Berkshire Hathaway 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

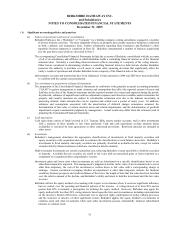

Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(n) Reinsurance

Provisions for losses and loss adjustment expenses are reported in the accompanying Consolidated Statements of

Earnings after deducting amounts recovered and estimates of amounts recoverable under reinsurance contracts.

Reinsurance contracts do not relieve the ceding company of its obligations to indemnify policyholders with respect

to the underlying insurance and reinsurance contracts.

(o) Insurance premium acquisition costs

Costs that vary and are related to the issuance of insurance policies are deferred, subject to ultimate recoverability, and

charged to underwriting expenses as the related premiums are earned. Acquisition costs consist of commissions,

premium taxes, advertising and other underwriting costs. The recoverability of premium acquisition costs,

generally, reflects anticipation of investment income. The unamortized balances of deferred premium acquisition

costs are included in other assets and were $1,287 million and $1,371 million at December 31, 2005 and 2004,

respectively.

(p) Foreign currency

The accounts of foreign-based subsidiaries are measured in most instances using the local currency as the functional

currency. Revenues and expenses of these businesses are translated into U.S. dollars at the average exchange rate

for the period. Assets and liabilities are translated at the exchange rate as of the end of the reporting period. Gains

or losses from translating the financial statements of foreign-based operations are included in shareholders’ equity

as a component of accumulated other comprehensive income. Unrealized gains or losses associated with available-

for-sale securities are included as a component of other comprehensive income. Gains and losses arising from other

transactions denominated in a foreign currency are included in the Consolidated Statements of Earnings.

(q) Deferred income taxes

Deferred income taxes are calculated under the liability method. Deferred tax assets and liabilities are based on

differences between the financial statement and tax bases of assets and liabilities at the enacted tax rates. Changes

in deferred income tax assets and liabilities that are associated with components of other comprehensive income

(primarily unrealized investment gains and losses) are charged or credited directly to other comprehensive income.

Otherwise, changes in deferred income tax assets and liabilities are included as a component of income tax expense.

Valuation allowances have been established for certain deferred tax assets where management has judged that

realization is not likely.

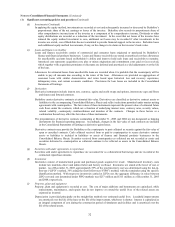

(r) Accounting pronouncements to be adopted in 2006

In May 2005, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) No. 154, “Accounting Changes and Error Corrections.” SFAS No. 154 changes the requirements for the

accounting for and reporting of a change in accounting principle. Previously, voluntary changes in accounting

principle were required to be recognized by including in net income of the period of change the cumulative effect of

changing to the new accounting principle. SFAS No. 154 requires retrospective application to prior periods’

financial statements of changes in accounting principle, unless it is impractical to determine either the period-

specific effects or the cumulative effect of the change. When it is impractical to determine the cumulative effect of

applying a change in accounting principle to all prior periods, this Statement requires that the new accounting

principle be applied as if it were adopted prospectively from the earliest date practicable. The provisions of this

Statement are effective for fiscal years beginning after December 15, 2005, with early adoption permitted. The

adoption of SFAS 154 is not expected to have a material effect on Berkshire’ s Consolidated Financial Statements.

In November 2005, FASB Staff Position Nos. FAS 115-1 and FAS 124-1, “The Meaning of Other-Than-Temporary

Impairment and Its Application to Certain Investments” was issued. The provisions of this pronouncement address

when an investment is considered impaired, whether the impairment is considered other than temporary and the

measurement of an impairment loss. In addition, this pronouncement requires certain disclosures regarding

unrealized losses that have not been recognized as losses in net earnings. The guidance in the pronouncement

amends SFAS No. 115 “Accounting for Certain Debt and Equity Securities” and is effective for reporting periods

beginning after December 15, 2005. Berkshire does not anticipate that the adoption of this FSP will have a material

effect on the Consolidated Financial Statements.

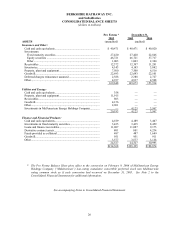

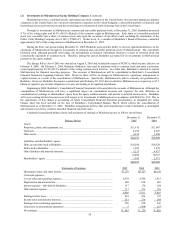

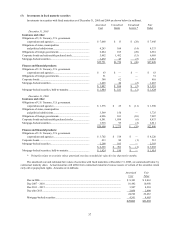

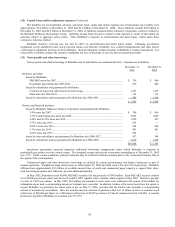

(2) Investments in MidAmerican Energy Holdings Company

Berkshire’ s investment in MidAmerican Energy Holdings Company (“MidAmerican”) as of December 31, 2005 and 2004,

which was accounted for pursuant to the equity method, is summarized below. Dollar amounts are in millions.

Carrying value

Shares Cost 2005 2004

Common stock............................................................................ 900,942 $ 32 $ 58 $ 50

Cumulative convertible preferred stock...................................... 41,263,395 1,613 2,778 2,439

$1,645 2,836 2,489

Redeemable 11% trust preferred securities (debt) at cost and par ................................................... 1,289 1,478

$4,125 $3,967