Clearwire 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.P

urc

h

ase o

bl

i

g

ation

s

—

As part o

f

t

h

eC

l

os

i

ng, we assume

d

certa

i

n agreements an

d

t

h

eo

bli

gat

i

ons t

h

ere-

un

d

er,

i

nc

l

u

di

ng a num

b

er o

f

arrangements

f

or t

h

e sourc

i

ng o

f

equ

i

pment, supp

li

es an

d

serv

i

ces w

i

t

h

ta

k

e-or-pa

y

obli

g

ations. Our obli

g

ations with these suppliers run throu

g

h 2013 and have total minimum purchase obli

g

ations of

$

334.8 million.

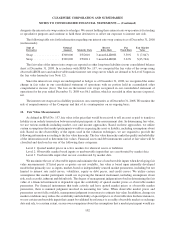

Legal proceedings

—

On December 1, 2008, Ada

p

tix, Inc., which we refer to as Ada

p

tix, filed suit for

p

aten

t

i

nfringement against us and Sprint in the U.S. District Court for the Eastern District of Texas, alleging that we an

d

S

pr

i

nt

i

n

f

r

i

n

g

e

d

s

i

x patents purporte

dly

owne

dby

A

d

apt

i

x. On Fe

b

ruar

y

10, 2009, A

d

apt

i

x

fil

e

d

an Amen

d

e

d

Comp

l

a

i

nt a

ll

e

gi

n

gi

n

f

r

i

n

g

ement o

f

a sevent

h

patent. A

d

apt

i

xa

ll

e

g

es t

h

at

by

o

ff

er

i

n

g

mo

bil

eW

i

MAX serv

i

ces to

c

ustomers in compliance with the 802.16 and 802.16e WiMAX standards, and by making, using and/or selling th

e

s

upport

i

n

g

W

i

MAX networ

k

use

d

to prov

id

e suc

h

W

i

MAX serv

i

ces, we an

d

Spr

i

nt

i

n

f

r

i

n

g

e

d

t

h

e seven patents

.

A

daptix is seekin

g

monetar

y

dama

g

es, attorne

y

s’ fees and a permanent in

j

unction en

j

oinin

g

us from further acts of

alle

g

ed infrin

g

ement. On Februar

y

2

5

, 2009, we filed an Answer to the Amended Complaint, den

y

in

g

infrin

g

emen

t

an

d

assert

i

ng severa

l

a

ffi

rmat

i

ve

d

e

f

enses,

i

nc

l

u

di

ng t

h

at t

h

e asserte

d

patents are

i

nva

lid

.Atr

i

a

li

ssc

h

e

d

u

l

e

df

or

D

ecember 2010, and the parties are expected to commence discover

y

in earl

y

2009.

O

n May 7, 2008, Spr

i

nt

fil

e

d

an act

i

on

i

nt

h

eDe

l

aware Court o

f

C

h

ancery aga

i

nst

i

PCS, Inc., w

hi

c

h

we re

f

er t

o

as

i

PCS, an

d

certa

i

nsu

b

s

idi

ar

i

es o

fi

PCS, w

hi

c

h

we re

f

er to as t

h

e

i

PCS Su

b

s

idi

ar

i

es, see

ki

n

g

a

d

ec

l

arator

y

judgment that, among other things, the Transactions do not violate iPCS’ and iPCS Subsidiaries’ rights under their

s

eparate agreements w

i

t

h

Spr

i

nt to operate an

d

manage port

i

ons o

f

Spr

i

nt’s PCS networ

ki

n certa

i

n geograp

hic

areas. T

h

eDe

l

aware case was

l

ater sta

y

e

dby

t

h

eDe

l

aware court. On Ma

y

12, 2008,

i

PCS an

d

t

h

e

i

PCS Su

b

s

idi

ar

i

e

s

filed a competin

g

lawsuit in the Circuit Court of Cook Count

y

, Illinois, alle

g

in

g

that the Transactions would breac

h

t

he exclusivity provisions in their management agreements with Sprint. On January 30, 2009, iPCS and the iPCS

S

u

b

s

idi

ar

i

es

fil

e

d

an Amen

d

e

d

Comp

l

a

i

nt see

ki

n

g

a

d

ec

l

arator

yj

u

dg

ment t

h

at t

h

e consummat

i

on o

f

t

h

e Trans-

actions violates their mana

g

ement a

g

reements with Sprint, a permanent in

j

unction preventin

g

Sprint and its relate

d

p

arties, which iPCS alle

g

es includes Clearwire, from implementin

g

the Transactions and competin

g

with Plaintiffs

,

d

amages aga

i

nst Spr

i

nt

f

or un

l

aw

f

u

l

compet

i

t

i

on an

d

costs an

dl

ega

lf

ees. No tr

i

a

ld

ate

i

ne

i

t

h

er case

i

s current

ly

s

cheduled. We are not named as a part

y

in either liti

g

ation, but have received a subpoena from iPCS and iPCS

S

ubsidiaries seekin

g

documents and testimon

y

. If iPCS prevails and obtains a permanent in

j

unction and the Cour

t

d

eems C

l

earw

i

re to

b

eare

l

ate

d

party un

d

er t

h

e management agreements t

h

en we may

b

e restr

i

cte

df

rom compet

i

ng

w

ith iPCS and iPCS Subsidiaries. We do not believe that the inabilit

y

to offer services in iPCS Covera

g

e area

s

w

ould have a material adverse effect on our business

.

Cl

earw

i

re

i

s a part

y

to var

i

ous ot

h

er pen

di

n

gl

e

g

a

l

procee

di

n

g

s, c

l

a

i

ms,

i

nvest

ig

at

i

ons an

d

a

d

m

i

n

i

strat

i

ve

p

roceedin

g

s. Our mana

g

ement and le

g

al counsel have reviewed the probable outcome of these proceedin

g

s, th

e

c

osts and expenses reasonably expected to be incurred, the availability and limits of our insurance coverage

,

e

x

i

st

i

n

g

contractua

li

n

d

emn

ifi

cat

i

on prov

i

s

i

ons an

d

eac

h

o

f

our esta

bli

s

h

e

dli

a

bili

t

i

es. W

hil

et

h

e outcome o

f

t

h

ese

other pendin

g

proceedin

g

s cannot be predicted with certaint

y

, based on our review, we believe that an

y

unrecorde

d

liabilit

y

that ma

y

result will not have a material adverse effect on our liquidit

y

, financial condition or results of

operat

i

ons

.

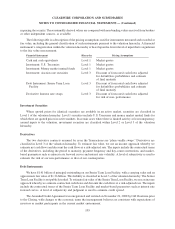

In

d

emni

f

ication agreements

—

We are current

l

y a party to, or contemp

l

at

i

ng enter

i

ng

i

nto,

i

n

d

emn

ifi

cat

i

on

agreements w

i

t

h

certa

i

no

ffi

cers an

d

eac

h

o

f

t

h

e mem

b

ers o

f

our Boar

d

o

f

D

i

rectors. No

li

a

bili

t

i

es

h

ave

b

ee

n

r

ecorded in the consolidated balance sheets for an

y

indemnification a

g

reements.

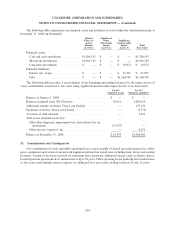

W

arrants — In accor

d

ance w

i

t

h

t

h

e Transact

i

on A

g

reement, a

ll

O

ld

C

l

earw

i

re warrants

i

ssue

d

an

d

outstan

d-

i

n

g

at t

h

eC

l

os

i

n

g

were exc

h

an

g

e

d

on a one-

f

or-one

b

as

i

s

f

or warrants w

i

t

h

equ

i

va

l

ent terms. T

h

e

f

a

i

rva

l

ue o

f

t

he

w

arrants exchan

g

ed of $18.5 million is included in the calculation of purchase consideration usin

g

the Black-

S

choles option pricing model using a share price of

$

6.62. See Note 3, Strategic Transactions, for further discussion

.

Holders ma

y

exercise their warrants at an

y

time, with exercise prices ran

g

in

g

from

$

3.00 to

$

48.00. Old Clearwir

e

g

ranted the holders of the warrants re

g

istration ri

g

hts coverin

g

the shares sub

j

ect to issuance under the warrants. The

1

06

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)