Clearwire 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sp

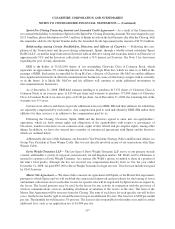

rint Pre-C

l

osing Financing Amount an

d

Amen

d

e

d

Cre

d

it Agreement— As a resu

l

to

f

t

h

e Transact

i

ons

,

we assume

d

t

h

e

li

a

bili

ty to re

i

m

b

urse Spr

i

nt

f

or t

h

e Spr

i

nt Pre-C

l

os

i

ng F

i

nanc

i

ng Amount. We were requ

i

re

d

to pay

$

213.0 million, plus related interest of $4.5 million, to Sprint in cash on the first business da

y

after the Closin

g

, wit

h

the remainder added as the Sprint Tranche under the Amended Credit Agreement in the amount of

$

179.2 million.

Re

l

ations

h

i

p

s among Certain Stoc

kh

o

ld

ers, Directors, an

d

O

ff

icers o

f

C

l

earwire —Fo

ll

ow

i

ng t

h

e com-

p

letion of the Transactions and the post-closin

g

ad

j

ustments, Sprint, throu

g

h a wholl

y

-owned subsidiar

y

Sprint

HoldCo LLC, owned the lar

g

est interest in Clearwire with an effective votin

g

and economic interest in Clearwire of

approximately

5

1% and the Investors collectively owned a 31% interest in Clearwire. See Note 3 for discussio

n

r

e

g

ar

di

n

g

t

h

e post c

l

os

i

n

g

a

dj

ustment.

E

RH is the holder of 35,922,958 shares of our outstandin

g

Clearwire Class A Common Stock, whic

h

r

epresents an approximate

5

% ownership interest in Clearwire. Eagle River Inc, which we refer to as ERI, is the

m

anager of ERH. Each entity is controlled by Craig McCaw, a director of Clearwire. Mr. McCaw and his affiliates

h

ave s

ig

n

ifi

cant

i

nvestments

i

not

h

er te

l

ecommun

i

cat

i

ons

b

us

i

nesses, some o

f

w

hi

c

h

ma

y

compete w

i

t

h

us current

ly

or in the future. It is likel

y

Mr. McCaw and his affiliates will continue to make additional investments in

telecommunications businesses

.

As of December 31, 2008, ERH held warrants entitling it to purchase

6

13,333 shares of Clearwire Class A

Common Stock at an exercise price of

$

15.00 per share and warrants to purchase 375,000 shares of Clearwire

Class A Common Stock at an exercise price of $3.00 per share. As of December 31, 2008, the remainin

g

life of the

warrants was 4.9 years

.

C

erta

i

no

f

our o

ffi

cers an

ddi

rectors prov

id

ea

ddi

t

i

ona

l

serv

i

ces to ERH, ERI an

d

t

h

e

i

ra

ffili

ates

f

or w

hi

c

h

t

h

e

y

are separatel

y

compensated b

y

such entities. An

y

compensation paid to such individuals b

y

ERH, ERI and/or their

affiliates for their services is in addition to the compensation paid b

y

us

.

F

ollowin

g

the Closin

g

, Clearwire, Sprint, ERH and the Investors a

g

reed to enter into an equit

y

holders’

agreement, w

hi

c

h

set

f

ort

h

certa

i

nr

i

g

h

ts an

d

o

bli

gat

i

ons o

f

t

h

e equ

i

ty

h

o

ld

ers w

i

t

h

respect to governance o

f

C

l

earw

i

re, trans

f

er restr

i

ct

i

ons on our common stoc

k

,r

igh

ts o

ffi

rst re

f

usa

l

an

d

pre-empt

i

ve r

igh

ts, amon

g

ot

h

er

things. In addition, we have also entered into a number of commercial agreements with Sprint and the Investors

which are outlined below

.

Additionally, the wife of Mr. Salemme, our Executive Vice President, Strategy, Policy and External Affairs is

a

G

roup V

i

ce Pres

id

ent at T

i

me Warner Ca

bl

e. S

h

e was not

di

rect

ly i

nvo

l

ve

di

nan

y

o

f

our transact

i

ons w

i

t

h

T

i

me

W

arner Cable.

D

avis Wrig

h

t Tremaine LLP— The law firm of Davis Wri

g

ht Tremaine LLP serves as our primar

y

outsid

e

c

ounse

l

,an

dh

an

dl

es a var

i

ety o

f

corporate, transact

i

ona

l

, tax an

dli

t

i

gat

i

on matters. Mr. Wo

lff

, our Co-C

h

a

i

rman,

is

m

arr

i

e

d

to a partner at Dav

i

sWr

igh

t Trema

i

ne. As a partner, Mr. Wo

lff

’s spouse

i

s ent

i

t

l

e

d

to s

h

are

i

n a port

i

on o

f

the firm’s total profits, althou

g

h she has not received an

y

compensation directl

y

from us. For the

y

ear ende

d

D

ecember 31, 2008, we paid

$

907,000 to Davis Wright Tremaine for legal services. This does not include fees pai

d

b

yO

ld

C

l

earw

i

re

.

Master

S

ite Agreement

—

We entered into a master site a

g

reement with Sprint, or the Master Site A

g

reement,

p

ursuant to which Sprint and we will establish the contractual framework and procedures for the leasin

g

of tower

an

d

antenna co

ll

ocat

i

on s

i

tes to eac

h

ot

h

er. Leases

f

or spec

ifi

cs

i

tes w

ill b

e negot

i

ate

db

y Spr

i

nt an

d

us on request

by

t

h

e

l

essee. T

h

e

l

ease

d

prem

i

ses ma

yb

e use

dby

t

h

e

l

essee

f

or an

y

act

i

v

i

t

yi

n connect

i

on w

i

t

h

t

h

e prov

i

s

i

on o

f

wireless communications services, includin

g

attachment of antennas to the towers at the sites. The term of the

Master Site Agreement will be ten years from the Closing. The term of each lease for each specific site will be fiv

e

y

ears, but the lessee has the ri

g

ht to extend the term for up to an additional 20

y

ears. The basic fee is

$

600 per month

p

er s

i

te. T

h

e mont

hly f

ee w

ill i

ncrease 3% per

y

ear. T

h

e

l

essee

i

sa

l

so respons

ibl

e

f

or t

h

eut

ili

t

y

costs an

df

or certa

in

additional fees, such as an a

pp

lication fee of $1,000

p

er site

.

11

7

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)