CVS 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 CVS Health

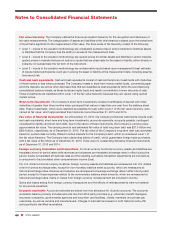

Notes to Consolidated Financial Statements

programs are generally less than billed charges. The Company monitors its revenues and receivables from these

reimbursement sources, as well as other third party insurance payors, and record an estimated contractual allow-

ance for sales and receivable balances at the revenue recognition date, to properly account for anticipated

differences between billed and reimbursed amounts. Accordingly, the total net sales and receivables reported in

the Company’s consolidated financial statements are recorded at the amount expected to be ultimately received

from these payors. Since billing functions for a portion of the Company’s revenue systems are largely computerized,

enabling online adjudication at the time of sale to record net revenues, the Company’s exposure in connection with

estimating contractual allowance adjustments is limited primarily to unbilled and initially rejected Medicare, Medicaid

and third party claims (typically approved for reimbursement once additional information is provided to the payor).

For the remaining portion of the Company’s revenue systems, the contractual allowance is estimated for all billed,

unbilled and initially rejected Medicare, Medicaid and third party claims. The Company evaluates several criteria in

developing the estimated contractual allowances on a monthly basis, including historical trends based on actual

claims paid, current contract and reimbursement terms, and changes in customer base and payor/product mix.

Contractual allowance estimates are adjusted to actual amounts as cash is received and claims are settled, and

the aggregate impact of these resulting adjustments was not significant to our results of operations for any of the

periods presented.

Patient co-payments associated with Medicare Part D, certain state Medicaid programs, Medicare Part B and

certain third party payors are typically not collected at the time products are delivered or services are rendered, but

are billed to the individuals as part of our normal billing procedures and subject to our normal accounts receivable

collections procedures.

Health Care Clinics

For services provided by our health care clinics, revenue recognition occurs for completed

services provided to patients, with adjustments taken for third party payor contractual obligations and patient direct

bill historical collection rates.

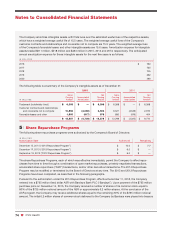

Loyalty Program

The Company’s customer loyalty program, ExtraCare®, is comprised of two components,

ExtraSavingsTM and ExtraBucks® Rewards. ExtraSavings coupons redeemed by customers are recorded as a

reduction of revenues when redeemed. ExtraBucks Rewards are accrued as a charge to cost of revenues when

earned, net of estimated breakage. The Company determines breakage based on historical redemption patterns.

See Note 13 for additional information about the revenues of the Company’s business segments.

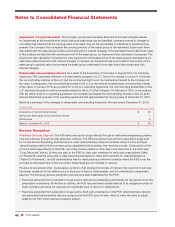

Cost of Revenues

Pharmacy Services Segment

The PSS’ cost of revenues includes: (i) the cost of prescription drugs sold during

the reporting period directly through its mail service dispensing pharmacies and indirectly through its retail pharmacy

network, (ii) shipping and handling costs, and (iii) the operating costs of its mail service dispensing pharmacies and

client service operations and related information technology support costs including depreciation and amortization.

The cost of prescription drugs sold component of cost of revenues includes: (i) the cost of the prescription drugs

purchased from manufacturers or distributors and shipped to members in clients’ benefit plans from the PSS’

mail service dispensing pharmacies, net of any volume-related or other discounts (see “Vendor allowances

and purchase discounts” on the following page) and (ii) the cost of prescription drugs sold (including Retail

Co-Payments) through the PSS’ retail pharmacy network under contracts where it is the principal, net of any

volume-related or other discounts.

Retail/LTC Segment

The RLS’ cost of revenues includes: the cost of merchandise sold during the reporting period

and the related purchasing costs, warehousing and delivery costs (including depreciation and amortization) and

actual and estimated inventory losses.

See Note 13 for additional information about the cost of revenues of the Company’s business segments.