Clearwire 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

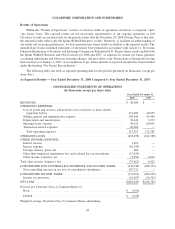

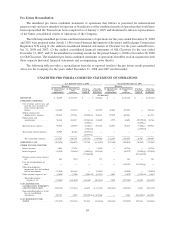

12 Month Per

i

o

d

Clearwir

e

Corporation(1)

11 Month Per

i

o

d

Old

Clearwir

e

P

urc

h

ase

A

cctn

g

and

Other(2)

C

learw

i

re

Corporation

P

r

o

F

o

rm

a

1

2 Month Per

i

od

C

learwir

e

C

orporation(1

)

1

2 Month Per

i

od

O

l

d

C

learwire

P

urc

h

ase

A

cctn

g

and

O

ther(2)

C

learw

i

re

C

orporatio

n

Pr

o

F

o

rm

a

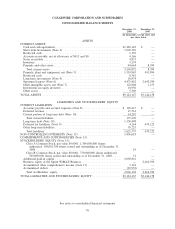

Historical Historica

l

Year Ended December

31

,

2008

Year Ended December

31

,

2007

(

In thousands

)

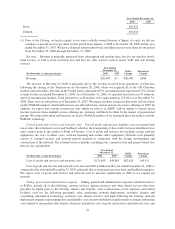

Income tax prov

i

s

i

on. .

.

.

..

.

(61,607) (

5

,379) 66,986(j) — (16,362) (

5

,427) 21,789(j)

—

NET LOSS

.

.............

$(432,626) $(739,520) $ 858,000 $ (314,146) $(224,725) $(727,466) $ 714,130 $(238,061)

(

1

)

Bas

i

so

f

Presentat

i

o

n

Spr

i

nt entere

di

nto an agreement w

i

t

h

O

ld

C

l

earw

i

re to com

bi

ne

b

ot

h

o

f

t

h

e

i

r next generat

i

on w

i

re

l

ess

b

roa

db

an

db

us

i

nesses to

f

orm a new

i

n

d

epen

d

ent compan

y

ca

ll

e

d

C

l

earw

i

re. On C

l

os

i

n

g

,O

ld

C

l

earw

i

re an

d

t

he

Sp

rint WiMAX Business com

p

leted the combination to form Clearwire

.

T

he Transactions are bein

g

accounted for under SFAS No. 141 as a reverse acquisition with the Sprint WiMAX

Bus

i

ness

d

eeme

d

to

b

et

h

e account

i

ng acqu

i

rer.

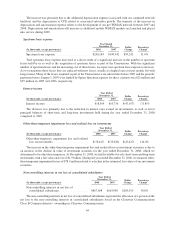

On the Closing, the Investors made an aggregate

$

3.2 billion capital contribution to Clearwire and its

s

u

b

s

idi

ar

y

C

l

earw

i

re Commun

i

cat

i

ons. In exc

h

an

g

e

f

or t

h

e

i

r

i

nvestment, Goo

gl

e

i

n

i

t

i

a

lly

rece

i

ve

d

2

5

,000,000 shares of Clearwire Class A Common Stock and S

p

rint and the other Investors received

5

05,000,000 shares of Clearwire Class B Common Stock and an equivalent amount of Clearwire Communication

s

Cl

ass B

C

ommon Interests. T

h

e num

b

er o

f

s

h

ares o

fCl

ear

wi

re

Cl

ass A an

d

B

C

ommon

S

toc

k

an

dCl

ear

wi

r

e

Communications Class B Common Interests, as a

pp

licable, that the Investors were entitled to receive under the

Transact

i

on Agreement was su

bj

ect to a post-c

l

os

i

ng a

dj

ustment

b

ase

d

on t

h

e tra

di

ng pr

i

ce o

f

C

l

earw

i

re C

l

ass A

Common Stock on NASDAQ over 15 randomly-selected trading days during the 30-day period ending on th

e

90th da

y

after the Closin

g

, or Februar

y

26, 2009, which we refer to as the Ad

j

ustment Date, with a floor of $17.00

p

er share and a cap of

$

23.00 per share. During the measurement period, Clearwire Class A Common Stock traded

below

$

17.00 per share on NASDAQ, so on the Adjustment Date, we issued to the Investors an additional

4,411,765 shares of Clearwire Class A Common Stock and 23,823,529 shares of Clearwire Class B Common Stock

and 23,823,529 additional Clearwire Communications Class B Common Interests to reflect the

$

17.00 final

p

ric

e

p

er share. Additionally, in accordance with the subscription agreement, on February 27, 2009, CW Investments

p

urchased 588,235 shares of Clearwire Class A Common Stock at

$

17.00 per share. For the purpose of determinin

g

t

he number of shares outstandin

g

within the unaudited pro forma combined statements of operations, we assume

d

t

hat the additional shares and common interests issued to the Investors on the Adjustment Date, as applicable, wer

e

i

ssue as o

f

t

h

eC

l

os

i

ng an

d

t

h

at t

h

eC

l

os

i

ng was consummate

d

on January 1, 2007. A

f

ter g

i

v

i

ng e

ff

ect to t

he

Transactions, the post-closin

g

ad

j

ustment and the investment b

y

CW Investments of $10 million, Sprint owns th

e

lar

g

est interest in Clearwire with an effective votin

g

and economic interest in Clearwire and its subsidiaries o

f

approximately 51%

.

I

n connect

i

on w

i

t

h

t

h

e

i

nte

g

rat

i

on o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness an

d

O

ld

C

l

earw

i

re operat

i

ons, we expec

t

th

at certa

i

n non-recurr

i

n

g

c

h

ar

g

es w

ill b

e

i

ncurre

d

.Wea

l

so expect t

h

at certa

i

ns

y

ner

gi

es m

igh

t

b

e rea

li

ze

dd

ue to

operatin

g

efficiencies or future revenue s

y

ner

g

ies expected to result from the Transactions. However, the amount

an

d

extent o

f

t

h

ose synerg

i

es cannot

b

e quant

ifi

e

d

at t

hi

st

i

me. T

h

ere

f

ore, no pro

f

orma a

dj

ustments

h

ave

b

ee

n

r

e

fl

ecte

di

nt

h

e unau

di

te

d

pro

f

orm com

bi

ne

d

statements o

f

operat

i

ons to re

fl

ect an

y

suc

h

costs or

b

ene

fi

ts.

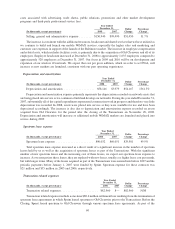

(2) Pro Forma A

dj

ustments Re

l

ate

d

to Purc

h

ase Account

i

n

g

an

d

Ot

h

er Non-recurr

i

n

g

C

h

ar

g

es

f

or t

h

e Years En

d

e

d

D

ecember 31

,

2008 and 200

7

T

he pro forma ad

j

ustments related to purchase accountin

g

have been derived from the preliminar

y

allocation

o

f

t

h

e purc

h

ase cons

id

erat

i

on to t

h

e

id

ent

ifi

a

bl

e tang

ibl

ean

di

ntang

ibl

e assets acqu

i

re

d

an

dli

a

bili

t

i

es assume

d

o

f

O

ld

C

l

earw

i

re,

i

nc

l

u

di

n

g

t

h

ea

ll

ocat

i

on o

f

t

h

e excess o

f

t

h

e est

i

mate

df

a

i

rva

l

ue o

f

net assets acqu

i

re

d

over t

h

e

p

urchase price. The allocation of the purchase consideration is preliminar

y

and based on valuations derived fro

m

estimated fair value assessments and assumptions used by management. The final purchase price allocation is

p

en

di

n

g

t

h

e

fi

na

li

zat

i

on o

f

appra

i

sa

l

va

l

uat

i

ons o

f

certa

i

n tan

gibl

ean

di

ntan

gibl

e assets acqu

i

re

d

.W

hil

e man-

a

g

ement

b

e

li

eves t

h

at

i

ts pre

li

m

i

nar

y

est

i

mates an

d

assumpt

i

ons un

d

er

lyi

n

g

t

h

eva

l

uat

i

ons are reasona

bl

e,

diff

eren

t

estimates and assumptions could result in different values being assigned to individual assets acquired and liabilities

66