Credit Agreement in the amount of

$

179.2 millio

n

f

or t

h

ere

i

m

b

ursement o

f

t

h

e rema

i

n

i

ng o

bli

gat

i

on o

f

t

h

e Spr

i

nt Pre-C

l

os

i

ng F

i

nanc

i

ng Amount. T

h

e Sen

i

or Term

L

oan Fac

ili

t

y

requ

i

res quarter

ly

pa

y

ments

i

nt

h

e amount o

f

1.00% o

f

t

h

eor

igi

na

l

pr

i

nc

i

pa

l

amount per

y

ear, w

i

t

h

t

he

r

emaining balance due on May 28, 2011

.

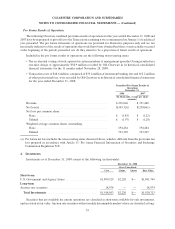

Th

e rate o

fi

nterest

f

or

b

orrow

i

ngs un

d

er t

h

e Sen

i

or Term Loan Fac

ili

ty

i

st

h

e LIBOR

b

ase rate p

l

us a marg

i

no

f

6.00%, with a base rate bein

g

no lower than 2.75% per annum or the alternate base rate, which is equal to the

g

reate

r

o

f (a) the Prime Rate or (b) the Federal Funds Effective rate

p

lu

s

1

⁄

1

2

⁄

⁄

of 1.00%, plus a mar

g

in of 5.00%, with a base

r

ate bein

g

no lower than 4.75% per annum. These mar

g

in rates increase b

y

50 basis points on each of the sixth,

t

welfth, and eighteen month anniversaries of the Closing. At our option, the accrued interest resulting from the

100

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)