CVS 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

2015 Annual Report

and a $1.25 billion, five-year unsecured back-up credit facility, which expires on July 1, 2020. The credit facilities

allow for borrowings at various rates that are dependent, in part, on the Company’s public debt ratings and require

the Company to pay a weighted average quarterly facility fee of approximately 0.03%, regardless of usage. As of

December 31, 2015, there were no borrowings outstanding under the back-up credit facilities. The weighted average

interest rate for short-term debt outstanding as of December 31, 2014 was 0.36%.

On May 20, 2015, in connection with the acquisition of Omnicare, the Company entered into a $13 billion unsecured

bridge loan facility. The Company paid approximately $52 million in fees in connection with the facility. The fees were

capitalized and amortized as interest expense over the period the bridge facility was outstanding. The bridge loan

facility expired on July 20, 2015 upon the Company’s issuance of unsecured senior notes with an aggregate principal

of $15 billion as discussed below. The bridge loan facility fees became fully amortized in July 2015.

On July 20, 2015, the Company issued an aggregate of $2.25 billion of 1.9% unsecured senior notes due 2018

(“2018 Notes”), an aggregate of $2.75 billion of 2.8% unsecured senior notes due 2020 (“2020 Notes”), an aggregate

of $1.5 billion of 3.5% unsecured senior notes due 2022 (“2022 Notes”), an aggregate of $3 billion of 3.875% unse-

cured senior notes due 2025 (“2025 Notes”), an aggregate of $2 billion of 4.875% unsecured senior notes due 2035

(“2035 Notes”), and an aggregate of $3.5 billion of 5.125% unsecured senior notes due 2045 (“2045 Notes” and,

together with the 2018 Notes, 2020 Notes, 2022 Notes, 2025 Notes and 2035 Notes, the “Notes”) for total proceeds

of approximately $14.8 billion, net of discounts and underwriting fees. The Notes pay interest semi-annually and

contain redemption terms which allow or require the Company to redeem the Notes at a defined redemption price

plus accrued and unpaid interest at the redemption date. The net proceeds of the Notes were used to fund the

Omnicare acquisition and the acquisition of the pharmacies and clinics of Target. The remaining proceeds were

used for general corporate purposes.

Upon the closing of the Omnicare acquisition in August 2015, the Company assumed the long-term debt of Omnicare

that had a fair value of approximately $3.1 billion, $2.0 billion of which was previously convertible into Omnicare

shares that holders were able to redeem subsequent to the acquisition. During the period from August 18, 2015 to

December 31, 2015, all but $5 million of the $2.0 billion of previously convertible debt was redeemed and repaid and

approximately $0.4 billion in Omnicare term debt assumed was repaid for total repayments of Omnicare debt of

approximately $2.4 billion in 2015.

The remaining principal of the Omnicare debt assumed was comprised of senior unsecured notes with an aggregate

principal amount of $700 million ($400 million of 4.75% senior notes due 2022 and $300 million of 5% senior notes

due 2024). In September 2015, the Company commenced exchange offers for the 4.75% senior notes due 2022 and

the 5% senior notes due 2024 to exchange all validly tendered and accepted notes issued by Omnicare for notes to

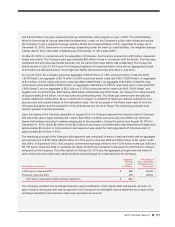

be issued by the Company. This offer expired on October 20, 2015 and the aggregate principal amounts below of

each of the Omnicare notes were validly tendered and exchanged for notes issued by the Company.

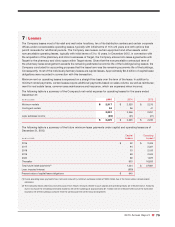

Aggregate Percentage of

Principal Total Outstanding

Amount Principal Amount

Interest Rate and Maturity (In Millions) Exchanged

4.75% senior notes due 2022 $ 388 96.8 %

5% senior notes due 2024 296 98.8 %

Total senior notes issued under exchange transaction $ 684

The Company recorded this exchange transaction as a modification of the original debt instruments. As such, no

gain or loss on extinguishment was recognized in the Company’s consolidated income statement as a result of this

exchange transaction and issuance costs were expensed as incurred.