CVS 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 CVS Health

Notes to Consolidated Financial Statements

Pension Plan Assumptions

The Company uses a series of actuarial assumptions to determine the benefit obligations and the net benefit costs.

The discount rate is determined by examining the current yields observed on the measurement date of fixed-inter-

est, high quality investments expected to be available during the period to maturity of the related benefits on a plan

by plan basis. The discount rate for the merged qualified plan that has been terminated is determined by examining

the current assumed lump sum and annuity purchase rates. The expected long-term rate of return on plan assets is

determined by using the plan’s target allocation and historical returns for each asset class on a plan by plan basis.

Certain of the Company’s pension plans use assumptions on expected compensation increases of plan participants.

These increases are determined by an actuarial analysis of the plan participants, their expected compensation

increases, and the duration of their earnings period until retirement. Each of these assumptions are reviewed as plan

characteristics change and on an annual basis with input from senior pension and financial executives and the

Company’s external actuarial consultants.

The discount rate for determining plan benefit obligations was 4.25% for all plans except the merged qualified

plan in 2015 and 4% for all plans in 2014. The discount rate for the merged qualified plan was 3.25% in 2015. The

expected long-term rate of return for the plans ranged from 5.75% to 6.75% in 2015 and ranged from 5.75% to

7.25% in 2014. The rate of compensation increases for certain of the plans with active participants ranged from 4%

to 6% in 2015 and 2014.

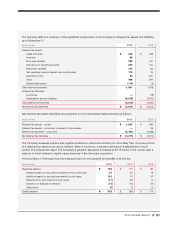

Return on Plan Assets

Historically, the Company used an investment strategy which emphasized equities in order to produce higher

expected returns, and in the long run, lower expected expense and cash contribution requirements. Beginning in

2013, the Company changed its investment strategy to be liability management driven. The qualified pension plan

asset allocation targets in 2014 and 2013 were revised to hold more fixed income investments based on the change

in the investment strategy. As of December 31, 2015, investment allocations for the two qualified defined benefit

plans range from 80% to 100% in fixed income and 0% to 20% in equities. The following tables show the fair value

allocation of plan assets by asset category as of December 31, 2015 and 2014.

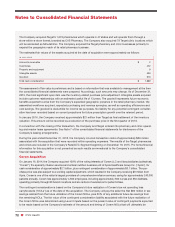

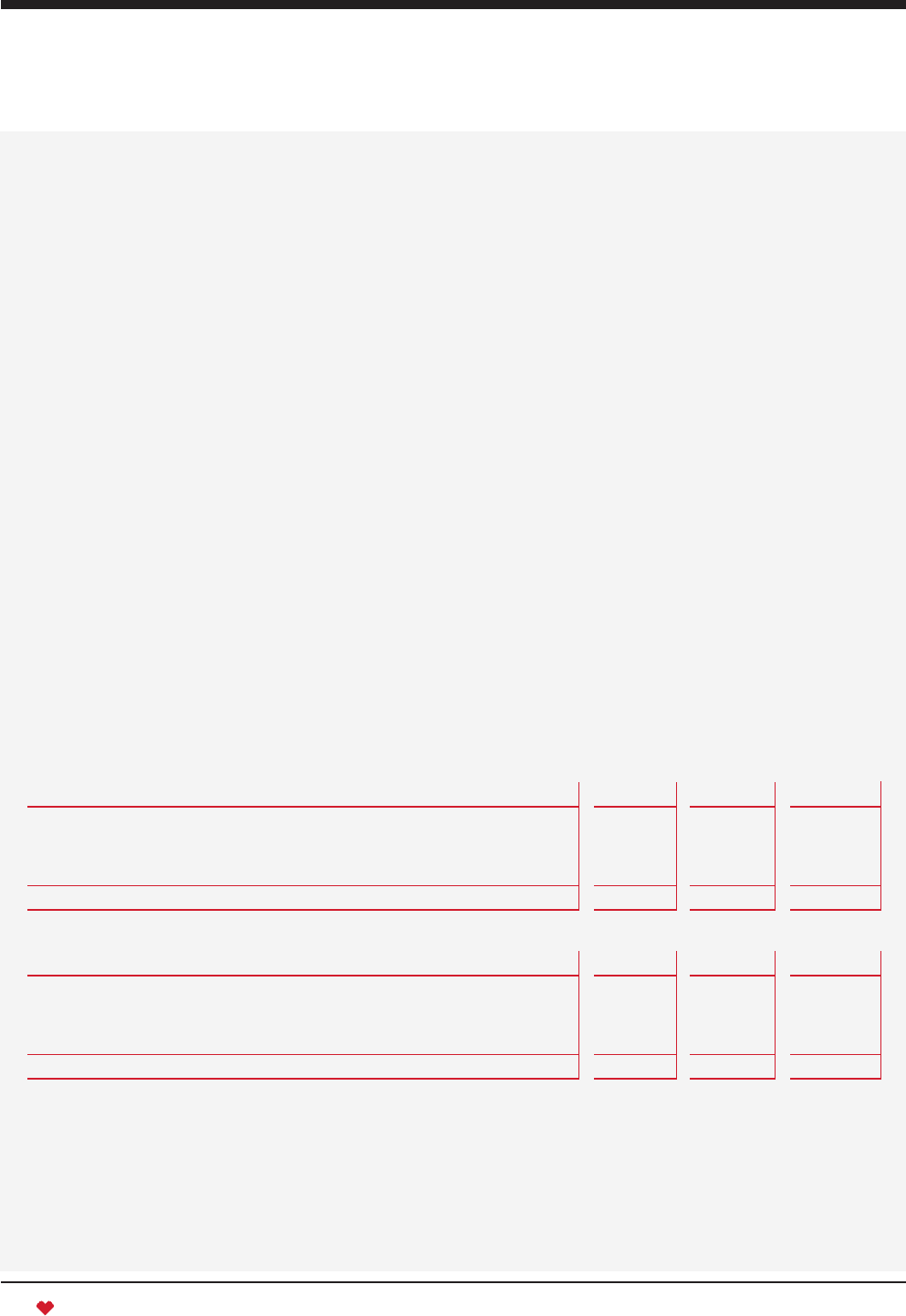

FAIR VALUE OF PLAN ASSETS AT DECEMBER 31, 2015

IN MILLIONS Level 1 Level 2 Level 3 Total

Cash and money market funds $ 10 $ — $ — $ 10

Fixed income funds 4 484 — 488

Equity mutual funds 115 — — 115

Total assets at fair value $ 129 $ 484 $ — $ 613

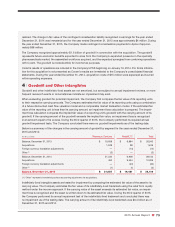

FAIR VALUE OF PLAN ASSETS AT DECEMBER 31, 2014

Level 1 Level 2 Level 3 Total

Cash and money market funds $ 7 $ — $ — $ 7

Fixed income funds — 514 — 514

Equity mutual funds 84 30 — 114

Total assets at fair value $ 91 $ 544 $ — $ 635

As of December 31, 2015, the Company’s qualified defined benefit pension plan assets consisted of 19% equity,

80% fixed income and 2% money market securities of which 21% were classified as Level 1 and 79% as Level 2

in the fair value hierarchy. The Company’s qualified defined benefit pension plan assets as of December 31, 2014

consisted of 18% equity, 81% fixed income and 1% money market securities of which 14% were classified as

Level 1 and 86% as Level 2 in the fair value hierarchy.