CVS 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

2015 Annual Report

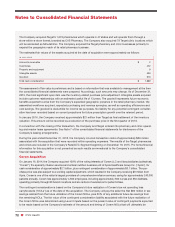

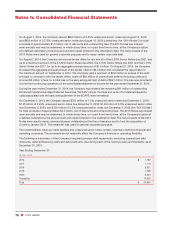

The assessment of fair value is preliminary and is based on information that was available to management at the

time the condensed consolidated financial statements were prepared. Accordingly, such amounts may change. The

most significant open items included the accounting for deferred income taxes and contingencies as management

is awaiting additional information to complete its assessment of these matters. The goodwill represents future

economic benefits expected to arise from the Company’s expanded presence in the pharmaceutical care market,

the assembled workforce acquired, expected purchasing and revenue synergies, as well as operating efficiencies

and cost savings. Goodwill of $8.6 billion was allocated to the Retail/LTC Segment and the remaining goodwill of

$0.5 billion was allocated to the Pharmacy Services Segment. Approximately $0.4 billion of the goodwill is deduct-

ible for income tax purposes. Intangible assets acquired include customer relationships and trade names of

$3.9 billion and $74 million, respectively, with estimated weighted average useful lives of 19.1 and 2.9 years,

respectively, and 18.8 years in total.

The fair value of trade accounts receivable acquired is $600 million, with the gross contractual amount being

$857 million. The Company expects $257 million of trade accounts receivable to be uncollectible. The fair value

of other receivables acquired is $147 million, with the gross contractual amount being $161 million. The Company

expects $14 million of other receivables to be uncollectible.

During the year ended December 31, 2015, the Company incurred transaction costs of $70 million associated with

the acquisition of Omnicare that were recorded within operating expenses.

The Company’s consolidated results of operations for the year ended December 31, 2015, include $2.6 billion of

net revenues and net income of $61 million associated with the operating results of Omnicare from August 18, 2015

to December 31, 2015. These Omnicare operating results include severance costs and accelerated stock-based

compensation.

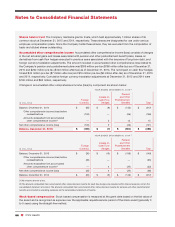

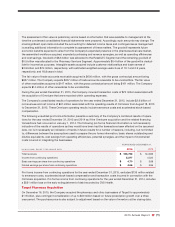

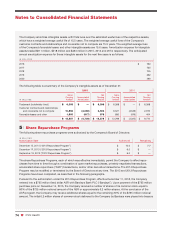

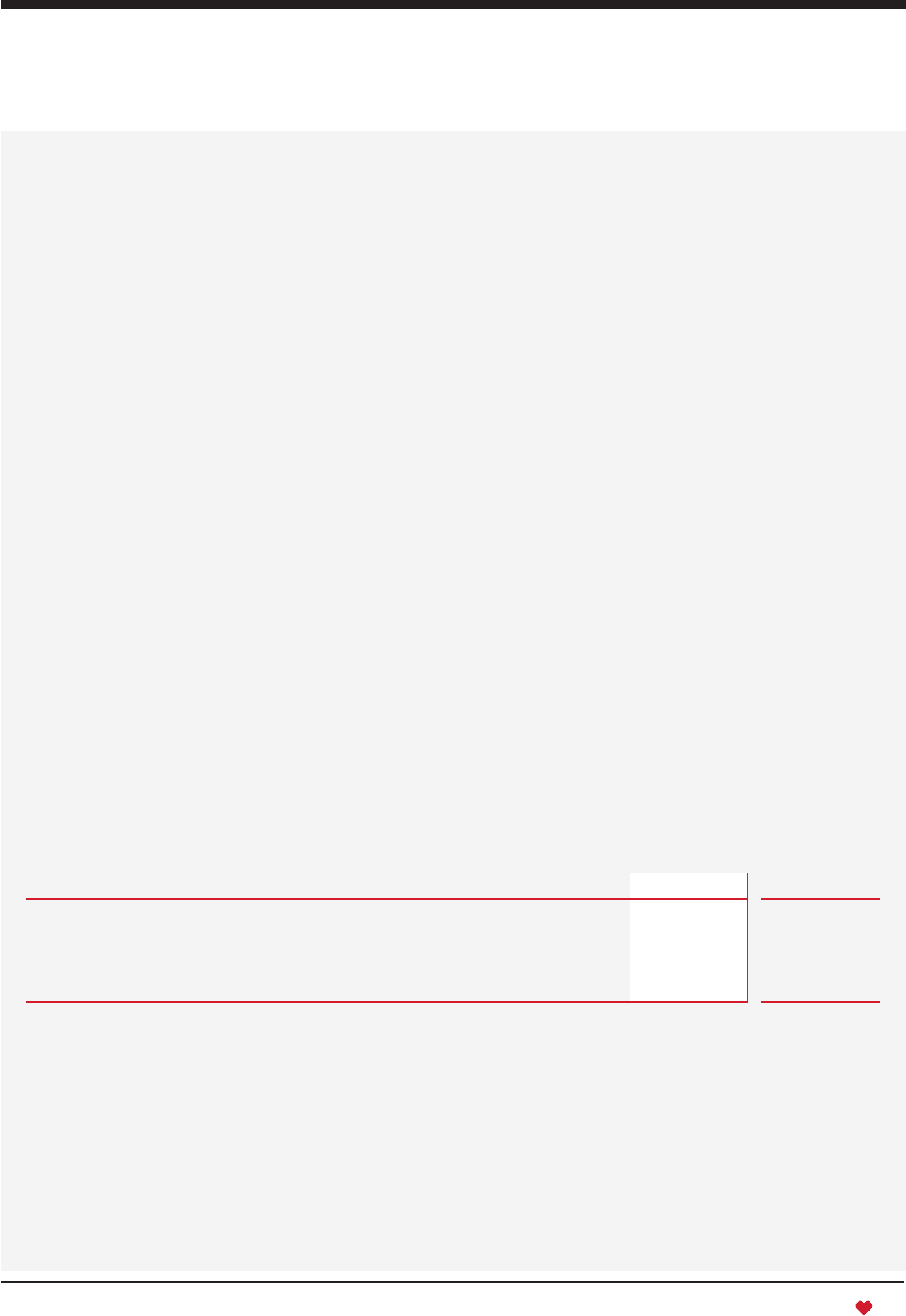

The following unaudited pro forma information presents a summary of the Company’s combined results of opera-

tions for the year ended December 31, 2015 and 2014 as if the Omnicare acquisition and the related financing

transactions had occurred on January 1, 2014. The following pro forma financial information is not necessarily

indicative of the results of operations as they would have been had the transactions been effected on the assumed

date, nor is it necessarily an indication of trends in future results for a number of reasons, including, but not limited

to, differences between the assumptions used to prepare the pro forma information, basic shares outstanding and

dilutive equivalents, cost savings from operating efficiencies, potential synergies, and the impact of incremental

costs incurred in integrating the businesses.

YEAR ENDED DECEMBER 31,

IN MILLIONS, EXCEPT PER SHARE DATA 2015 2014

Total revenues

$ 156,798

$ 144,836

Income from continuing operations

5,277

4,522

Basic earnings per share from continuing operations

$ 4.70

$ 3.88

Diluted earnings per share from continuing operations

$ 4.66

$ 3.85

Pro forma income from continuing operations for the year ended December 31, 2015, excludes $135 million related

to severance costs, accelerated stock-based compensation and transaction costs incurred in connection with the

Omnicare acquisition. Pro forma income from continuing operations for the year ended December 31, 2014, includes

a $521 million loss on the early extinguishment of debt recorded by CVS Health.

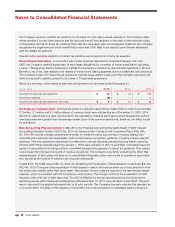

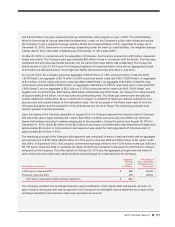

Target Pharmacy Acquisition

On December 16, 2015, the Company acquired the pharmacy and clinic businesses of Target for approximately

$1.9 billion, plus contingent consideration of up to $50 million based on future prescription growth over a three

year period. The purchase price is also subject to adjustment based on the value of inventory at the closing date.