CVS 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 CVS Health

Notes to Consolidated Financial Statements

The Company records uncertain tax positions on the basis of a two-step process whereby (1) the Company deter-

mines whether it is more likely than not that the tax positions will be sustained on the basis of the technical merits

of the position and (2) for those tax positions that meet the more-likely-than-not recognition threshold, the Company

recognizes the largest amount of tax benefit that is more than 50% likely to be realized upon ultimate settlement

with the related tax authority.

Interest and/or penalties related to uncertain tax positions are recognized in income tax expense.

Discontinued Operations In connection with certain business dispositions completed between 1991 and

1997, the Company retained guarantees on store lease obligations for a number of former subsidiaries, including

Linens ‘n Things which filed for bankruptcy in 2008. The Company’s income from discontinued operations in 2015 of

$9 million, net of tax, was related to the release of certain store lease guarantees due to a settlement with a landlord.

The Company’s loss from discontinued operations includes lease-related costs which the Company believes it will

likely be required to satisfy pursuant to its Linens ‘n Things lease guarantees.

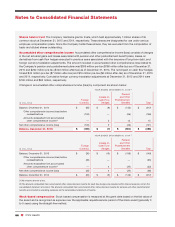

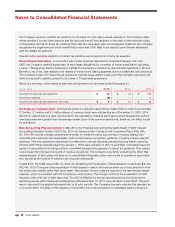

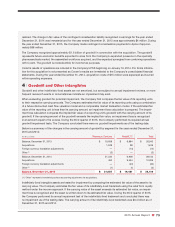

Below is a summary of the results of discontinued operations for the years ended December 31:

IN MILLIONS 2015 2014 2013

Income from discontinued operations

$ 15

$ (1) $ (12)

Income tax expense

(6)

— 4

Income from discontinued operations, net of tax

$ 9

$ (1) $ (8)

Earnings per common share Earnings per share is computed using the two-class method. Options to purchase

2.7 million, 2.1 million and 6.2 million shares of common stock were outstanding as of December 31, 2015, 2014

and 2013, respectively, but were not included in the calculation of diluted earnings per share because the options’

exercise prices were greater than the average market price of the common shares and, therefore, the effect would

be antidilutive.

New Accounting Pronouncement In May 2014, the Financial Accounting Standards Board (“FASB”) issued

Accounting Standard Update (“ASU”) No. 2014-09,

Revenue from Contracts with Customers

(Topic 606). ASU

No. 2014-09 outlines a single comprehensive model for entities to use in accounting for revenue arising from

contracts with customers and supersedes most current revenue recognition guidance, including industry-specific

guidance. This new guidance is expected to be effective for annual reporting periods (including interim reporting

periods within those periods) beginning January 1, 2018; early adoption in 2017 is permitted. Companies have the

option of using either a full retrospective or a modified retrospective approach to adopt the guidance. This update

could impact the timing and amounts of revenue recognized. The Company is currently evaluating the effect that

implementation of this update will have on its consolidated financial position and results of operations upon adop-

tion, as well as the method of transition and required disclosures.

In April 2015, the FASB issued ASU No. 2015-03,

Simplifying the Presentation of Debt Issuance Costs

(Topic 835-30).

ASU No. 2015-03 requires the presentation of debt issuance costs in the balance sheet as a direct deduction from

the related debt liability rather than as an asset. Amortization of such costs are required to be reported as interest

expense, which is consistent with the Company’s current policy. This change conforms the presentation of debt

issuance costs with that of debt discounts. The ASU is effective for annual reporting periods (including interim

reporting periods within those periods) beginning after December 15, 2015; early adoption is permitted. The guid-

ance is required to be applied retrospectively to all prior periods. The Company has early adopted this standard as

of June 30, 2015. The effect of the adoption of ASU 2015-03 on the Company’s consolidated balance sheet is a