Clearwire 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Transact

i

ons, Spr

i

nt contr

ib

ute

db

ot

h

t

h

e spectrum

l

ease agreements an

d

t

h

e spectrum assets un

d

er

l

y

i

ng t

h

os

e

a

g

reements to our business. As a result of the Transactions, the spectrum lease a

g

reements were effectivel

y

t

erminated, and the settlement of those agreements was accounted for as a separate element apart from the busines

s

c

om

bi

nat

i

on. T

h

e sett

l

ement

l

oss recogn

i

ze

df

rom t

h

e term

i

nat

i

on was va

l

ue

db

ase

d

on t

h

e amount

b

yw

hi

c

h

t

he

a

g

reements were favorable or unfavorable to our business as compared to current market rates.

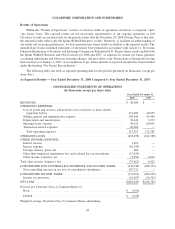

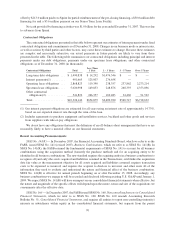

I

nterest expens

e

(

In thousands, except percenta

g

es) 2008 2007

Dolla

r

C

han

ge

P

ercenta

ge

C

han

g

e

Yea

r

E

n

ded

D

ecember 31

,

I

nterest expens

e

...............................

$(

16,545

)$

—

$(

16,545

)

N/M

T

he increase in interest expense was due to

$

7.9 million of interest expense recorded on the note payable t

o

S

print for the repa

y

ment of the Sprint Pre-Closin

g

Financin

g

Amount and the

$

8.6 million of interest expense

r

ecor

d

e

d

on t

h

e

l

on

g

-term

d

e

b

t acqu

i

re

df

rom O

ld

C

l

earw

i

re as part o

f

t

h

eC

l

os

i

n

g

.

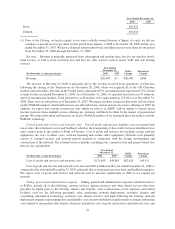

Other-than-temporary impairment loss and realized loss on investment

s

(

In thousands, except percenta

g

es) 2008 2007

Dolla

r

C

han

ge

P

ercenta

ge

C

han

g

e

Yea

r

E

n

ded

D

ecember 31

,

O

t

h

er-t

h

an-temporar

yi

mpa

i

rment

l

oss an

d

rea

li

ze

dl

os

s

o

n

i

nvestments, ne

t

...........................

$

(17,036) $— $(17,036) N/M

Th

e

i

ncrease

i

nt

h

eot

h

er-t

h

an-temporary

i

mpa

i

rment

l

oss an

d

rea

li

ze

dl

oss on

i

nvestments

i

spr

i

mar

il

y

d

ue to a

d

ec

li

ne

i

nt

h

eva

l

ue o

fi

nvestment secur

i

t

i

es

f

or t

h

e per

i

o

df

o

ll

ow

i

n

g

t

h

eC

l

os

i

n

g

,w

hi

c

h

we

d

eterm

i

ne

d

to

b

eot

h

er

t

han temporary. During the year ended December 31, 2008, we incurred other-than-temporary impairment losses o

f

$

17.0 million related to a decline in the estimated fair values of our investment securities.

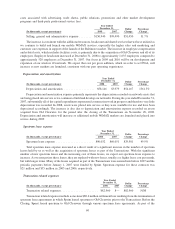

T

ax

p

rovision

(

In thousands, except percentages

)

2008 2007

Dollar

Chang

e

Percenta

ge

Change

Year Ende

d

December

31,

I

ncome tax

p

rovisio

n

....................... $

(

61,607

)

$

(

16,362

)

$

(

45,245

)

276.5

%

Th

e

i

ncrease

i

nt

h

e

i

ncome tax prov

i

s

i

on

i

spr

i

mar

ily d

ue to

i

ncrease

dd

e

f

erre

d

tax

li

a

bili

t

i

es

f

rom a

ddi

t

i

ona

l

amortization taken for federal income tax purposes by the Sprint WiMAX Business on certain indefinite-lived

licensed spectrum prior to the Closing. The Sprint WiMAX Business incurred significant deferred tax liabilitie

s

r

e

l

ate

d

to t

h

e spectrum

li

censes. Due to t

h

e

i

n

d

e

fi

n

i

te-

li

ve

d

nature o

f

suc

hi

ntan

gibl

e assets, we can not est

i

mate t

he

amount or timin

g

,ifan

y

, of such deferred tax liabilities reversin

g

in future periods. Accordin

g

l

y

, these deferred tax

liabilities are not relevant future taxable income and their increase is not offset b

y

a release of valuation allowanc

e

on our net operat

i

ng

l

osses. T

h

e ongo

i

ng

diff

erence

b

etween

b

oo

k

an

d

tax amort

i

zat

i

on resu

l

te

di

nana

ddi

t

i

ona

l

deferred income tax provision of $61.4 million in 2008 prior to the Closin

g.

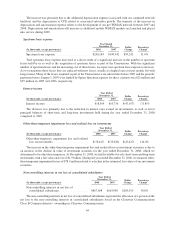

Non-controlling interests in net loss o

f

consolidated subsidiaries

(

In thousands, except percentages

)

2008 200

7

Do

ll

ar

Change

Percenta

ge

Change

Yea

r

E

n

ded

D

ecember 31

,

Non-contro

lli

n

gi

nterests

i

n net

l

oss o

f

conso

lid

ate

d

subs

i

d

i

a

ri

es

................................

$159,721 $— $159,721 N/M

Th

e non-contro

lli

n

gi

nterests

i

n net

l

oss represent t

h

ea

ll

ocat

i

on o

f

a port

i

on o

f

t

h

e net

l

oss to t

h

e non

-

c

ontro

lli

n

gi

nterests

i

n conso

lid

ate

d

su

b

s

idi

ar

i

es

b

ase

d

on t

h

e owners

hi

p

by

Spr

i

nt an

d

t

h

e Investors, ot

h

er t

h

an

G

oogle, of Clearwire Communications Class B Common Interests upon the Closing.

61