Clearwire 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.l

en

d

ers was o

b

ta

i

ne

d

. On Novem

b

er 21, 2008, O

ld

C

l

earw

i

re entere

di

nto t

h

e Amen

d

e

d

Cre

di

t Agreement

w

ith the lenders to satisf

y

this closin

g

condition. The Amended Credit A

g

reement resulted in additiona

l

f

ees to be paid and adjustments to the underlying interest rates. The Sprint Pre-Closing Financing Amount

w

as assume

db

yC

l

earw

i

re on t

h

eC

l

os

i

ng as a resu

l

to

f

t

h

e

fi

nanc

i

ng o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness

by

Sprint for the period April 1, 2008 throu

g

h the Closin

g

, and added as an additional tranche under the

Amen

d

e

d

Cre

di

t Agreement. Pro

f

orma

i

nterest expense was ca

l

cu

l

ate

d

over t

h

e per

i

o

d

us

i

ng t

h

ee

ff

ect

i

ve

interest method resulting in an adjustment of

$

175.7 million and

$

191.6 million for the years ended

Decem

b

er 31, 2008 an

d

2007, respect

i

ve

ly

,

b

ase

d

on an e

ff

ect

i

ve

i

nterest rate o

f

14.0 percent. Pro

f

orma

interest expense also reflects an adjustment to accrete the debt to par value. Pro forma interest expense was

calculated based on the contractual terms under the Amended Credit Agreement, assuming a term equal t

o

its contractual maturit

y

of 30 months and the underl

y

in

g

interest rate was the base rate of 2.75 percent, a

s

t

he 3 month LIBOR rate in effect at the Closin

g

was less than the base rate. A one-ei

g

hth percenta

ge

change in the interest rate would increase or decrease interest expense by

$

1.6 million and

$

1.7 million for

th

e

y

ears en

d

e

d

Decem

b

er 31, 2008 an

d

2007, respect

i

ve

ly.

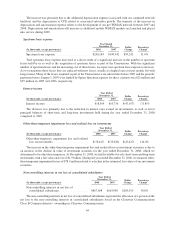

(i) Represents the allocation of a portion of the pro forma combined net loss to the non-controllin

g

interests

i

n conso

lid

ate

d

su

b

s

idi

ar

i

es

b

ase

d

on Spr

i

nt’s an

d

t

h

e Investors’ (ot

h

er t

h

an Goog

l

e) owners

hi

po

f

t

he

C

learwire Communications Class B Common Interests in Clearwire Communications upon Closin

g

and

reflects the contributions by CW Investments and the Investors at

$

17.00 per share following the post-

c

l

os

i

ng a

dj

ustment. T

hi

sa

dj

ustment

i

s

b

ase

d

on pre-tax

l

oss s

i

nce

i

ncome tax consequences assoc

i

ate

d

w

ith an

y

loss allocated to the Clearwire Communications Class B Common Interests will be incurre

d

directly by the Investors (other than Google) and by Sprint

.

(

j

) Represents t

h

ea

dj

ustment to re

fl

ect t

h

e pro

f

orma

i

ncome tax expense

f

or eac

h

per

i

o

d

w

hi

c

h

was

determined b

y

computin

g

the pro forma effective tax rates for each period,

g

ivin

g

effect to th

e

Transactions. Clearwire expects to generate net operating losses into the foreseeable future and thu

s

h

as recor

d

e

d

ava

l

uat

i

on a

ll

owance

f

or t

h

e

d

e

f

erre

d

tax assets not expecte

d

to

b

e rea

li

ze

d

.T

h

ere

f

ore,

f

or

t

he

y

ears ended December 31, 2008 and 2007, no tax benefit was reco

g

nized.

Liquidity and Capital Resource Requirement

s

At the Closing, we received an aggregate of

$

3.2 billion of cash proceeds from the Investors. We expect the

c

as

h

procee

d

s

f

rom t

hi

s

i

nvestment to pr

i

mar

ily b

e use

d

to expan

d

our mo

bil

eW

i

MAX networ

ki

nt

h

eUn

i

te

d

S

tates,

f

or spectrum acqu

i

s

i

t

i

ons, an

df

or

g

enera

l

corporate purposes. As o

f

Decem

b

er 31, 2008, w

i

t

h

t

h

e procee

d

s

of the investment, we believe that we held sufficient cash, cash e

q

uivalents and marketable securities to cause ou

r

e

st

i

mate

dli

qu

idi

ty nee

d

sto

b

e sat

i

s

fi

e

df

or at

l

east 12 mont

h

s

.

T

o execute our plans, we will likel

y

seek additional capital in the near future and over the lon

g

term. An

y

a

ddi

t

i

ona

ld

e

b

t

fi

nanc

i

ng wou

ld i

ncrease our

f

uture

fi

nanc

i

a

l

comm

i

tments, w

hil

e any a

ddi

t

i

ona

l

equ

i

ty

fi

nanc

i

n

g

wou

ld b

e

dil

ut

i

ve to our stoc

kh

o

ld

ers. T

hi

sa

ddi

t

i

ona

lfi

nanc

i

ng may not

b

eava

il

a

bl

etouson

f

avora

bl

e terms or a

t

all. Our abilit

y

to obtain additional financin

g

depends on several factors, includin

g

our market success as we deplo

y

n

ew mobile WiMAX markets, general economic conditions and the state of the capital markets, our futur

e

c

re

di

twort

hi

ness an

d

restr

i

ct

i

ons conta

i

ne

di

nex

i

st

i

ng or

f

uture

d

e

b

t agreements

.

We re

g

ularl

y

evaluate our plans and strate

gy

, and these evaluations often result in chan

g

es, some of which ma

y

be material and ma

y

si

g

nificantl

y

increase or decrease our cash requirements. Chan

g

es in our plans and strate

gy

m

ay

i

nc

l

u

d

e, among ot

h

er t

hi

ngs, c

h

anges to t

h

e extent an

d

t

i

m

i

ng o

f

our networ

kd

ep

l

oyment,

i

ncreases o

r

decreases in the number of our emplo

y

ees, introduction of new features or services, investments in capital an

d

n

etwork infrastructure, acquisitions of spectrum or an

y

combination of the fore

g

oin

g.

I

na

ddi

t

i

on, recent

di

stress

i

nt

h

e

fi

nanc

i

a

l

mar

k

ets

h

as resu

l

te

di

n extreme vo

l

at

ili

t

yi

n secur

i

t

y

pr

i

ces,

di

m

i

n

i

s

h

e

dli

qu

idi

t

y

an

d

cre

di

tava

il

a

bili

t

y

an

dd

ec

li

n

i

n

g

va

l

uat

i

ons o

f

certa

i

n

i

nvestments. Ot

h

er t

h

an t

he

i

m

p

airment of our auction rate securities, we have assessed the im

p

lications of these factors on our curren

t

b

us

i

ness an

dd

eterm

i

ne

d

t

h

at t

h

ere

h

as not

b

een a s

ig

n

ifi

cant

i

mpact to our

fi

nanc

i

a

l

pos

i

t

i

on or

li

qu

idi

t

yd

ur

i

n

g

2008. I

f

t

h

e nat

i

ona

l

or

gl

o

b

a

l

econom

y

or cre

di

t mar

k

et con

di

t

i

ons

i

n

g

enera

l

were to

d

eter

i

orate

f

urt

h

er

i

nt

h

e

future, it is possible that such chan

g

es could adversel

y

affect our cash flows throu

g

h increased interest costs or our

68