CVS 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 CVS Health

Notes to Consolidated Financial Statements

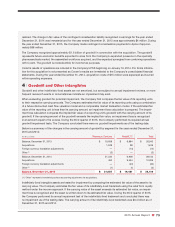

at the SKU level and valued front store inventory as of January 1, 2015 and calculated the cumulative impact. The

effect of these changes in accounting principle as of January 1, 2015, was a decrease in inventories of $7 million, an

increase in current deferred income tax assets of $3 million and a decrease in retained earnings of $4 million.

Had the Company not made these changes in accounting principle, for the year ended December 31, 2015, income

from continuing operations would have been lower by $27 million. Basic and diluted earnings per share from continu-

ing operations attributable to CVS Health would have been approximately $0.02 per share lower for the year ended

December 31, 2015.

3 | Acquisitions

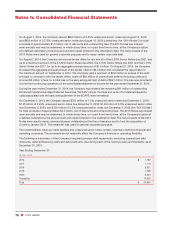

Omnicare Acquisition

On August 18, 2015, the Company acquired 100% of the outstanding common shares and voting interests of

Omnicare, for $98 per share for a total of $9.6 billion and assumed long-term debt with a fair value of approximately

$3.1 billion. Additionally, holders of Omnicare restricted stock units and performance based restricted stock units

received 738,765 CVS Health Corporation restricted stock awards with a fair value of approximately $80 million

as replacement awards. Omnicare is a leading health care services company that specializes in the management

of complex pharmaceutical care. Omnicare’s long-term care (“LTC”) business is the nation’s largest provider of

pharmaceuticals, related pharmacy consulting and other ancillary services to chronic care facilities and other care

settings. In addition, Omnicare has a specialty pharmacy business operating primarily under the name of Advanced

Care Scripts, and provides commercialization services under the name of RxCrossroads®. The Company is including

LTC and the commercialization services in its former Retail Pharmacy Segment, which has been renamed the

“Retail/LTC Segment,” and will include the specialty pharmacy business in its Pharmacy Services Segment. The

Company acquired Omnicare to expand its operations in dispensing prescription drugs to assisted-living and

long-term care facilities, and to broaden its presence in the specialty pharmacy business as the Company seeks to

serve a greater percentage of the growing senior patient population in the United States.

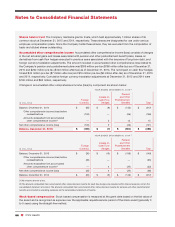

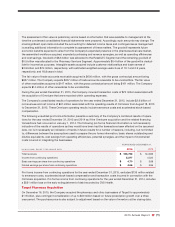

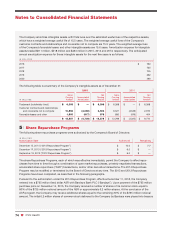

The fair value of the consideration transferred on the date of acquisition consisted of the following:

IN MILLIONS

Cash paid to Omnicare shareholders $ 9,636

Fair value of replacement equity awards issued to Omnicare employees for precombination services 9

Total consideration $ 9,645

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date

of acquisition:

IN MILLIONS

Current assets (including cash of $298) $ 1,657

Property and equipment 313

Goodwill 9,090

Intangible assets 3,962

Other noncurrent assets 64

Current liabilities (705)

Long-term debt (3,110)

Deferred income tax liabilities (1,518)

Other noncurrent liabilities (69)

Redeemable noncontrolling interest (39)

Total consideration $ 9,645