CVS 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 CVS Health

Notes to Consolidated Financial Statements

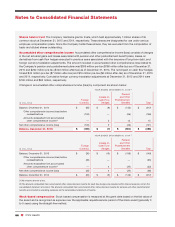

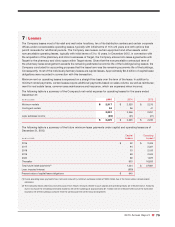

6 | Borrowings and Credit Agreements

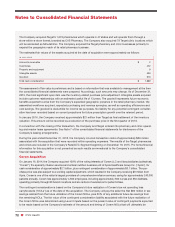

The following table is a summary of the Company’s borrowings as of December 31:

IN MILLIONS 2015 2014

Commercial paper

$ —

$ 685

3.25% senior notes due 2015

—

550

1.2% senior notes due 2016

750

750

6.125% senior notes due 2016

421

421

5.75% senior notes due 2017

1,080

1,080

1.9% senior notes due 2018

2,250

—

2.25% senior notes due 2018

1,250

1,250

2.25% senior notes due 2019

850

850

6.6% senior notes due 2019

394

394

2.8% senior notes due 2020

2,750

—

4.75% senior notes due 2020

450

450

4.125% senior notes due 2021

550

550

2.75% senior notes due 2022

1,250

1,250

3.5% senior notes due 2022

1,500

—

4.75% senior notes due 2022

400

—

4% senior notes due 2023

1,250

1,250

3.375% senior notes due 2024

650

650

5% senior notes due 2024

300

—

3.875% senior notes due 2025

3,000

—

6.25% senior notes due 2027

453

453

3.25% senior exchange debentures due 2035

5

—

4.875% senior notes due 2035

2,000

—

6.125% senior notes due 2039

734

734

5.75% senior notes due 2041

493

493

5.3% senior notes due 2043

750

750

5.125% senior notes due 2045

3,500

—

Capital lease obligations

644

391

Other

20

41

Total debt principal

27,694

12,992

Debt premiums

39

—

Debt discounts and deferred financing costs

(269)

(102)

27,464

12,890

Less:

Short-term debt (commercial paper)

—

(685)

Current portion of long-term debt

(1,197)

(575)

Long-term debt

$ 26,267

$ 11,630

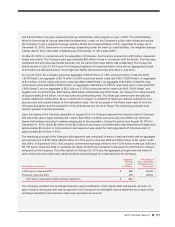

The Company did not have any commercial paper outstanding as of December 31, 2015. In connection with its

commercial paper program, the Company maintains a $1.0 billion, five-year unsecured back-up credit facility, which

expires on May 23, 2018, a $1.25 billion, five-year unsecured back-up credit facility, which expires on July 24, 2019,