CVS 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

2015 Annual Report

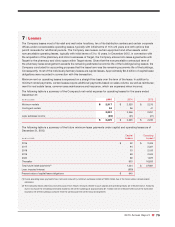

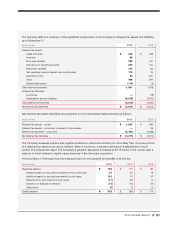

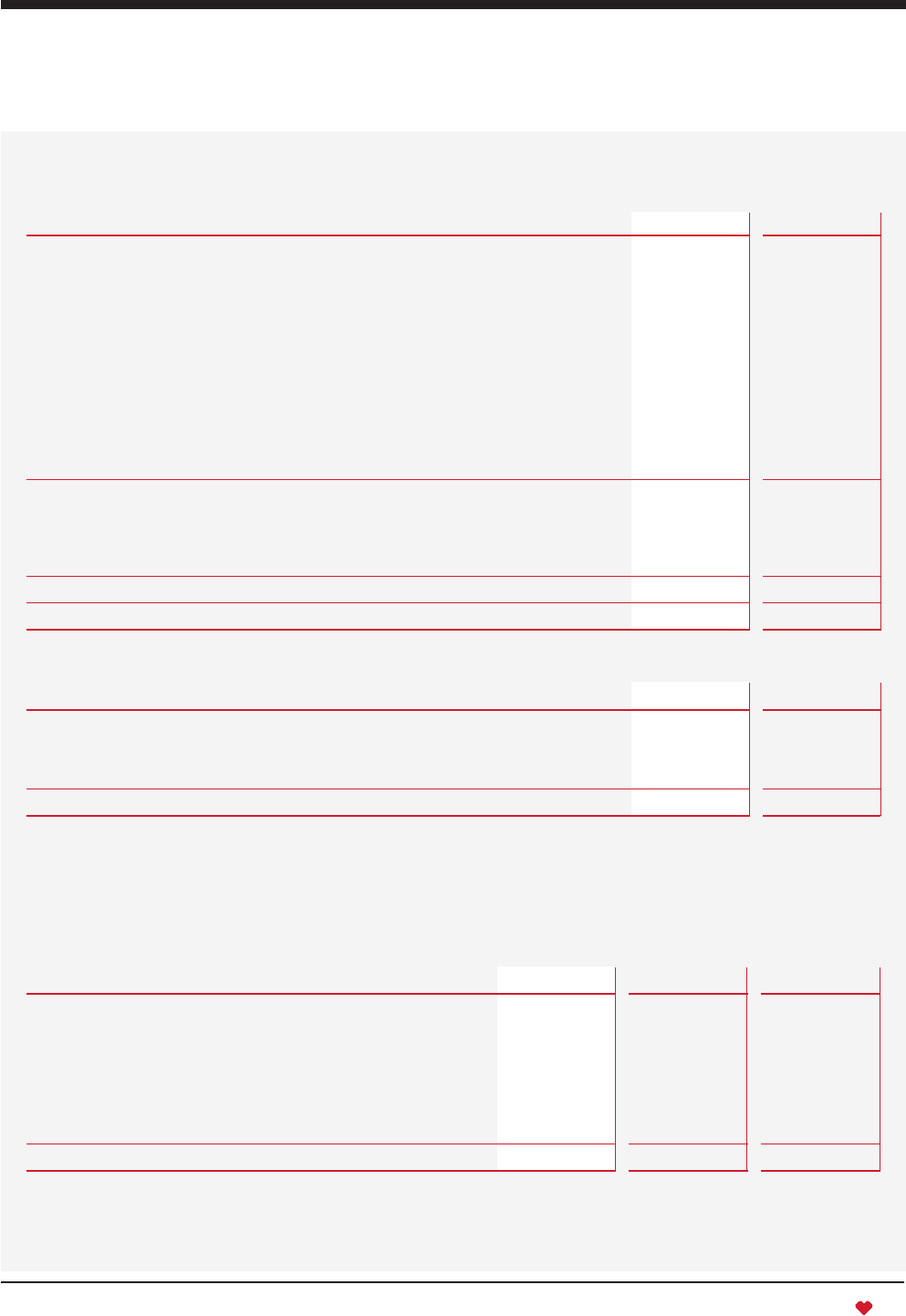

The following table is a summary of the significant components of the Company’s deferred tax assets and liabilities

as of December 31:

IN MILLIONS 2015 2014

Deferred tax assets:

Lease and rents

$ 378

$ 396

Inventory

99

—

Employee benefits

359

311

Allowance for doubtful accounts

279

164

Retirement benefits

105

80

Net operating loss and capital loss carryforwards

115

74

Deferred income

83

261

Other

498

297

Valuation allowance

(115)

(5)

Total deferred tax assets

1,801

1,578

Deferred tax liabilities:

Inventories

—

(18)

Depreciation and amortization

(6,018)

(4,572)

Total deferred tax liabilities

(6,018)

(4,590)

Net deferred tax liabilities

$ (4,217)

$ (3,012)

Net deferred tax assets (liabilities) are presented on the consolidated balance sheets as follows:

IN MILLIONS 2015 2014

Deferred tax assets – current

$ 1,220

$ 985

Deferred tax assets – noncurrent (included in other assets)

—

39

Deferred tax liabilities – noncurrent

(5,437)

(4,036)

Net deferred tax liabilities

$ (4,217)

$ (3,012)

The Company assesses positive and negative evidence to determine whether it is more likely than not some portion

of a deferred tax asset would not be realized. When it would not, a valuation allowance is established for such

portion of a deferred tax asset. The Company’s valuation allowance increased by $110 million in the current year, a

majority of which relates to capital losses assumed in the Omnicare acquisition.

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

IN MILLIONS 2015 2014 2013

Beginning balance

$ 188

$ 117 $ 80

Additions based on tax positions related to the current year

57

32 19

Additions based on tax positions related to prior years

122

70 37

Reductions for tax positions of prior years

(11)

(15) (1)

Expiration of statutes of limitation

(13)

(15) (17)

Settlements

(5)

(1) (1)

Ending balance

$ 338

$ 188 $ 117