Berkshire Hathaway 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

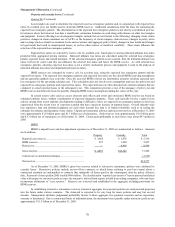

Management’s Discussion (Continued)

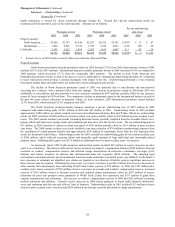

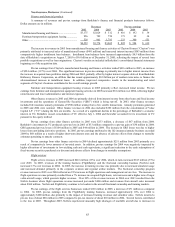

Flight services (Continued)

owner demand outpacing increases in capacity. Consequently, NetJets subcontracted additional aircraft capacity through charter

services. The costs associated with subcontracted flights were not fully recoverable from clients and caused an incremental pre-

tax cost of approximately $85 million in 2005. NetJets has added aircraft to the core fleet and is developing strategies to address

capacity issues and restore profitability. NetJets recorded a special charge of $20 million in the fourth quarter of 2005 for prior

periods’ compensation related to a new labor contract with its pilots and flight attendants. Additionally, interest expense in 2005

increased approximately $23 million due to higher interest rates.

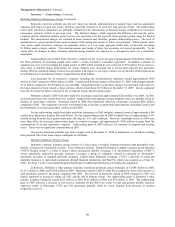

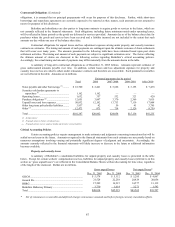

McLane Company

On May 23, 2003, Berkshire acquired McLane Company, Inc., (“McLane”) a distributor of grocery and food products

to retailers, convenience stores and restaurants. Results of McLane’ s business operations are included in Berkshire’ s

consolidated results beginning on that date. McLane’ s revenues in 2005 totaled $24.1 billion compared to $23.4 billion in 2004

and approximately $22.0 billion for the full year of 2003. Sales of grocery products increased about 5% in 2005 and were

partially offset by lower sales to foodservice customers. McLane’ s business is marked by high sales volume and very low profit

margins.

Pre-tax earnings in 2005 of $217 million declined $11 million versus 2004. The gross margin percentage was

relatively unchanged between years. However, the resulting increased gross profit was more than offset by higher payroll, fuel

and insurance expenses. Approximately 33% of McLane’ s annual revenues currently derive from sales to Wal-Mart. Loss or

curtailment of purchasing by Wal-Mart could have a material adverse impact on revenues and pre-tax earnings of McLane.

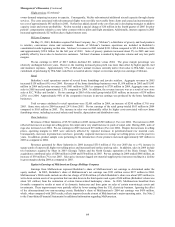

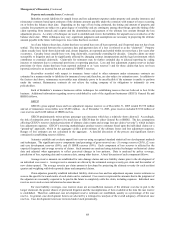

Retail

Berkshire’ s retail operations consist of several home furnishings and jewelry retailers. Aggregate revenues in 2005

increased $158 million (6%) over 2004. Revenues of the home furnishings businesses were $1,958 million in 2005 and $1,843

million in 2004 and jewelry revenues were $801 million in 2005 as compared to $758 million in 2004. Aggregate same store

sales in 2005 increased approximately 2.5% compared to 2004. In addition, the revenue increase was as a result of new store

sales at R.C. Willey and Jordan’ s. Pre-tax earnings in 2005 of the retail group totaled $201 million, an increase of $38 million

(23%) over 2004. Approximately 90% of the comparative increase in pre-tax earnings was produced by the home furnishings

businesses.

Total revenues attributed to retail operations were $2,601 million in 2004, an increase of $290 million (13%) over

2003. Same store sales in 2004 increased 2.4% from 2003. Pre-tax earnings of the retail group totaled $163 million in 2004

compared to $165 million in 2003. The increase in sales was substantially offset by higher costs associated with new home

furnishings stores, including increased salaries and benefits, depreciation and distribution costs.

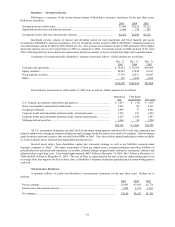

Shaw Industries

Revenues of Shaw Industries of $5,723 million in 2005 increased $549 million (11%) over 2004. The increase in 2005

reflected increases in average net selling prices for carpet and a very small increase in yards of carpet sold. During 2005, sales of

rugs also increased over 2004. Pre-tax earnings in 2005 increased $19 million (4%) over 2004. Despite the increases in selling

prices, operating margins in 2005 were adversely affected by repeated increases in petroleum-based raw material costs.

Consequently, increases in production costs have, generally, outpaced increases in average net selling prices over the past two

years. In addition, product sample costs pertaining to the introduction of new products increased approximately $29 million in

2005 as compared to 2004.

Revenues generated by Shaw Industries in 2004 increased $514 million (11%) over 2003 due to a 9% increase in

square yards of carpet sold, higher net selling prices and increased hard surface and rug sales. In addition, sales in 2004 include

two businesses acquired by Shaw in 2003 (Georgia Tufters and the North Georgia operations of the Dixie Group). These

acquisitions contributed sales of $240 million in 2004 and $50 million in 2003. Pre-tax earnings in 2004 totaled $466 million, an

increase of $30 million (7%) over 2003. Sales price increases lagged raw material supplier price increases resulting in a decline

in gross margins during 2004 as compared to 2003.

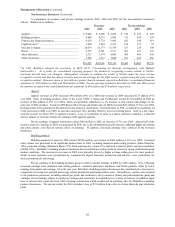

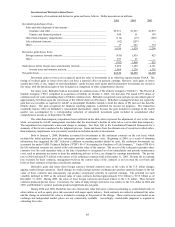

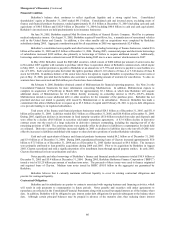

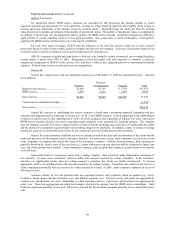

Equity in Earnings of MidAmerican Energy Holdings Company

Earnings from MidAmerican represent Berkshire’ s share of MidAmerican’ s net earnings as determined under the

equity method. In 2005, Berkshire’ s share of MidAmerican’ s net earnings was $523 million versus $237 million in 2004.

MidAmerican’ s 2004 results include an after-tax charge of $340 million (of which Berkshire’ s share was about $255 million) to

write down certain assets of an operation that was shut down in the third quarter and a gain of $44 million (Berkshire’ s share was

about $33 million) from the realization of certain Enron-related bankruptcy claims. In 2005, MidAmerican benefited from

favorable comparative results at most of its domestic businesses and from gains on sales of certain non-strategic assets and

investments. These improvements were partially offset by lower earnings from the U.K. electricity business. Ignoring the effect

of the aforementioned two non-recurring events, Berkshire’ s share of MidAmerican’ s 2004 net earnings was $459 million,

which, when compared with 2003 results, reflects improved results at most of MidAmerican’ s major operating units. See Note 2

to the Consolidated Financial Statements for additional information regarding MidAmerican.