CVS 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

26 CVS Health

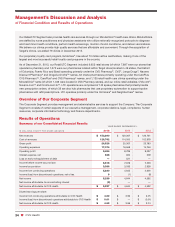

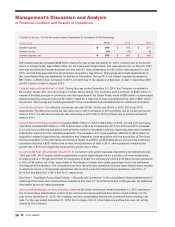

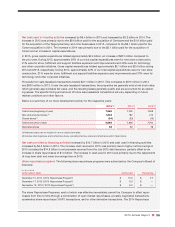

Interest expense, net

for the years ended December 31 consisted of the following:

IN MILLIONS 2015 2014 2013

Interest expense $ 859 $ 615 $ 517

Interest income (21) (15) (8)

Interest expense, net $ 838 $ 600 $ 509

Net interest expense increased $238 million during the year ended December 31, 2015, primarily due to the amorti-

zation of bridge facility fees of $52 million for the unsecured bridge facility that was entered into on May 20, 2015

and was amortized to interest expense over the period it was outstanding, the $15 billion debt issuance in July

2015, and the debt assumed from the Omnicare acquisition. See Note 6, “Borrowings and Credit Agreements” to

the consolidated financial statements for additional information. During 2014, net interest expense increased by

$91 million, to $600 million compared to 2013, primarily due to the issuance of $4 billion of debt in December 2013

and $1.5 billion of debt in August 2014.

Loss on early extinguishment of debt

During the year ended December 31, 2014, the Company completed a

$2.0 billion tender offer and repurchase of certain Senior Notes. The Company paid a premium of $490 million in

excess of the debt principal in connection with the repurchase of the Senior Notes, wrote off $26 million of unamortized

deferred financing costs and incurred $5 million in fees, for a total loss on early extinguishment of debt of $521 million.

See Note 6, “Borrowings and Credit Agreements” to the consolidated financial statements for additional information.

Income tax provision

Our effective income tax rate was 39.3%, 39.5% and 38.9% in 2015, 2014 and 2013,

respectively. The effective income tax rate was lower in 2015 compared to 2014 primarily due to certain permanent

items in 2014. The effective income tax rate was higher in 2014 than in 2013 primarily due to certain permanent

items in 2014.

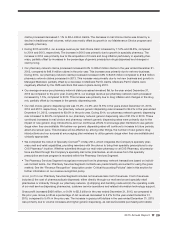

Income from continuing operations

increased $585 million or 12.6% to $5.2 billion in 2015. Income from continuing

operations increased $45 million or 1.0% to $4.6 billion in 2014 as compared to 2013. The 2015 and 2014 increases

in income from continuing operations were primarily related to increases in generic dispensing rates and increased

prescription volume for both operating segments. The increase in 2015 was negatively affected by $272 million of

acquisition-related bridge financing, transaction and integration costs associated with the acquisition of Omnicare

and the acquisition of the pharmacies and clinics of Target. In addition, as discussed above, income from continuing

operations included a $521 million loss on early extinguishment of debt in 2014, which positively impacted the

growth rate in 2015 and negatively impacted the growth rate in 2014.

Income (loss) from discontinued operations

In connection with certain business dispositions completed between

1991 and 1997, the Company retained guarantees on store lease obligations for a number of former subsidiaries,

including Linens ‘n Things, which filed for bankruptcy in 2008. The Company’s income from discontinued operations

in 2015 of $9 million, net of tax, was related to the release of certain store lease guarantees due to the settlement

of a dispute with a landlord. The Company’s loss from discontinued operations includes lease-related costs required

to satisfy its Linens ‘n Things lease guarantees. We incurred a loss from discontinued operations, net of tax, of

$1 million and $8 million in 2014 and 2013, respectively.

See Note 1 “Significant Accounting Policies —Discontinued Operations” to the consolidated financial statements for

additional information about discontinued operations and Note 12 “Commitments and Contingencies” for additional

information about our lease guarantees.

Net income attributable to noncontrolling interest

of $2 million for the year ended December 31, 2015 represents

the noncontrolling shareholders’ portion of the net income from several less than wholly owned entities. For the

year ended December 31, 2014, the Company had two consolidated entities with immaterial noncontrolling inter-

ests. For the year ended December 31, 2013, the Company did not consolidate any entities that were not wholly

owned by the Company.