Berkshire Hathaway 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

So guided, we’ ve concluded that we should now write mega-cat policies only at prices far higher

than prevailed last year – and then only with an aggregate exposure that would not cause us distress if shifts

in some important variable produce far more costly storms in the near future. To a lesser degree, we felt

this way after 2004 – and cut back our writings when prices didn’ t move. Now our caution has intensified.

If prices seem appropriate, however, we continue to have both the ability and the appetite to be the largest

writer of mega-cat coverage in the world.

* * * * * * * * * * * *

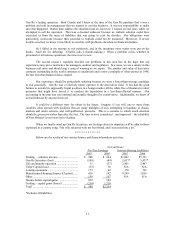

Our smaller insurers, with MedPro added to the fold, delivered truly outstanding results last year.

However, what you see in the table below does not do full justice to their performance. That’ s because we

increased the loss reserves of MedPro by about $125 million immediately after our purchase.

No one knows with any precision what amount will be required to pay the claims we inherited.

Medical malpractice insurance is a “long-tail” line, meaning that claims often take many years to settle. In

addition, there are other losses that have occurred, but that we won’ t even hear about for some time. One

thing, though, we have learned – the hard way – after many years in the business: Surprises in insurance are

far from symmetrical. You are lucky if you get one that is pleasant for every ten that go the other way.

Too often, however, insurers react to looming loss problems with optimism. They behave like the fellow in

a switchblade fight who, after his opponent has taken a mighty swipe at his throat, exclaimed, “You never

touched me.” His adversary’ s reply: “Just wait until you try to shake your head.”

Excluding the reserves we added for prior periods, MedPro wrote at an underwriting profit. And

our other primary companies, in aggregate, had an underwriting profit of $324 million on $1,270 million of

volume. This is an extraordinary result, and our thanks go to Rod Eldred of Berkshire Hathaway

Homestate Companies, John Kizer of Central States Indemnity, Tom Nerney of U. S. Liability, Don Towle

of Kansas Bankers Surety and Don Wurster of National Indemnity.

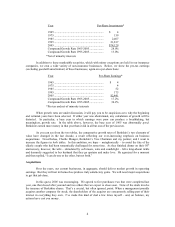

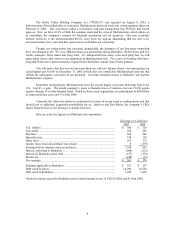

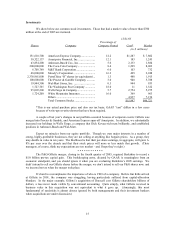

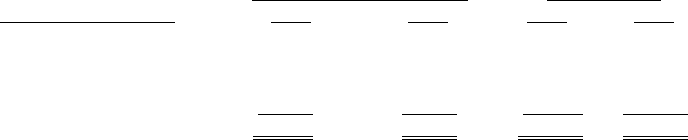

Here’ s the overall tally on our underwriting and float for each major sector of insurance:

(in $ millions)

Underwriting Profit (Loss) Yearend Float

Insurance Operations 2005 2004 2005 2004

General Re ....................... $( 334) $ 3 $22,920 $23,120

B-H Reinsurance.............. (1,069) 417 16,233 15,278

GEICO ............................. 1,221 970 6,692 5,960

Other Primary................... 235* 161 3,442 1,736

Total................................. $ 53 $1,551 $49,287 $46,094

*Includes MedPro from June 30, 2005.

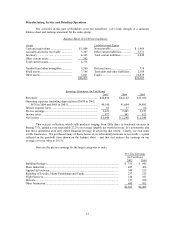

Regulated Utility Business

We have an 80.5% (fully diluted) interest in MidAmerican Energy Holdings, which owns a wide

variety of utility operations. The largest of these are (1) Yorkshire Electricity and Northern Electric, whose

3.7 million electric customers make it the third largest distributor of electricity in the U.K.; (2)

MidAmerican Energy, which serves 706,000 electric customers, primarily in Iowa; and (3) Kern River and

Northern Natural pipelines, which carry 7.8% of the natural gas consumed in the U.S. When our PacifiCorp

acquisition closes, we will add 1.6 million electric customers in six Western states, with Oregon and Utah

providing us the most business. This transaction will increase MidAmerican’ s revenues by $3.3 billion and

its assets by $14.1 billion.

8