CVS 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

2015 Annual Report

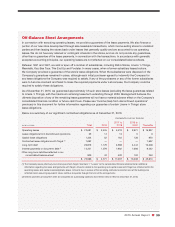

Off-Balance Sheet Arrangements

In connection with executing operating leases, we provide a guarantee of the lease payments. We also finance a

portion of our new store development through sale-leaseback transactions, which involve selling stores to unrelated

parties and then leasing the stores back under leases that generally qualify and are accounted for as operating

leases. We do not have any retained or contingent interests in the stores, and we do not provide any guarantees,

other than a guarantee of the lease payments, in connection with the transactions. In accordance with generally

accepted accounting principles, our operating leases are not reflected on our consolidated balance sheets.

Between 1991 and 1997, we sold or spun off a number of subsidiaries, including Bob’s Stores, Linens ‘n Things,

Marshalls, Kay-Bee Toys, This End Up and Footstar. In many cases, when a former subsidiary leased a store,

the Company provided a guarantee of the store’s lease obligations. When the subsidiaries were disposed of, the

Company’s guarantees remained in place, although each initial purchaser agreed to indemnify the Company for

any lease obligations the Company was required to satisfy. If any of the purchasers or any of the former subsidiaries

were to become insolvent and failed to make the required payments under a store lease, the Company could be

required to satisfy these obligations.

As of December 31, 2015, we guaranteed approximately 72 such store leases (excluding the lease guarantees related

to Linens ‘n Things), with the maximum remaining lease term extending through 2026. Management believes the

ultimate disposition of any of the remaining lease guarantees will not have a material adverse effect on the Company’s

consolidated financial condition or future cash flows. Please see “Income (loss) from discontinued operations”

previously in this document for further information regarding our guarantee of certain Linens ‘n Things’ store

lease obligations.

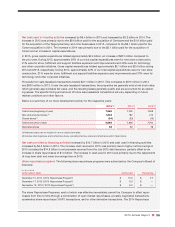

Below is a summary of our significant contractual obligations as of December 31, 2015:

PAYMENTS DUE BY PERIOD

2017 to 2019 to

IN MILLIONS Total 2016 2018 2020 Thereafter

Operating leases $ 27,681 $ 2,405 $ 4,518 $ 3,921 $ 16,837

Lease obligations from discontinued operations 35 14 13 5 3

Capital lease obligations 1,324 52 164 138 970

Contractual lease obligations with Target (1) 1,697 — — — 1,697

Long-term debt 26,819 1,179 4,588 4,444 16,608

Interest payments on long-term debt (2) 14,201 1,079 1,982 1,698 9,442

Other long-term liabilities reflected in our

consolidated balance sheet 829 42 432 102 253

$ 72,586 $ 4,771 $ 11,697 $ 10,308 $ 45,810

(1) The Company leases pharmacy and clinic space from Target. See Note 7, “Leases” to the consolidated financial statements for additional

information regarding the lease arrangements with Target. Amounts related to the operating and capital leases with Target are reflected within the

operating leases and capital lease obligations above. Amounts due in excess of the remaining estimated economic lives of the buildings are

reflected herein assuming equivalent stores continue to operate through the term of the arrangements.

(2) Interest payments on long-term debt are calculated on outstanding balances and interest rates in effect on December 31, 2015.