CVS 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

2015 Annual Report

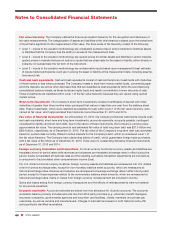

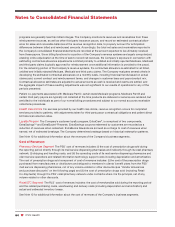

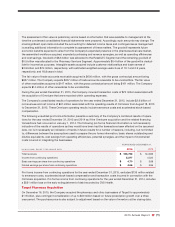

The activity in the allowance for doubtful accounts receivable for the years ended December 31 is as follows:

IN MILLIONS 2015 2014 2013

Beginning balance

$ 256

$ 256 $ 243

Additions charged to bad debt expense

216

185 195

Write-offs charged to allowance

(311)

(185) (182)

Ending balance

$ 161

$ 256 $ 256

Inventories All inventories are stated at the lower of cost or market. Prescription drug inventories in the RLS and

PSS, as well as front store inventories in the RLS stores are accounted for using the weighted average cost method.

See Note 2, “Changes in Accounting Principle.” Physical inventory counts are taken on a regular basis in each retail

store and long-term care pharmacy and a continuous cycle count process is the primary procedure used to validate

the inventory balances on hand in each distribution center and mail facility to ensure that the amounts reflected in

the accompanying consolidated financial statements are properly stated. During the interim period between physical

inventory counts, the Company accrues for anticipated physical inventory losses on a location-by-location basis

based on historical results and current trends.

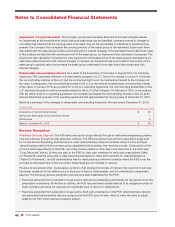

Property and equipment Property, equipment and improvements to leased premises are depreciated using the

straight-line method over the estimated useful lives of the assets, or when applicable, the term of the lease, which-

ever is shorter. Estimated useful lives generally range from 10 to 40 years for buildings, building improvements and

leasehold improvements and 3 to 10 years for fixtures, equipment and internally developed software. Repair and

maintenance costs are charged directly to expense as incurred. Major renewals or replacements that substantially

extend the useful life of an asset are capitalized and depreciated. Application development stage costs for signifi-

cant internally developed software projects are capitalized and depreciated.

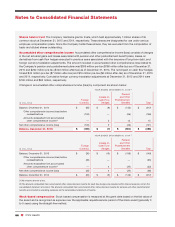

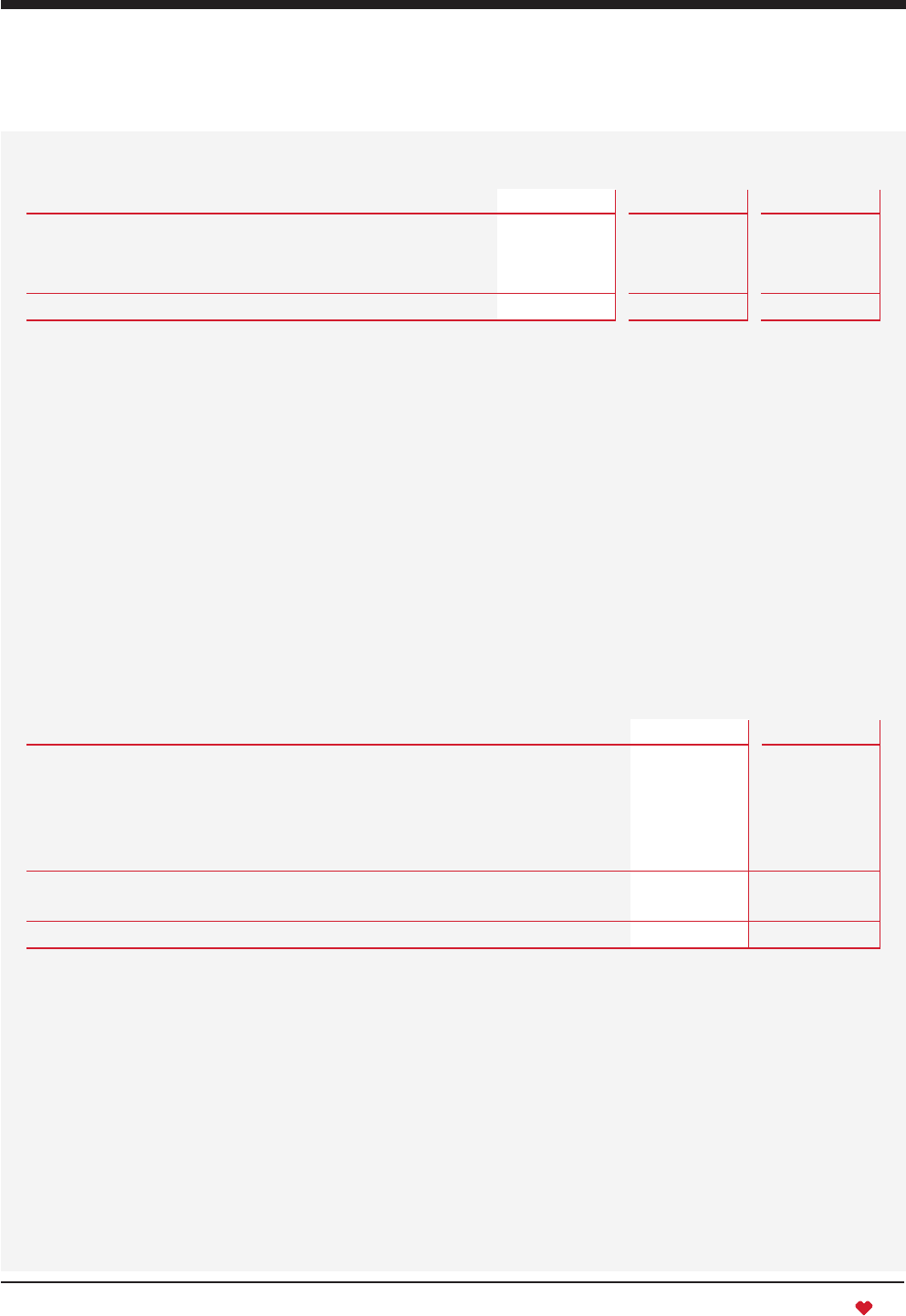

The following are the components of property and equipment at December 31:

IN MILLIONS 2015 2014

Land

$ 1,635

$ 1,506

Building and improvements

3,168

2,828

Fixtures and equipment

10,001

8,958

Leasehold improvements

4,015

3,626

Software

2,217

1,868

21,036

18,786

Accumulated depreciation and amortization

(11,181)

(9,943)

Property and equipment, net

$ 9,855

$ 8,843

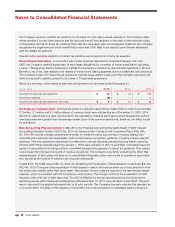

The gross amount of property and equipment under capital leases was $528 million and $268 million as of

December 31, 2015 and 2014, respectively. Accumulated amortization of property and equipment under capital

lease was $97 million and $86 million as of December 31, 2015 and 2014, respectively. Amortization of property and

equipment under capital lease is included within depreciation expense. Depreciation expense totaled $1.5 billion in

2015 and $1.4 billion in both 2014 and 2013.

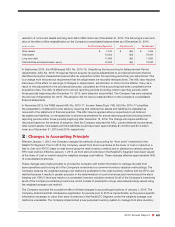

Goodwill and other indefinitely-lived assets Goodwill and other indefinitely-lived assets are not amortized, but

are subject to impairment reviews annually, or more frequently if necessary. See Note 4 for additional information on

goodwill and other indefinitely-lived assets.

Intangible assets Purchased customer contracts and relationships are amortized on a straight-line basis over

their estimated useful lives between 9 and 20 years. Purchased customer lists are amortized on a straight-line basis

over their estimated useful lives of up to 10 years. Purchased leases are amortized on a straight-line basis over the

remaining life of the lease. See Note 4 for additional information about intangible assets.