Clearwire 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Of note in our pro forma results for the year ended December 31, 2008:

•

We ended the year with 475,000 subscribers in 51 markets; a 21% increase from 2007.

•

We increased revenue by 52% and achieved a $2.31 increase in ARPU to $39.12.

•

Household penetration(4) reached 7% on average for our U.S. pre-WiMAX markets,

with a quarter of those U.S. markets reaching 15% or higher penetration for the year.

•

Our 46 U.S. pre-WiMAX markets as a group produced positive market EBITDA(2)(5)

margins for the fi rst time.

•

Market EBITDA margin for our 25 Initial markets as a group increased to 33%

for the year (and reached 40% in the fourth quarter); up from 6% in 2007.

•

We ended 2008 with a strong balance sheet, including $3.1 billion of cash

and short-term investments.

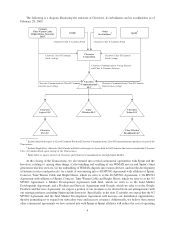

We spent much of 2008 focused on completing our strategic transaction and ensuring a

successful integration of the Clearwire and Sprint 4G businesses, which ultimately caused a

shift in our original market deployment plans for the year. We believed then, as we believe

now, that the price of getting it right and starting the new company o on a solid footing,

measured by the resulting delay in launching new WiMAX markets in late 2008 and early

2009, was well worth it. Our new markets will launch under a unifi ed brand and benefi t

from a common core network platform and integrated back o ce systems.

That was 2008. We are already executing against our signifi cant growth plans for

2009 and beyond.

THE CLEAR™ NETWORK – NEW MARKETS, NEW DEVICES

We began 2009 with the launch of our mobile WiMAX services in Portland, Oregon,

under our CLEAR™ brand. I’m pleased to report that our initial network performance has

exceeded the targets that we set for ourselves. And our customers are noticing. Right out

of the gate, our sales teams in Portland are introducing new customers to CLEAR™ services

at an unprecedented rate.

In March, we launched the CLEAR Spot™ accessory that allows customers to create their

own personal hotspot opening up the WiMAX ecosystem to hundreds of standard Wi-Fi-

enabled products ranging from the Apple® iPod® Touch to the BlackBerry® Bold to the Sony

PSP® and more.

This summer, we’re planning to expand our CLEAR™ network to Las Vegas and Atlanta,

adding more than 4.5 million people to our coverage footprint. We also expect to launch

a dual mode 3G/4G modem giving CLEAR™ customers access to a nationwide 3G mobile

data network.