CVS 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 CVS Health

Notes to Consolidated Financial Statements

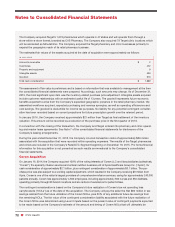

The Company amortizes intangible assets with finite lives over the estimated useful lives of the respective assets,

which have a weighted average useful life of 15.5 years. The weighted average useful lives of the Company’s

customer contracts and relationships and covenants not to compete are 15.5 years. The weighted average lives

of the Company’s favorable leases and other intangible assets are 15.6 years. Amortization expense for intangible

assets totaled $611 million, $518 million and $494 million in 2015, 2014 and 2013, respectively. The anticipated

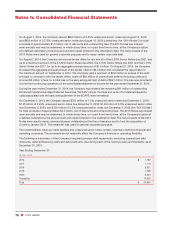

annual amortization expense for these intangible assets for the next five years is as follows:

IN MILLIONS

2016 $ 760

2017 735

2018 705

2019 662

2020 490

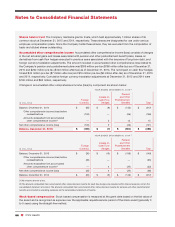

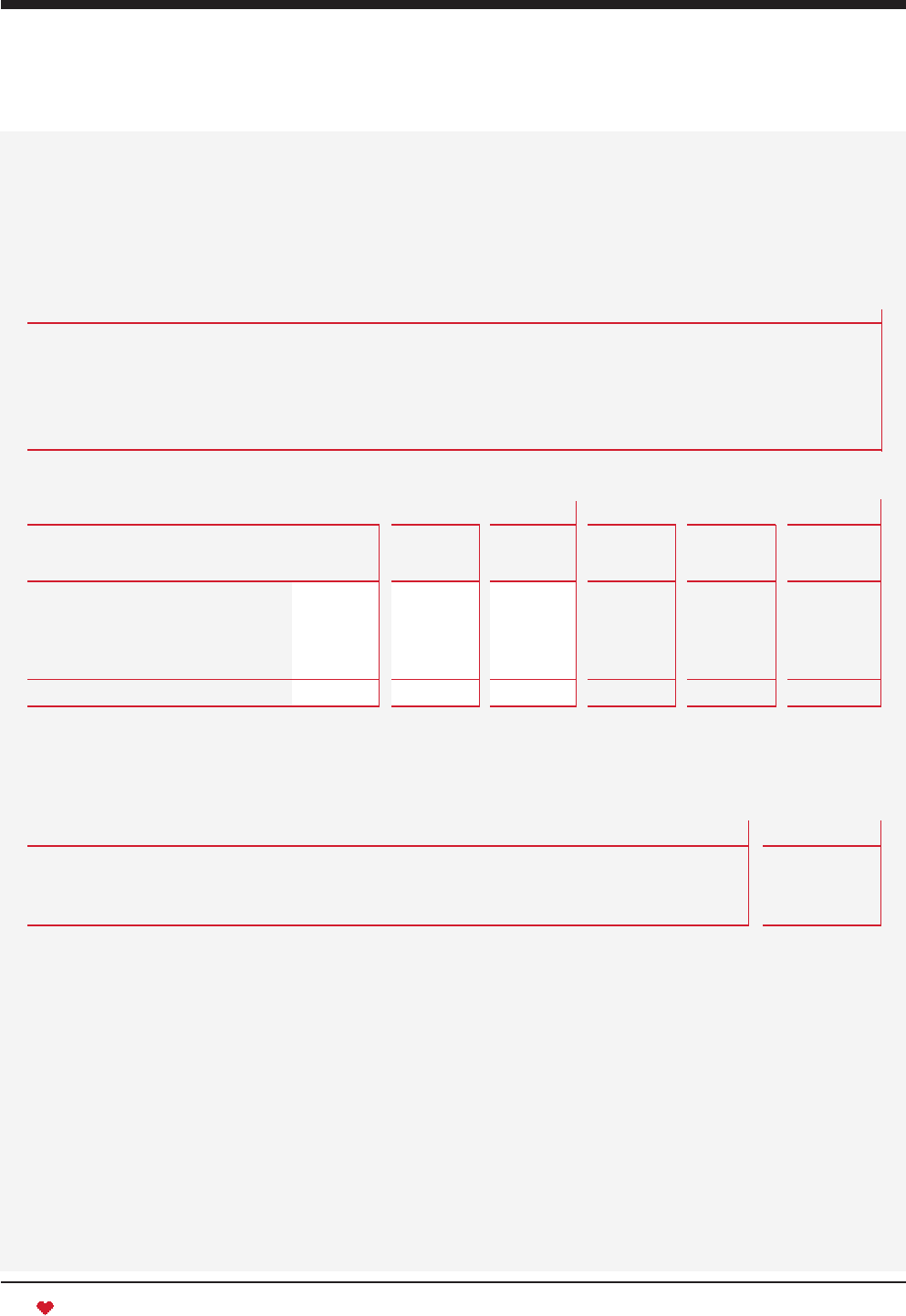

The following table is a summary of the Company’s intangible assets as of December 31:

2015 2014

Gross

Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

IN MILLIONS Amount Amortization Amount Amount Amortization

Amount

Trademark (indefinitely-lived)

$ 6,398 $ — $ 6,398

$ 6,398 $ — $ 6,398

Customer contracts and relationships

and covenants not to compete

10,594 (4,092) 6,502

6,521 (3,549) 2,972

Favorable leases and other

1,595 (617) 978

880 (476) 404

$ 18,587 $ (4,709) $ 13,878

$ 13,799 $ (4,025) $ 9,774

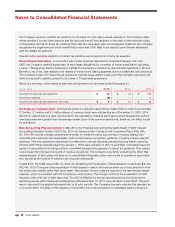

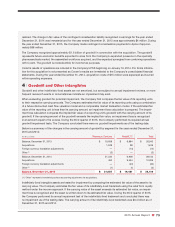

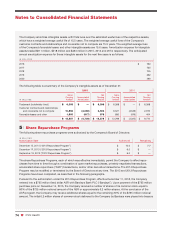

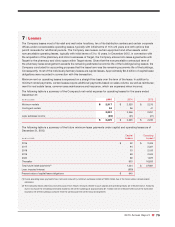

5 | Share Repurchase Programs

The following share repurchase programs were authorized by the Company’s Board of Directors:

IN BILLIONS

Authorization Date Authorized Remaining

December 15, 2014 (“2014 Repurchase Program”) $ 10.0 $ 7.7

December 17, 2013 (“2013 Repurchase Program”) $ 6.0 $ —

September 19, 2012 (“2012 Repurchase Program”) $ 6.0 $ —

The share Repurchase Programs, each of which was effective immediately, permit the Company to effect repur-

chases from time to time through a combination of open market repurchases, privately negotiated transactions,

accelerated share repurchase (“ASR”) transactions, and/or other derivative transactions. The 2014 Repurchase

Program may be modified or terminated by the Board of Directors at any time. The 2013 and 2012 Repurchase

Programs have been completed, as described in the following paragraphs.

Pursuant to the authorization under the 2014 Repurchase Program, effective December 11, 2015, the Company

entered into a $725 million fixed dollar ASR with Barclays Bank PLC (“Barclays”). Upon payment of the $725 million

purchase price on December 14, 2015, the Company received a number of shares of its common stock equal to

80% of the $725 million notional amount of the ASR or approximately 6.2 million shares. At the conclusion of the

ASR program, the Company may receive additional shares equal to the remaining 20% of the $725 million notional

amount. The initial 6.2 million shares of common stock delivered to the Company by Barclays were placed into treasury