CVS 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 CVS Health

Notes to Consolidated Financial Statements

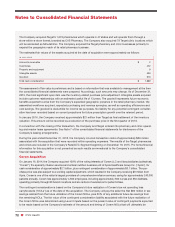

The Company acquired Target’s 1,672 pharmacies which operate in 47 states and will operate them through a

store-within-a-store format, branded as CVS Pharmacy. The Company also acquired 79 Target clinic locations which

will be rebranded as MinuteClinic. The Company acquired the Target pharmacy and clinic businesses primarily to

expand the geographic reach of its retail pharmacy business.

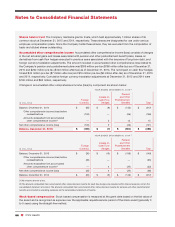

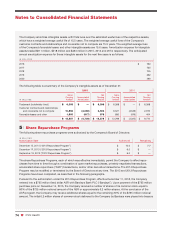

The estimated fair values of the assets acquired at the date of acquisition were approximately as follows:

IN MILLIONS

Accounts receivable $ 2

Inventories 472

Property and equipment 9

Intangible assets 490

Goodwill 916

Total cash consideration $ 1,889

The assessment of fair value is preliminary and is based on information that was available to management at the time

the consolidated financial statements were prepared. Accordingly, such amounts may change. As of December 31,

2015, the most significant open item was the inventory related purchase price adjustment. Intangible assets acquired

include customer relationships with an estimated useful life of 13 years. The goodwill represents future economic

benefits expected to arise from the Company’s expanded geographic presence in the retail pharmacy market, the

assembled workforce acquired, expected purchasing and revenue synergies, as well as operating efficiencies and

cost savings. The goodwill is deductible for income tax purposes. No liability for any potential contingent consider-

ation has been recorded based on current projections for future prescription growth over the relevant period.

In January 2016, the Company received approximately $21 million from Target as final settlement of the inventory

valuation. This amount will be recorded as a reduction of the purchase price in the first quarter of 2016.

In connection with the closing of the transaction, the Company and Target entered into pharmacy and clinic operat-

ing and master lease agreements. See Note 7 of the consolidated financial statements for disclosures of the

Company’s leasing arrangements.

During the year ended December 31, 2015, the Company incurred transaction costs of approximately $26 million

associated with the acquisition that were recorded within operating expenses. The results of the Target pharmacies

and clinics are included in the Company’s Retail/LTC Segment beginning on December 16, 2015. Pro forma financial

information for this acquisition is not presented as such results are immaterial to the Company’s consolidated

financial statements.

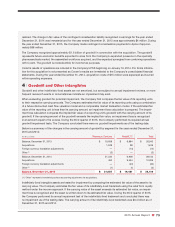

Coram Acquisition

On January 16, 2014, the Company acquired 100% of the voting interests of Coram LLC and its subsidiaries (collectively,

“Coram”), the specialty infusion services and enteral nutrition business unit of Apria Healthcare Group Inc. (“Apria”), for

cash consideration of approximately $2.1 billion, plus contingent consideration of approximately $0.1 billion. The pur-

chase price was also subject to a working capital adjustment, which resulted in the Company receiving $9 million from

Apria. Coram is one of the nation’s largest providers of comprehensive infusion services, caring for approximately 240,000

patients annually. Coram has approximately 4,600 employees, including approximately 600 nurses and 250 dietitians,

operating primarily through 83 branch locations and six centers of excellence for patient intake.

The contingent consideration is based on the Company’s future realization of Coram’s tax net operating loss

carryforwards (“NOLs”) as of the date of the acquisition. The Company will pay the seller the first $60 million in tax

savings realized from the future utilization of the Coram NOLs, plus 50% of any additional future tax savings from

the remaining NOLs. The fair value of the contingent consideration liability associated with the future realization of

the Coram NOLs was determined using Level 3 inputs based on the present value of contingent payments expected

to be made based on the Company’s estimate of the amount and timing of Coram NOLs that will ultimately be