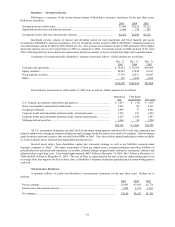

Berkshire Hathaway 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

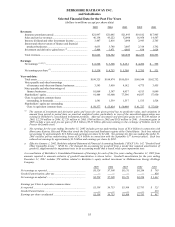

Results of Operations

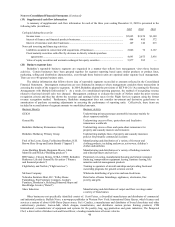

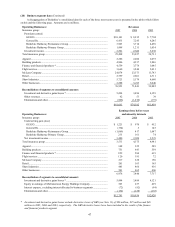

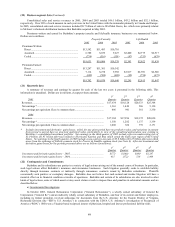

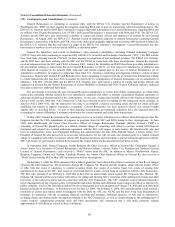

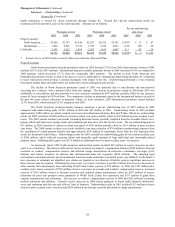

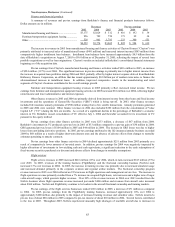

Net earnings for each of the past three years are disaggregated in the table that follows. Amounts are after deducting

income taxes and minority interests. Dollars are in millions.

2005 2004 2003

Insurance – underwriting............................................................................................... $ 27 $1,008 $1,114

Insurance – investment income..................................................................................... 2,412 2,045 2,276

Non-insurance businesses ............................................................................................. 2,160 1,913 1,745

Equity in earnings of MidAmerican Energy Holdings Company ................................. 523 237 429

Interest expense, unallocated ........................................................................................ (46) (59) (59)

Other ............................................................................................................................. (78) (95) (83)

Investment and derivative gains/losses ......................................................................... 3,530 2,259 2,729

Net earnings...................................................................................................... $8,528 $7,308 $8,151

Berkshire’ s operating businesses are managed on an unusually decentralized basis. There are essentially no centralized

or integrated business functions (such as sales, marketing, purchasing, legal or human resources) and there is minimal

involvement by Berkshire’ s corporate headquarters in the day-to-day business activities of the operating businesses. Berkshire’ s

corporate office management participates in and is ultimately responsible for significant capital allocation decisions, investment

activities and the selection of the Chief Executive to head each of the operating businesses.

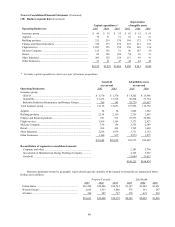

Accordingly, Berkshire’ s reportable business segments are organized in a manner that reflects how Berkshire’ s top

management views those business activities. Certain businesses have been grouped based upon similar products or product lines,

marketing, selling and distribution characteristics even though those businesses are operated by separate local management.

There are over 40 separate reporting units. The business segment data (Note 20 to the Consolidated Financial Statements) should

be read in conjunction with this discussion.

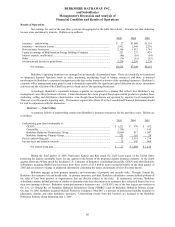

Insurance — Underwriting

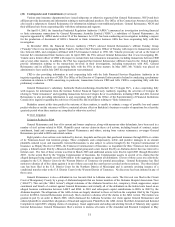

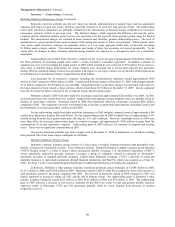

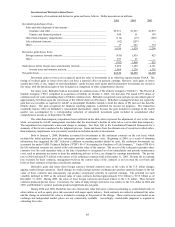

A summary follows of underwriting results from Berkshire’ s insurance businesses for the past three years. Dollars are

in millions.

2005 2004 2003

Underwriting gain (loss) attributable to:

GEICO.................................................................................................................... $ 1,221 $ 970 $ 452

General Re .............................................................................................................. (334) 3 145

Berkshire Hathaway Reinsurance Group................................................................ (1,069) 417 1,047

Berkshire Hathaway Primary Group....................................................................... 235 161 74

Pre-tax underwriting gain.............................................................................................. 53 1,551 1,718

Income taxes and minority interests.............................................................................. 26 543 604

Net underwriting gain....................................................................................... $ 27 $ 1,008 $ 1,114

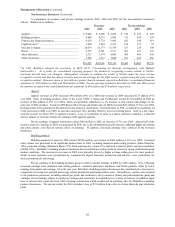

During the third quarter of 2005, Hurricanes Katrina and Rita struck the Gulf Coast region of the United States

producing the largest catastrophe losses for any quarter in the history of the property/casualty insurance industry. In the fourth

quarter, Hurricane Wilma struck the Southeast U.S. Estimates of Berkshire’ s (including General Re, GEICO and other Berkshire

subsidiaries including BHRG) pre-tax losses from these events of $3.4 billion were recorded primarily in the third quarter of

2005 and are subject to change as additional information concerning the nature and amount of losses becomes known.

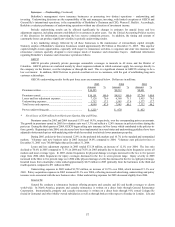

Berkshire engages in both primary insurance and reinsurance of property and casualty risks. Through General Re,

Berkshire also reinsures life and health risks. In primary insurance activities, Berkshire subsidiaries assume defined portions of

the risks of loss from persons or organizations that are directly subject to the risks. In reinsurance activities, Berkshire

subsidiaries assume defined portions of similar or dissimilar risks that other insurers or reinsurers have subjected themselves to in

their own insuring activities. Berkshire’ s principal insurance businesses are: (1) GEICO, one of the four largest auto insurers in

the U.S., (2) General Re, (3) Berkshire Hathaway Reinsurance Group (“BHRG”) and (4) Berkshire Hathaway Primary Group.

On June 30, 2005, Berkshire acquired Medical Protective Company (“Med Pro”), a provider of professional liability insurance to

physicians, dentists and other healthcare providers. Underwriting results from this business are included in the Berkshire

Hathaway Primary Group beginning July 1, 2005.