CVS 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

2015 Annual Report

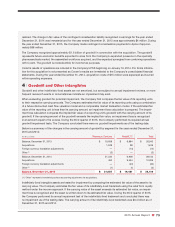

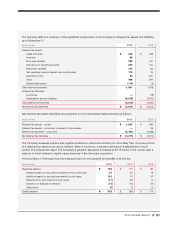

The Company continued to have no investments in Level 3 alternative investments during the years ended

December 31, 2015 and 2014.

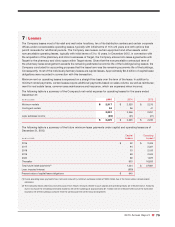

Cash Flows

The Company contributed $22 million, $42 million and $33 million to the pension plans during 2015, 2014 and 2013,

respectively. The Company plans to make approximately $37 million in contributions to the pension plans during

2016. These contributions include contributions made to certain nonqualified benefit plans for which there is no

funding requirement. The Company estimates the following future benefit payments which are calculated using the

same actuarial assumptions used to measure the benefit obligation as of December 31, 2015:

IN MILLIONS

2016 $ 37

2017 (1) 39

2018 51

2019 50

2020 49

Thereafter 250

(1) Excludes any payments associated with the ultimate settlement of the terminated plan discussed above.

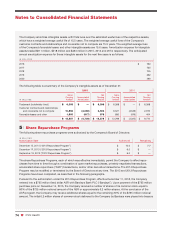

Multiemployer Pension Plans

The Company also contributes to a number of multiemployer pension plans under the terms of collective-bargaining

agreements that cover its union-represented employees. The risks of participating in these multiemployer plans are

different from single-employer pension plans in the following aspects: (i) assets contributed to the multiemployer plan

by one employer may be used to provide benefits to employees of other participating employers, (ii) if a participating

employer stops contributing to the plan, the unfunded obligations of the plan may be borne by the remaining partici-

pating employers, and (iii) if the Company chooses to stop participating in some of its multiemployer plans, the

Company may be required to pay those plans an amount based on the underfunded status of the plan, referred to

as a withdrawal liability.

None of the multiemployer pension plans in which the Company participates are individually significant to the

Company. Total Company contributions to multiemployer pension plans were $14 million in 2015 and 2014 and

$13 million in 2013.

Other Postretirement Benefits

The Company provides postretirement health care and life insurance benefits to certain retirees who meet eligibility

requirements. The Company’s funding policy is generally to pay covered expenses as they are incurred. For retiree

medical plan accounting, the Company reviews external data and its own historical trends for health care costs to

determine the health care cost trend rates. As of December 31, 2015 and 2014, the Company’s other postretirement

benefits have an accumulated postretirement benefit obligation of $33 million and $31 million, respectively. Net

periodic benefit costs related to these other postretirement benefits were $2 million in 2015, $1 million in 2014, and

$11 million in 2013. The net periodic benefit costs for 2013 include a settlement loss of $8 million.

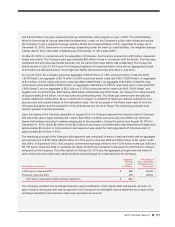

Pursuant to various collective bargaining agreements, the Company also contributes to multiemployer health and

welfare plans that cover certain union-represented employees. The plans provide postretirement health care and life

insurance benefits to certain employees who meet eligibility requirements. Total Company contributions to multiem-

ployer health and welfare plans were $60 million, $58 million and $55 million in 2015, 2014 and 2013, respectively.