CVS 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 CVS Health

Notes to Consolidated Financial Statements

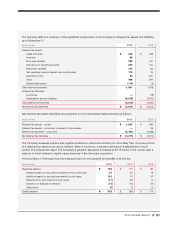

The Company and most of its subsidiaries are subject to U.S. federal income tax as well as income tax of numerous

state and local jurisdictions. The Company is a participant in the Compliance Assurance Process (“CAP”), which is a

voluntary program offered by the Internal Revenue Service (“IRS”) under which participating taxpayers work collabo-

ratively with the IRS to identify and resolve potential tax issues through open, cooperative and transparent interaction

prior to the filing of their federal income tax. The IRS is currently examining the Company’s 2014 and 2015 consoli-

dated U.S. federal income tax returns.

The Company and its subsidiaries are also currently under income tax examinations by a number of state and local

tax authorities. As of December 31, 2015, no examination has resulted in any proposed adjustments that would

result in a material change to the Company’s results of operations, financial condition or liquidity.

Substantially all material state and local income tax matters have been concluded for fiscal years through 2010.

Although certain state exams will be concluded and certain state statutes will lapse in 2016, the change in the

balance of our uncertain tax positions will be immaterial. In addition, it is reasonably possible that the Company’s

unrecognized tax benefits could significantly change within the next twelve months due to the anticipated conclu-

sion of various examinations with the IRS for various years. An estimate of the range of the possible change cannot

be made at this time.

The Company recognizes interest accrued related to unrecognized tax benefits and penalties in income tax expense.

The Company recognized interest of approximately $5 million during the year ended December 31, 2015, $6 million

during the year ended December 31, 2014, and $4 million during the year ended December 31, 2013. The Company

had approximately $16 million and $11 million accrued for interest and penalties as of December 31, 2015 and

2014, respectively.

There are no material uncertain tax positions as of December 31, 2015 the ultimate deductibility of which is highly

certain but for which there is uncertainty about the timing. If there were, any such items would impact deferred tax

accounting only, not the annual effective income tax rate, and would accelerate the payment of cash to the taxing

authority to a period earlier than expected.

As of December 31, 2015, the total amount of unrecognized tax benefits that, if recognized, would affect the

effective income tax rate is approximately $292 million, after considering the federal benefit of state income taxes.

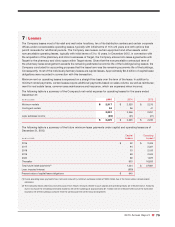

12 | Commitments and Contingencies

Lease Guarantees

Between 1991 and 1997, the Company sold or spun off a number of subsidiaries, including Bob’s Stores,

Linens ‘n Things, Marshalls, Kay-Bee Toys, Wilsons, This End Up and Footstar. In many cases, when a former

subsidiary leased a store, the Company provided a guarantee of the store’s lease obligations. When the subsidiar-

ies were disposed of, the Company’s guarantees remained in place, although each initial purchaser has agreed to

indemnify the Company for any lease obligations the Company was required to satisfy. If any of the purchasers or

any of the former subsidiaries were to become insolvent and failed to make the required payments under a store

lease, the Company could be required to satisfy these obligations.

As of December 31, 2015, the Company guaranteed approximately 72 such store leases (excluding the lease guaran-

tees related to Linens ‘n Things, which are discussed in Note 1), with the maximum remaining lease term extending

through 2026. Management believes the ultimate disposition of any of the remaining guarantees will not have a

material adverse effect on the Company’s consolidated financial condition, results of operations or future cash flows.

Legal Matters

The Company is a party to legal proceedings, investigations and claims in the ordinary course of its business,

including the matters described later in this document. The Company records accruals for outstanding legal matters

when it believes it is probable that a loss will be incurred and the amount can be reasonably estimated. The