Clearwire 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

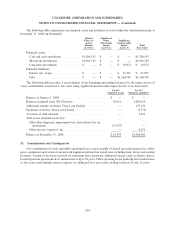

Expense recorded related to stock options in the year ended December 31, 2008 was

$

2.4 million. In addition to

options issued in exchange as part of the Transactions, the fair value of option grants during 2008 was

$

954,000. The

t

otal unreco

g

nized share-based compensation costs related to non-vested stock options outstandin

g

at December 31,

2

008 was approximately

$

9.0 million and is expected to be recognized over a weighted average period of

approx

i

mate

l

y 2 years

.

As of December 31, 2008, our forfeiture rate used in the calculation of stock o

p

tion ex

p

ense is 12.

66

%

.

R

estricted Stock Units

I

n connection with the Transactions, all Old Clearwire restricted stock units, which we refer to as RSUs issue

d

an

d

outstan

di

ng at t

h

eC

l

os

i

ng were exc

h

ange

d

on a one-

f

or-one

b

as

i

s

f

or RSUs w

i

t

h

equ

i

va

l

ent terms. T

h

e

f

a

ir

value of the proportionatel

y

vested RSUs exchan

g

ed of

$

1.4 million (see Note 3) is included in the calculation of

p

urchase consideration at a fair value equal to an unrestricted share, which is $6.62. Followin

g

the Closin

g

,w

e

grante

d

RSUs to certa

i

no

ffi

cers an

d

emp

l

oyees un

d

er t

h

e 2008 P

l

an. A

ll

RSUs vest over a

f

our-year per

i

o

d

.Un

d

e

r

S

FAS No. 123(R), t

h

e

f

a

i

rva

l

ue o

f

our RSUs

i

s

b

ase

d

on t

h

e grant-

d

ate

f

a

i

r mar

k

et va

l

ue o

f

t

h

e common stoc

k

,

w

hich equals the

g

rant date market price

.

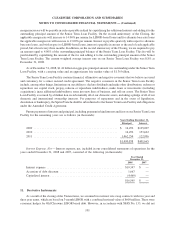

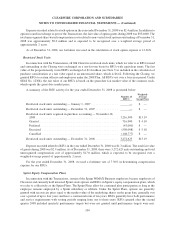

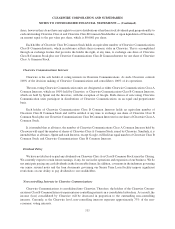

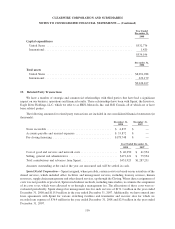

A summary of the RSU activity for the year ended December 31, 2008 is presented below:

N

umber o

f

RSU

’

s

We

i

ghted-

A

vera

g

e

G

rant Pr

i

c

e

R

estr

i

cte

d

stoc

k

un

i

ts outstan

di

n

g

— Januar

y

1, 200

7

.

................ — $

—

R

estr

i

cte

d

stoc

k

un

i

ts outstan

di

ng — Decem

b

er 31, 2007 .............. —

$—

R

estr

i

cte

d

stoc

k

un

i

ts acqu

i

re

di

n purc

h

ase account

i

ng — Novem

b

er 28,

2

008

.

.................................................

.

3

,

216

,

500

$

13.1

9

Granted

.

...............................................

.

716

,

000

$

4.1

0

F

o

rf

e

i

ted

................................................

(

43,000

)

$—

Exerc

i

se

d

...............................................

(

508,098) $ 5.18

C

ance

ll

e

d

...............................................

(

108,777

)$

—

R

estr

i

cte

d

stoc

k

un

i

ts outstan

di

ng — Decem

b

er 31, 200

8

.............. 3

,

272

,

625

$

13.1

9

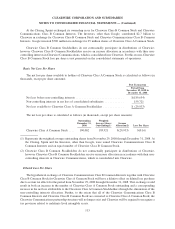

Expense recorded related to RSUs in the year ended December 31, 2008 was $1.3 million. The total fair value

o

f grants during 2008 was

$

2.9 million. As of December 31, 2008, there were 3,272,625 units outstanding and tota

l

unreco

g

nized compensation cost of approximatel

y$

17.0 million, which is expected to be reco

g

nized over a

w

ei

g

hted-avera

g

e period of approximatel

y

2

y

ears.

For the year ended December 31, 2008, we used a forfeiture rate of 7.50% in determining compensatio

n

expense

f

or our RSUs.

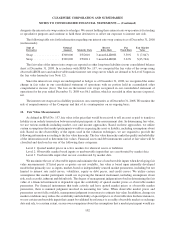

Sprint Equity Compensation Plans

I

n connect

i

on w

i

t

h

t

h

e Transact

i

ons, certa

i

no

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness emp

l

o

y

ees

b

ecame emp

l

o

y

ees o

f

Clearwire and currently hold unvested Sprint stock options and RSUs in Sprint’s equity compensation plans, whic

h

w

ere

f

er to co

ll

ect

i

ve

ly

as t

h

e Spr

i

nt P

l

ans. T

h

e Spr

i

nt P

l

ans a

ll

ow

f

or cont

i

nue

d

p

l

an part

i

c

i

pat

i

on as

l

on

g

as t

h

e

emp

l

o

y

ee rema

i

ns emp

l

o

y

e

dby

a Spr

i

nt su

b

s

idi

ar

y

or a

ffili

ate. Un

d

er t

h

e Spr

i

nt P

l

ans, opt

i

ons are

g

enera

lly

g

ranted with an exercise price equal to the market value of the underl

y

in

g

shares on the

g

rant date,

g

enerall

y

vest

o

ver a per

i

o

d

o

f

up to

f

our years an

dh

ave a contractua

l

term o

f

ten years. RSUs genera

ll

y

h

ave

b

ot

h

per

f

ormanc

e

an

d

serv

i

ce requ

i

rements w

i

t

h

vest

i

n

g

per

i

o

d

s ran

gi

n

gf

rom one to t

h

ree

y

ears. RSUs

g

rante

d

a

f

ter t

h

e secon

d

q

uarter 2008 included quarterl

y

performance tar

g

ets but were not

g

ranted until performance tar

g

ets were met

.

109

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)