CVS 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

2015 Annual Report

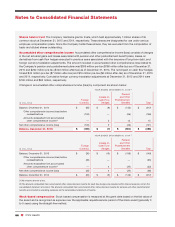

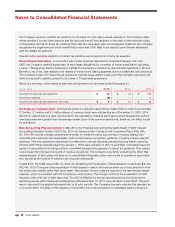

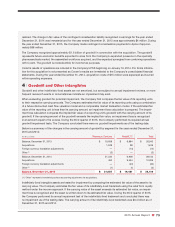

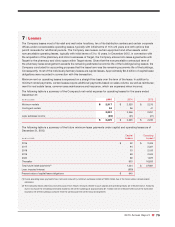

reduction of noncurrent assets and long-term debt of $65 million as of December 31, 2014. The following is a reconcili-

ation of the effect of this reclassification on the Company’s consolidated balance sheet as of December 31, 2014:

IN MILLIONS As Previously Reported Adjustments As Revised

Other assets $ 1,510 $ (65) $ 1,445

Total assets 74,252 (65) 74,187

Long-term debt 11,695 (65) 11,630

Total liabilities and shareholders’ equity 74,252 (65) 74,187

In September 2015, the FASB issued ASU No. 2015-16,

Simplifying the Accounting for Measurement-Period

Adjustments

. ASU No. 2015-16 requires that an acquirer recognize adjustments to provisional amounts that are

identified during the measurement period after an acquisition within the reporting period they are determined. This

is a change from the previous requirement that the adjustments be recorded retrospectively. The ASU also requires

disclosure of the effect on earnings of changes in depreciation, amortization or other income effects, if any, as a

result of the adjustment to the provisional amounts, calculated as if the accounting had been completed at the

acquisition date. The ASU is effective for annual reporting periods (including interim reporting periods within

those periods) beginning after December 15, 2015; early adoption is permitted. The Company has early adopted

the ASU as of September 30, 2015. The adoption did not have a material effect on the Company’s consolidated

financial statements.

In November 2015, the FASB issued ASU No. 2015-17,

Income Taxes (Topic 740)

. ASU No. 2015-17 simplifies

the presentation of deferred income taxes by requiring that deferred tax assets and liabilities be classified as

nocurrent in the statement of financial position. This ASU may be applied either prospectively to all deferred

tax assets and liabilities, or retrospectively to all periods presented for annual reporting periods (including interim

reporting periods within those periods) beginning after December 15, 2016. The change will require additional

disclosure based on the method of adoption. Had the Company adopted this ASU, current deferred income taxes,

total current assets, total assets and total liabilities would have been approximately $1.2 billion and $1.0 billion

lower as of December 31, 2015 and 2014, respectively.

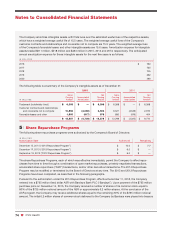

2 | Changes in Accounting Principle

Effective January 1, 2015, the Company changed its methods of accounting for “front store” inventories in the

Retail/LTC Segment. Prior to 2015, the Company valued front store inventories at the lower of cost or market on a

first-in, first-out (“FIFO”) basis in retail stores using the retail inventory method and in distribution centers using the

FIFO cost method. Effective January 1, 2015, all front store inventories in the Retail/LTC Segment have been valued

at the lower of cost or market using the weighted average cost method. These changes affected approximately 36%

of consolidated inventories.

These changes were made primarily to provide the Company with better information to manage its retail front

store operations and to bring all of the Company’s inventories to a common inventory valuation methodology. The

Company believes the weighted average cost method is preferable to the retail inventory method and the FIFO cost

method because it results in greater precision in the determination of cost of revenues and inventories at the stock

keeping unit (“SKU”) level and results in a consistent inventory valuation method for all of the Company’s inventories

as all of the Company’s remaining inventories, which consist of prescription drugs, were already being valued using

the weighted average cost method.

The Company recorded the cumulative effect of these changes in accounting principle as of January 1, 2015. The

Company determined that retrospective application for periods prior to 2015 is impracticable, as the period-specific

information necessary to value front store inventories in the Retail/LTC Segment under the weighted average cost

method is unavailable. The Company implemented a new perpetual inventory system to manage front store inventory