CVS 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adding the Med D lives we manage for our health plan

clients, the total rises to more than 11 million Med D

lives under management, up 41 percent from the prior

year, and making us the clear leader in the Med D space.

Through our enterprise clinical capabilities, we have

an unmatched ability to drive Med D Star ratings—for

SilverScript as well as our health plan clients’ offerings.

In fact, SilverScript was the largest PDP to achieve a

four-star rating, and 73 percent of our clients’ lives were

enrolled in a high performing plan for the 2016 plan year.

Our specialty business, with its breadth of offerings,

has been a key driver of revenue gains

Throughout 2015, we continued to capture an outsized

share of the specialty market, the industry’s fastest-grow-

ing sector. Our CVS SpecialtyTM

business is the nation’s

largest, and our growth has outpaced both the industry

overall and that of our nearest competitor. In 2015,

revenues from the specialty drugs we dispensed and

managed across the enterprise totaled nearly $40 billion,

increasing 32 percent over the prior year.

CVS Specialty offers all the traditional capabilities that

payors expect from a specialty pharmacy. We’ve raised

the bar as well by offering a unique range of differen-

tiated solutions through our integrated model. Take

our highly popular Specialty ConnectTM

offering, which

gives specialty patients the option of picking up their

medications at any CVS Pharmacy® location or having

the medication delivered by mail. More than 54 percent

of our specialty patients prefer in-store pickup—along

with the opportunity to consult with a pharmacist face-

to-face—and we’ve served more than 100,000 of them

in this way since we rolled out the program in 2014.

Among specialty patients that opt for in-store pickup,

we’ve seen adherence improve by 11.4 percent.

Our differentiated offerings also include Accordant® rare

disease case management and Coram® infusion services,

both of which make CVS Specialty particularly attractive

to manufacturers who want to launch new drugs through

limited distribution networks. Only CVS Specialty has the

NovoLogix® technology platform, enabling us to help our

clients manage all specialty medications including those

paid under the medical benefit.

Retail pharmacy growth has outpaced our competitors

while the Target deal further broadens our reach

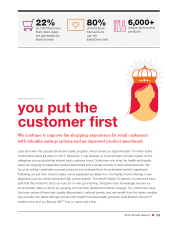

At CVS Pharmacy, same store sales increased 1.7 percent

in 2015. Pharmacy same store sales rose 4.5 percent,

while front store same store sales decreased 5 percent,

driven primarily by our exit from tobacco sales in 2014.

CVS Pharmacy filled 21.6 percent of all retail prescriptions

in 2015 to lead the U.S. retail drugstore market. In fact,

our retail prescription business has grown at twice the

rate of the overall market since 2010.

3

2015 Annual Report

Gross new business

wins to start 2016

n 84% Health Plan

n 12% Employer

n 4% Government

With a client retention rate

of 98%, net new business

for 2016 totaled $12.7B

$40billion

in revenues from specialty drugs

dispensed and managed across the enterprise

CVS Pharmacy filled

21.6%

of all retail prescriptions

in 2015 to lead the U.S. retail

drugstore market

Total

$14.8B