CVS 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 CVS Health

Notes to Consolidated Financial Statements

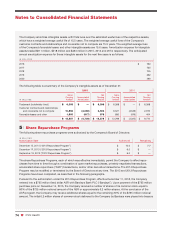

Shares held in trust The Company maintains grantor trusts, which held approximately 1 million shares of its

common stock at December 31, 2015 and 2014, respectively. These shares are designated for use under various

employee compensation plans. Since the Company holds these shares, they are excluded from the computation of

basic and diluted shares outstanding.

Accumulated other comprehensive income Accumulated other comprehensive income (loss) consists of changes

in the net actuarial gains and losses associated with pension and other postretirement benefit plans, losses on

derivatives from cash flow hedges executed in previous years associated with the issuance of long-term debt, and

foreign currency translation adjustments. The amount included in accumulated other comprehensive loss related to

the Company’s pension and postretirement plans was $305 million pre-tax ($186 million after-tax) as of December 31,

2015 and $234 million pre-tax ($143 million after-tax) as of December 31, 2014. The net impact on cash flow hedges

totaled $14 million pre-tax ($7 million after-tax) and $16 million pre-tax ($9 million after-tax) as of December 31, 2015

and 2014, respectively. Cumulative foreign currency translation adjustments at December 31, 2015 and 2014 were

$165 million and $65 million, respectively.

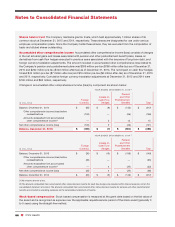

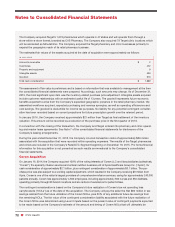

Changes in accumulated other comprehensive income (loss) by component are shown below:

YEAR ENDED DECEMBER 31, 2015 (1)

Pension

Losses on and Other

Foreign Cash Flow Postretirement

IN MILLIONS Currency Hedges Benefits Total

Balance, December 31, 2014 $ (65) $ (9) $ (143) $ (217)

Other comprehensive income (loss) before

reclassifications (100) — (56) (156)

Amounts reclassified from accumulated

other comprehensive income (2) — 2 13 15

Net other comprehensive income (loss) (100) 2 (43) (141)

Balance, December 31, 2015

$ (165)

$ (7)

$ (186)

$ (358)

YEAR ENDED DECEMBER 31, 2014 (1)

Pension

Losses on and Other

Foreign Cash Flow Postretirement

IN MILLIONS Currency Hedges Benefits Total

Balance, December 31, 2013 $ (30) $ (13) $ (106) $ (149)

Other comprehensive income (loss) before

reclassifications (35) — — (35)

Amounts reclassified from accumulated

other comprehensive income (2) — 4 (37) (33)

Net other comprehensive income (loss) (35) 4 (37) (68)

Balance, December 31, 2014 $ (65) $ (9) $ (143) $ (217)

(1) All amounts are net of tax.

(2) The amounts reclassified from accumulated other comprehensive income for cash flow hedges are recorded within interest expense, net on the

consolidated statement of income. The amounts reclassified from accumulated other comprehensive income for pension and other postretirement

benefits are included in operating expenses on the consolidated statement of income.

Stock-based compensation Stock-based compensation is measured at the grant date based on the fair value of

the award and is recognized as expense over the applicable requisite service period of the stock award (generally 3

to 5 years) using the straight-line method.