CVS 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

2015 Annual Report

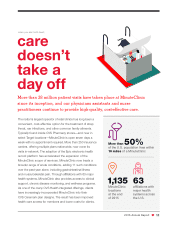

MinuteClinic, and we operate more retail clinics than all

our competitors combined. CVS MinuteClinic plays an

important, complementary role with traditional medical

practices. Through our 2015 implementation of the Epic

electronic health record platform, we are now sharing

information with approximately 275 health systems

and provider organizations. The Epic platform has also

allowed us to expand the CVS MinuteClinic scope of

services to cover 28 of the 50 most common primary

care diagnoses.

CVS MinuteClinic has been exploring a number of

transformative digital offerings, such as telehealth, to

improve access and convenience. This is just one of the

many ways in which we have been working to enhance

our digital capabilities across the enterprise to strengthen

engagement with patients and providers. For example,

we’ve added several features to the CVS Pharmacy

app that have improved the customer experience in

the pharmacy as well as the front of the store. Benefits

include improved adherence as well as savings of both

time and money.

The aging population has created new growth opportu-

nities and was a key driver of our Omnicare acquisition

The nation’s aging population will play a major role in the

evolving health care market, and it will create new oppor-

tunities for CVS Health. The number of people 65 or

older is expected to grow 18 percent in just the next five

years—and 38 percent through 2025. This demographic

utilizes more than double the number of prescriptions

of the under-65 population, creating a long-term tailwind

for the industry. Increased utilization, combined with

growth in specialty medications, is expected to fuel a

6 percent rise in prescription expenditures annually over

the next decade.

With this projected growth in prescription expenditures,

it’s important to keep in mind that pharmacy care remains

the most cost-effective way of reducing overall health

care costs. Getting and keeping patients on the neces-

sary medications to manage chronic diseases can drive

billions of dollars in costs out of the system. Compared

with our peers, we have more ways in which we can

touch patients to help drive adherence and improve out-

comes—from our retail, mail, and specialty pharmacies

to our MinuteClinic locations and now through Omnicare.

Approximately 70 percent of people over age 65 are

likely to require some form of long-term care service and

support. The Omnicare acquisition bolsters our ability to

serve this population across the continuum of senior care.

Omnicare’s nationwide footprint includes a significant

presence in both the assisted living and skilled nursing

facility settings, giving us broad reach and an ability to

leverage clinical insights to improve care.

Through our combined enterprise assets, we will also

bridge some of the historic gaps in Omnicare’s offerings

to better address the unmet needs of these high-risk

populations. For example, Omnicare’s robust offering

for the skilled nursing facility market did not include a

complete solution to address care coordination issues

during a patient’s admittance or discharge. With roughly

9,600 retail locations, we can ensure the timeliness of

medication adherence through first-fill and emergency

prescriptions, reducing the potential for costly hospital

readmissions. In addition, we’ve launched an integrated

discharge solution that will coordinate care and offer the

CVS Health suite of services to patients returning home.

We are developing integrated solutions for the assisted

living, independent living, and home care markets as well.

Before signing off, I must note with pride the more

than $80 million we contributed to our communities in

2015 through the CVS Health Foundation, CVS Health

Charity Classic, corporate grants, gifts in-kind, and

employee giving. That total also includes the more than

$7.5 million raised for the American Lung Association’s

LUNG FORCE as well as Stand Up to Cancer through

our two in-store campaigns. Moreover, our remarkable

colleagues volunteered their time to a broad range of

community outreach programs and donated nearly

$1 million to the causes they care most about. They also

supported the CVS Health Employee Relief Fund that

helps colleagues who have suffered significant hardship

as a result of a natural disaster, family death, medical

emergency, or other unforeseen events.

In closing, I am confident that our leadership across the

pharmacy spectrum will help us continue to drive supe-

rior value for our health care partners and shareholders.

As we expand our core pharmacy business, we will

also broaden our reach into new health care channels

and make investments to drive sustainable enterprise

growth. On behalf of our board of directors and our

more than 240,000 colleagues who work hard each and

every day to help people on their path to better health,

thank you for investing in CVS Health.

Sincerely,

Larry J. Merlo

President and Chief Executive Officer

February 9, 2016