CVS 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

2015 Annual Report

On September 30, 2015, the Company’s Board of Directors approved a resolution to merge the four tax-qualified

defined benefit plans that existed in 2014 and terminate the resulting merged plan. The merger was effective

September 30, 2015 and the merged plan termination was effective December 31, 2015. It is expected to take

approximately 18 to 24 months to complete the settlement of the terminated plan from the date of the approved

resolution. The assumptions used to calculate the pension liability as of December 31, 2015 reflect the resolution

to terminate the merged plan. This resulted in the pension liability and pre-tax accumulated other comprehensive

income both increasing by $67 million during the three months ended December 31, 2015. The pension liability will

be settled in either lump sum payments or purchased annuities. Currently, there is not enough information available

to determine the ultimate cost of the termination; however, based on current market rates the one-time settlement

charge at final liquidation is estimated to be in the range of approximately $175 million to $250 million.

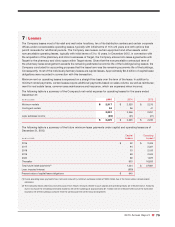

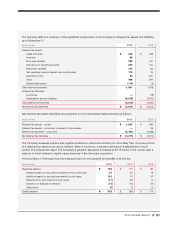

The following tables outline the change in benefit obligations and plan assets over the comparable periods:

IN MILLIONS 2015 2014

Change in benefit obligation:

Benefit obligation at beginning of year

$ 796

$ 694

Acquisition

8

—

Service cost

—

1

Interest cost

31

32

Actuarial loss

45

119

Benefit payments

(36)

(41)

Settlements

—

(9)

Benefit obligation at end of year

$ 844

$ 796

IN MILLIONS 2015 2014

Change in plan assets:

Fair value of plan assets at the beginning of the year

$ 635

$ 568

Acquisitions

5

—

Actual return on plan assets

(13)

75

Employer contributions

22

42

Benefit payments

(36)

(41)

Settlements

—

(9)

Fair value of plan assets at the end of the year

613

635

Funded status

$ (231)

$ (161)

The components of net periodic benefit costs for the years ended December 31, 2015, 2014 and 2013 are

shown below:

IN MILLIONS 2015 2014 2013

Components of net periodic benefit cost:

Interest cost

$ 31

$ 32 $ 30

Expected return on plan assets

(33)

(31) (34)

Amortization of net loss

21

16 22

Settlement loss

—

3 —

Service cost

—

1 1

Net periodic pension cost

$ 19

$ 21 $ 19