CVS 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4CVS Health

Although our integrated model has certainly played

a key role in these results, nearly 44 percent of our

prescription growth since 2013 has been driven by

share gains from non-CVS Caremark payors. This is due

in part to the many programs we have put in place to

provide all customers with excellent service and value.

Our growth has also led to valuable economies of scale.

For example, our labor cost to fill prescriptions has fallen

by approximately 13 percent (excluding wage inflation)

over the past five years.

Our stores are also playing an important role in what we

call the retailization of health care. With the rise in con-

sumer-directed health plans, it is imperative that patients

stay on their medications. We encourage appropriate

patient behavior through our industry-leading adherence

programs. Additionally, the Affordable Care Act has led

increasing numbers of individuals to choose their own

health plans on public exchanges. We can effectively

support health plan partners with in-store displays and

service centers that support their outreach efforts.

I’ve already touched on the Target deal, which has

expanded our presence to regions such as Seattle, Den-

ver, Portland, and Salt Lake City. Across the enterprise,

you can now find a CVS Health location in every U.S.

state. We are currently in the process of rebranding these

assets as CVS Pharmacy® and MinuteClinic® locations.

CVS Pharmacy stores have typically filled twice the num-

ber of prescriptions as Target pharmacies, so these new

locations represent a significant opportunity to drive script

growth and profitability. In addition to the acquired Target

locations, we opened 161 new stores in 2015. Factoring

in closings, net units increased by 130 stores.

For our PBM business, members now have approxi-

mately 9,600 CVS Pharmacy locations to choose from.

That’s up from about 7,800 in 2014. This enhances the

relevance of Pharmacy Advisor, Maintenance Choice,

and our other integrated offerings since more members

will benefit from easier access to them.

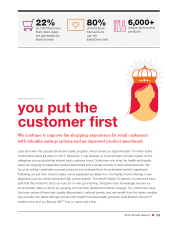

Health and Beauty and ExtraCare® are driving front store

gains; CVS MinuteClinic™ expands its scope of services

In the front of the store, our average basket size in

2015 (after excluding the impact of our exit from

tobacco) increased 2 percent—and 4 percent in our

core health and beauty businesses. These results are

gratifying given the lackluster trend in overall shopping

visits across the retail landscape. Health and beauty

offer higher margins and growth opportunities than

other front store categories, and we are expanding

our emphasis on both through a combination of store

remodelings, merchandising enhancements, and

improved product mix.

Among other front store initiatives, shoppers have

responded enthusiastically to our expanded healthy

food options. We’ve also continued to strengthen our

position with Hispanic customers, the fastest-growing

demographic in the United States, by launching CVS

Pharmacy y más™ in 12 locations in Miami. These

stores offer hundreds of Hispanic products and services

not found in traditional drugstores, and we saw sales

in the test stores increase by an average of 10 percent.

We expect to expand on this concept in 2016.

The ExtraCare loyalty program, now in its 18th year,

continues to play an indispensable role in driving

profitable front store sales across all our stores. It helps

identify our higher-value shoppers so we can build on

our relationship with them through personalized promo-

tions. Such shoppers represent 30 percent of our retail

customer base, but they are responsible for driving more

than 80 percent of sales in the front of the store.

It has been more than a year since we stopped selling

tobacco in our stores, a move that better aligned our

business practices with our goals as a health care

company. At the time, we also reasoned that removing

a convenient location to buy cigarettes could decrease

overall tobacco use. A new study conducted by our

CVS Health Research Institute has shown that approxi-

mately 95 million fewer packs were sold in states where

CVS Pharmacy has a 15 percent or greater share of the

retail pharmacy market compared to states without a

large CVS Pharmacy presence. We continue to promote

smoking cessation in a variety of other ways, with our

30,000 pharmacists and 3,100 nurse practitioners

taking the lead.

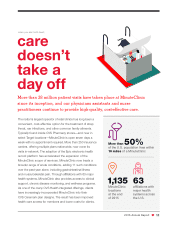

The expansion of CVS MinuteClinic continued in 2015,

with the number of locations at year end totaling 1,135

in 33 states and Washington, D.C. That includes the 79

clinics we acquired from Target. More than 50 percent

of the U.S. population now lives within 10 miles of a

We have more ways in which

we can assist patients to help

drive adherence and improve

outcomes.