Clearwire 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.assume

d

,an

d

t

h

e resu

l

t

i

ng amount o

f

t

h

e excess o

f

est

i

mate

df

a

i

rva

l

ue o

f

net assets acqu

i

re

d

over t

h

e purc

h

as

e

p

rice

.

Art

i

c

l

e11o

f

Regu

l

at

i

on S-X requ

i

res t

h

at pro

f

orma a

dj

ustments re

fl

ecte

di

nt

h

e unau

di

te

d

pro

f

orma

s

tatement o

f

operat

i

ons are

di

rect

ly

re

l

ate

d

to t

h

e transact

i

on

f

or w

hi

c

h

pro

f

orma

fi

nanc

i

a

li

n

f

ormat

i

on

i

s presente

d

and have a continuin

g

impact on the results of operations. Certain char

g

es have been excluded in the unaudited pr

o

f

orma com

bi

ne

d

statement o

f

operat

i

ons as suc

h

c

h

arges were

i

ncurre

di

n

di

rect connect

i

on w

i

t

h

or at t

h

et

i

me o

f

t

h

e

Transact

i

ons an

d

are not expecte

d

to

h

ave an ongo

i

ng

i

mpact on t

h

e resu

l

ts o

f

operat

i

ons a

f

ter t

h

eC

l

os

i

ng

.

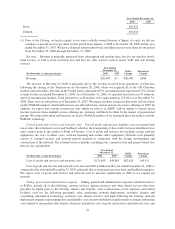

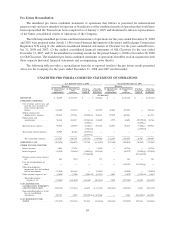

(a) Represents the accelerated vesting of stock options for certain members of management upon the Closing,

w

hich resulted in a one-time char

g

e of approximatel

y$

38.9 million recorded b

y

Old Clearwire in its

historical financial statements for the 11 months ended November 28, 2008. As these are non-recurrin

g

char

g

es directl

y

attributable to the Transactions, the

y

are excluded from the unaudited pro forma

com

bi

ne

d

statement o

f

operat

i

ons

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2008.

(b) The adjustments are to record depreciation and amortization expense on a pro forma basis related to the

new

b

as

i

so

f

O

ld

C

l

earw

i

re property, p

l

ant an

d

equ

i

pment

i

n purc

h

ase account

i

ng w

hi

c

h

are

b

e

i

n

g

d

eprec

i

ate

d

an

d

amort

i

ze

d

over t

h

e

i

r est

i

mate

d

rema

i

n

i

n

g

use

f

u

lli

ves on a stra

igh

t-

li

ne

b

as

i

s. T

he

reduction in depreciation results from a decrease in the carr

y

in

g

value of propert

y

, plant and equipment a

s

a result of the allocation of the excess of the estimated fair value of net assets ac

q

uired over the

p

urchas

e

pr

i

ce.

(c) Represents t

h

ea

dj

ustments to recor

d

amort

i

zat

i

on on a pro

f

orma

b

as

i

sre

l

ate

d

to t

h

enew

b

as

i

so

f

t

h

eO

ld

Cl

earw

i

re spectrum

l

ease contracts an

d

ot

h

er

i

ntan

gibl

e assets over t

h

e

i

r est

i

mate

d

we

igh

te

d

avera

g

e

remainin

g

useful lives on a strai

g

ht-line basis

.

(

d

) Represents t

h

ee

li

m

i

nat

i

on o

fi

ntercompany ot

h

er

i

ncome an

d

re

l

ate

d

expenses assoc

i

ate

d

w

i

t

h

t

he

historical a

g

reements pre-Closin

g

between the Sprint WiMAX Business and Old Clearwire, where Ol

d

C

learwire leased s

p

ectrum licenses from the S

p

rint WiMAX Business.

(e) Represents the reversal of transaction costs of

$

48.6 million for the

y

ear ended December 31, 2008,

comprised of $33.4 million of investment bankin

g

fees and $15.2 million of other professional fees,

recor

d

e

di

nt

h

eO

ld

C

l

earw

i

re

hi

stor

i

ca

lfi

nanc

i

a

l

statements

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2008. A

s

th

ese are non-recurr

i

ng c

h

arges

di

rect

l

y attr

ib

uta

bl

etot

h

e Transact

i

ons, t

h

ey are exc

l

u

d

e

df

rom t

he

unaudited pro forma combined statement of operations for the

y

ear ended December 31, 2008.

(

f

)Pr

i

or to t

h

eC

l

os

i

n

g

, Spr

i

nt

l

ease

d

spectrum to O

ld

C

l

earw

i

re t

h

rou

gh

var

i

ous spectrum

l

ease a

g

reements

.

As part o

f

t

h

e Transact

i

ons, Spr

i

nt contr

ib

ute

db

ot

h

t

h

e spectrum

l

ease a

g

reements an

d

t

h

e spectru

m

assets underlying those agreements. As a result of the Transactions, the spectrum lease agreements wer

e

e

ff

ect

i

ve

l

y term

i

nate

d

,an

d

t

h

e sett

l

ement o

f

t

h

ose agreements was accounte

df

or as a separate e

l

emen

t

f

rom the business combination. A settlement loss of

$

80.6 million resulted from the termination as the

a

g

reements were considered to be unfavorable to us relative to current market rates. This one-time char

ge

recor

d

e

db

yC

l

earw

i

re at t

h

eC

l

os

i

ng

i

sexc

l

u

d

e

df

rom t

h

e unau

di

te

d

pro

f

orma com

bi

ne

d

statement o

f

o

perat

i

ons

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2008.

(g) Prior to the Closing of the Transactions, Old Clearwire refinanced the Senior Term Loan Facility and

rene

g

ot

i

ate

d

t

h

e

l

oan terms. H

i

stor

i

ca

li

nterest expense re

l

ate

d

to t

h

e Sen

i

or Term Loan Fac

ili

t

yb

e

f

ore t

he

refinancin

g

and amortization of the deferred financin

g

fees recorded b

y

Old Clearwire, in the amounts o

f

$94.1 million and $95.3 million for the years ended December 31, 2008 and 2007, respectively, have bee

n

reverse

d

as

if

t

h

e Transact

i

ons were consummate

d

on January 1, 2007. A

ddi

t

i

ona

ll

y, t

h

e

l

oss on

extin

g

uishment of debt of $159.2 million recorded for the

y

ear ended December 31, 2007 was reversed

in the unaudited

p

ro forma combined statement of o

p

erations.

(

h

) Represents t

h

ea

dj

ustment to recor

d

pro

f

orma

i

nterest expense assum

i

n

g

t

h

e Sen

i

or Term Loan Fac

ili

t

y

and the Sprint Tranche under the Amended Credit Agreement were outstanding as of the beginning of th

e

earliest period presented, January 1, 2007. The Closing would have resulted in an event of default unde

r

th

e terms o

f

t

h

e cre

di

ta

g

reement un

d

er

lyi

n

g

t

h

e Sen

i

or Term Loan Fac

ili

t

y

un

l

ess t

h

e consent o

f

t

h

e

6

7