Clearwire 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ons

id

erat

i

on pa

id

re

l

at

i

ng to ot

h

er

i

ntang

ibl

e assets cons

i

ste

d

o

f

t

h

e

f

o

ll

ow

i

ng (

i

nt

h

ousan

d

s):

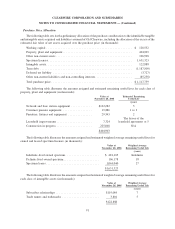

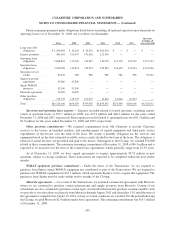

2

008

2

00

7

Year Ende

d

D

ecember

31

,

C

ash

.

.........................................................

.

$

992

$

1

,

31

6

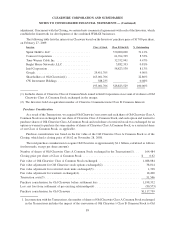

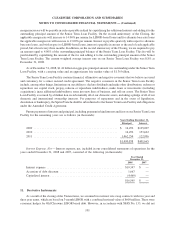

Amortization expense relating to other intangible assets was as follows (in thousands)

:

2008 2007

Y

ear Ende

d

D

ecember

31,

$2,888 $43

B

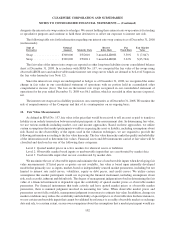

ased on the other intan

g

ible assets recorded as of December 31, 2008, the future amortization is expected to

b

e as follows

(

in thousands

):

2009

.

..............................................................

$

31,93

9

2010

...............................................................

2

7,

021

2011

...............................................................

22,103

2

0

1

2

.

..............................................................

1

7

,

18

5

2013

.

..............................................................

1

2

,

29

1

T

h

e

r

ea

f

ter

.

.........................................................

.

1

2

,

26

9

Tota

l

...............................................................

$122,80

8

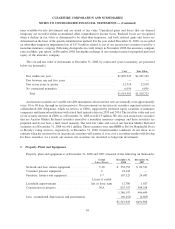

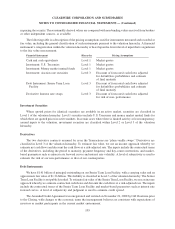

8. Accounts Payable and Accrued Expense

s

A

ccounts pa

y

able and accrued expenses as of December 31, 2008 and 2007 consisted of the followin

g

(i

n

th

ousan

d

s

):

2

008

2

00

7

December

31,

Accounts payable

.

...........................................

$

78

,

695

$

—

A

cc

r

ued

in

te

r

est

.............................................

8

,9

5

3—

Salaries and benefits

..........................................

26,337 —

B

usiness and income taxes pa

y

abl

e

...............................

7

,2

6

4—

Accrue

dp

ro

f

ess

i

ona

lf

ees

......................................

5

,286

O

t

h

e

r

.....................................................

18,882

—

$

145

,

417

$

—

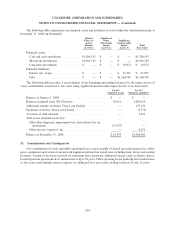

9

. Income Taxe

s

We account for income taxes in accordance with the

p

rovision of SFAS No. 109. SFAS No. 109 re

q

uires tha

t

d

e

f

erre

di

ncome taxes

b

e

d

eterm

i

ne

db

ase

d

on t

h

e est

i

mate

df

uture tax e

ff

ects o

f diff

erences

b

et

w

een t

h

e

fi

nanc

i

a

l

s

tatement and tax bases of assets and liabilities usin

g

the tax rates expected to be in effect when an

y

temporar

y

differences reverse or when the net operatin

g

loss, capital loss or tax credit carr

y

forwards are utilized.

Prior to the Transactions, the le

g

al entities representin

g

the Sprint WiMAX Business were included in th

e

fili

ng o

f

Spr

i

nt’s conso

lid

ate

df

e

d

era

l

an

d

certa

i

n state

i

ncome tax returns. Income tax expense an

d

re

l

ate

di

ncom

e

tax

b

a

l

ances were accounte

df

or

i

n accor

d

ance w

i

t

h

SFAS No. 109 an

d

presente

di

nt

h

e

fi

nanc

i

a

l

statements, as

if

we

were filin

g

stand-alone separate returns usin

g

an estimated combined federal and state mar

g

inal tax rate of 39% u

p

9

7

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)