Berkshire Hathaway 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

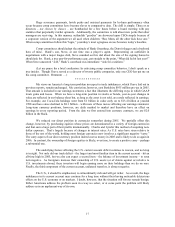

27

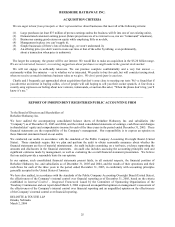

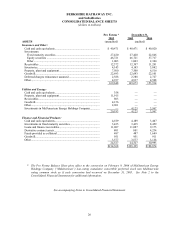

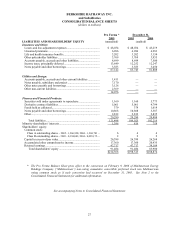

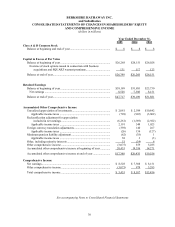

BERKSHIRE HATHAWAY INC.

and Subsidiaries

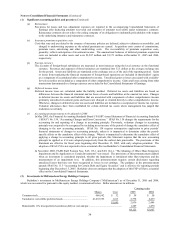

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

Pro Forma * December 31,

2005 2005 2004

LIABILITIES AND SHAREHOLDERS’ E

Q

UITY

(

unaudited

)

(

audited

)

Insurance and Other:

Losses and loss ad

j

ustment ex

p

enses ............................................. $ 48,034 $ 48,034 $ 45,219

Unearned

p

remiums ....................................................................... 6,206 6,206 6,283

Life and health insurance benefits.................................................. 3,202 3,202 3,154

Other

p

olic

y

holder liabilities.......................................................... 3,769 3,769 3,955

Accounts

p

a

y

able, accruals and other liabilities............................. 8,699 8,699 7,500

Income taxes,

p

rinci

p

all

y

deferre

d

................................................. 13,649 12,252 12,247

N

otes

p

a

y

able and other borrowin

g

s .............................................. 3,583 3,583 3,450

87,142 85,745 81,808

Utilities and Ener

gy

:

Accounts

p

a

y

able, accruals and other current liabilities ................ 1,411

—

—

N

otes

p

a

y

able, subsidiar

y

and

p

ro

j

ec

t

............................................ 7,170

—

—

Other notes

p

a

y

able and borrowin

g

s .............................................. 3,126

—

—

Other non-current liabilities ........................................................... 2,369

—

—

14,076

—

—

F

inance and Financial Products:

Securities sold under a

g

reements to re

p

urchase............................. 1,160 1,160 5,773

Derivative contract liabilities ......................................................... 5,061 5,061 4,794

Funds held as collateral .................................................................. 379 379 1,619

N

otes

p

a

y

able and other borrowin

g

s .............................................. 10,868 10,868 5,387

Other............................................................................................... 2,812 2,812 2,835

20,280 20,280 20,408

Total liabilities............................................................................. 121,498 106,025 102,216

Minorit

y

shareholders’ interests........................................................ 1,386 816 758

Shareholders’ e

q

uit

y

:

Common stock:

Class A outstandin

g

shares

–

2005 - 1,260,920; 2004 - 1,268,783 .. 6 6 6

Class B outstandin

g

shares

–

2005 - 8,394,083; 2004 - 8,099,175... 2 2 2

Ca

p

ital in excess of

p

ar value......................................................... 26,399 26,399 26,268

Accumulated other com

p

rehensive income.................................... 17,360 17,360 20,435

Retained earnin

g

s ........................................................................... 47,717 47,717 39,189

Total shareholders’ e

q

uit

y

........................................................ 91,484 91,484 85,900

$214,368 $198,325 $188,874

* The Pro Forma Balance Sheet gives effect to the conversion on February 9, 2006 of MidAmerican Energy

Holdings Company (“MidAmerican”) non-voting cumulative convertible preferred stock into MidAmerican

voting common stock as if such conversion had occurred on December 31, 2005. See Note 2 to the

Consolidated Financial Statements for additional information.

See accompanying Notes to Consolidated Financial Statements