Clearwire 2008 Annual Report Download - page 95

Download and view the complete annual report

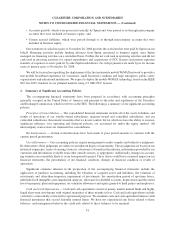

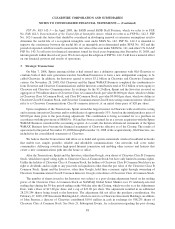

Please find page 95 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.deferred the adoption of SFAS No. 157 for our nonfinancial assets and nonfinancial liabilities, except those items

r

ecogn

i

ze

d

or

di

sc

l

ose

d

at

f

a

i

rva

l

ue on an annua

l

or more

f

requent

l

y recurr

i

ng

b

as

i

s, unt

il

January 1, 2009

.

See Note 12, Fair Value Measurements, for information regarding our use of fair value measurements and ou

r

adoption of the provisions of SFAS No. 157.

Accounts Recei

v

abl

e

—

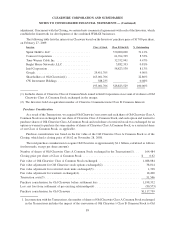

Accounts receivables are stated at amounts due from customers net of an allowance

f

or

d

ou

b

t

f

u

l

accounts. We spec

ifi

ca

ll

y prov

id

ea

ll

owances

f

or customers w

i

t

hk

nown

di

sputes or co

ll

ecta

bili

t

y

i

ssues. T

h

e rema

i

n

i

n

g

reserve recor

d

e

di

nt

h

ea

ll

owance

f

or

d

ou

b

t

f

u

l

accounts

i

s our

b

est est

i

mate o

f

t

h

e amount o

f

p

robable losses in the remainin

g

accounts receivable based upon an evaluation of the a

g

e of receivables and

hi

stor

i

ca

l

exper

i

ence.

I

nventory — Inventor

y

primaril

y

consists of customer premise equipment, which we refer to as CPE, and othe

r

accessories sold to customers and is stated at the lower of cost or net realizable value. Cost is determined under the

avera

g

e cost met

h

o

d

. We recor

di

nventor

y

wr

i

te-

d

owns

f

or o

b

so

l

ete an

d

s

l

ow-mov

i

n

gi

tems

b

ase

d

on

i

nventor

y

turnover tren

d

san

dhi

stor

i

ca

l

ex

p

er

i

ence

.

P

roperty, P

l

ant an

d

E

q

uipmen

t

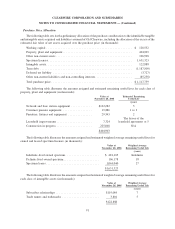

— Propert

y

,p

l

ant an

d

equ

i

pment are state

d

at cost, net o

f

accumu

l

ate

d

depreciation. Depreciation is calculated on a strai

g

ht-line basis over the estimated useful lives of the assets. We

c

apitalize costs of additions and improvements, includin

g

direct costs of constructin

g

propert

y

, plant and equipment

an

di

nterest costs re

l

ate

d

to construct

i

on. T

h

e est

i

mate

d

use

f

u

l lif

eo

f

equ

i

pment

i

s

d

eterm

i

ne

db

ase

d

on

hi

stor

i

ca

l

usa

g

e of identical or similar equipment, with consideration

g

iven to technolo

g

ical chan

g

es and industr

y

trends tha

t

c

ould im

p

act the network architecture and asset utilization. Leasehold im

p

rovements are recorded at cost an

d

amort

i

ze

d

over t

h

e

l

esser o

f

t

h

e

i

r est

i

mate

d

use

f

u

lli

ves or t

h

ere

l

ate

dl

ease term,

i

nc

l

u

di

ng renewa

l

st

h

at are

r

easonabl

y

assured. Maintenance and repairs are expensed as incurred.

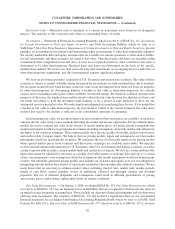

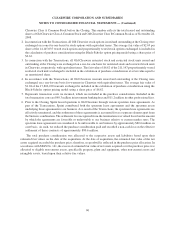

Property, plant and equipment are assessed for impairment whenever events or changes in circumstance

s

i

n

di

cate t

h

at t

h

e carr

yi

n

g

amount o

f

an asset ma

y

not

b

e recovera

bl

e, as requ

i

re

dby

SFAS No. 144, Accounting fo

r

t

h

e Impairment or Disposa

l

of Long-Live

d

Assets

,

w

hi

c

h

we re

f

er to as SFAS No. 144. T

h

e

d

ec

li

ne

i

nt

h

e stoc

kp

r

i

c

e

from the Closing to December 31, 2008, coupled with our stock price at December 31, 2008 being below our boo

k

va

l

ue per s

h

are at t

h

eC

l

os

i

ng, was

d

eeme

d

to

b

eatr

i

gger

i

ng event, requ

i

r

i

ng us to per

f

orm an

i

mpa

i

rment test

.

A

ccordin

g

to SFAS No. 144, if the total of the expected undiscounted future cash flows is less than the carr

y

in

g

amount of the asset, a loss is reco

g

nized for the difference between the fair value and carr

y

in

g

value of the assets

.

Impa

i

rment ana

l

yses, w

h

en per

f

orme

d

, are

b

ase

d

on

f

orecaste

d

cas

hfl

ows t

h

at cons

id

er our

b

us

i

ness an

d

technolo

gy

strate

gy

, mana

g

ement’s views of

g

rowth rates for the business, anticipated future economic and

r

e

g

ulator

y

conditions and expected technolo

g

ical availabilit

y

. For purposes of reco

g

nition and measurement, w

e

group our

l

ong-

li

ve

d

assets at t

h

e

l

owest

l

eve

lf

or w

hi

c

h

t

h

ere are

id

ent

ifi

a

bl

e cas

hfl

ows w

hi

c

h

are

l

arge

ly

i

n

d

epen

d

ent o

f

ot

h

er assets an

dli

a

bili

t

i

es. T

h

ere were no propert

y

,p

l

ant an

d

equ

i

pment

i

mpa

i

rment

l

osses recor

d

e

d

i

n the

y

ears ended December 31, 2008 and 2007.

I

nterna

ll

y Deve

l

ope

d

Software — We cap

i

ta

li

ze costs re

l

ate

d

to computer so

f

tware

d

eve

l

ope

d

or o

b

ta

i

ne

df

or

i

nterna

l

use

i

n accor

d

ance w

i

t

h

Statement o

f

Pos

i

t

i

on, w

hi

c

h

we re

f

er to as SOP, No. 98-1

,

Accounting for t

h

e Costs

of

Computer So

f

tware Developed or Obtained

f

or Internal Use

.

Software obtained for internal use has generally

b

een enterpr

i

se-

l

eve

lb

us

i

ness an

dfi

nance so

f

tware custom

i

ze

d

to meet spec

ifi

c operat

i

ona

l

nee

d

s. Costs

i

ncurre

d

i

n the a

pp

lication develo

p

ment

p

hase are ca

p

italized and amortized over the useful life of the software, which is

g

enerall

y

three

y

ears. Costs reco

g

nized in the preliminar

y

pro

j

ect phase and the post-implementation phase are

e

xpense

d

as

i

ncurre

d.

S

pectrum Licenses — Spectrum licenses primaril

y

include owned spectrum licenses with indefinite lives

,

owne

d

spectrum

li

censes w

i

t

hd

e

fi

n

i

te

li

ves, an

df

avora

bl

e spectrum

l

eases. T

h

e cost o

fi

n

d

e

fi

n

i

te

li

ve

d

spectrum

li

censes ac

q

u

i

re

d

are

f

a

i

rva

l

ue

d

at t

h

e

d

ate o

f

ac

q

u

i

s

i

t

i

on. We account

f

or our s

p

ectrum

li

censes w

i

t

hi

n

d

e

fi

n

i

te

li

ve

s

i

n accordance with the

p

rovisions of SFAS No. 142, Goodwill and Other Intangible Assets

,

which we refer to as

S

FAS No. 142. The impairment test for intangible assets with indefinite useful lives consists of a comparison of th

e

83

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)