Berkshire Hathaway 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

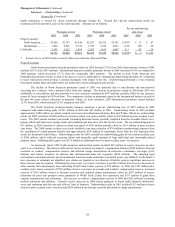

Insurance — Underwriting (Continued)

Berkshire’ s management views insurance businesses as possessing two distinct operations – underwriting and

investing. Underwriting decisions are the responsibility of the unit managers; investing, with limited exceptions at GEICO and

General Re’ s international operations, is the responsibility of Berkshire’ s Chairman and CEO, Warren E. Buffett. Accordingly,

Berkshire evaluates performance of underwriting operations without any allocation of investment income.

Periodic underwriting results can be affected significantly by changes in estimates for unpaid losses and loss

adjustment expenses, including amounts established for occurrences in prior years. See the Critical Accounting Policies section

of this discussion for information concerning the loss reserve estimation process. In addition, the timing and amount of

catastrophe losses can produce significant volatility in periodic underwriting results.

A key marketing strategy followed by all these businesses is the maintenance of extraordinary capital strength.

Statutory surplus of Berkshire’ s insurance businesses totaled approximately $52 billion at December 31, 2005. This superior

capital strength creates opportunities, especially with respect to reinsurance activities, to negotiate and enter into insurance and

reinsurance contracts specially designed to meet unique needs of insurance and reinsurance buyers. Additional information

regarding Berkshire’ s insurance and reinsurance operations follows.

GEICO

GEICO provides primarily private passenger automobile coverages to insureds in 49 states and the District of

Columbia. GEICO policies are marketed mainly by direct response methods in which customers apply for coverage directly to

the company via the Internet, over the telephone or through the mail. This is a significant element in GEICO’ s strategy to be a

low cost insurer. In addition, GEICO strives to provide excellent service to customers, with the goal of establishing long-term

customer relationships.

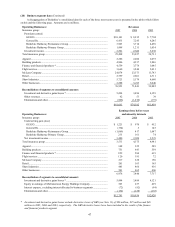

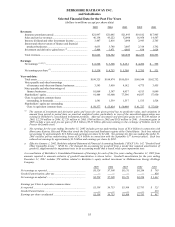

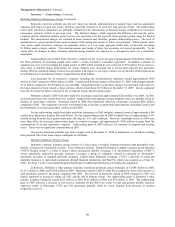

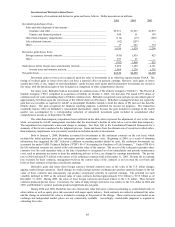

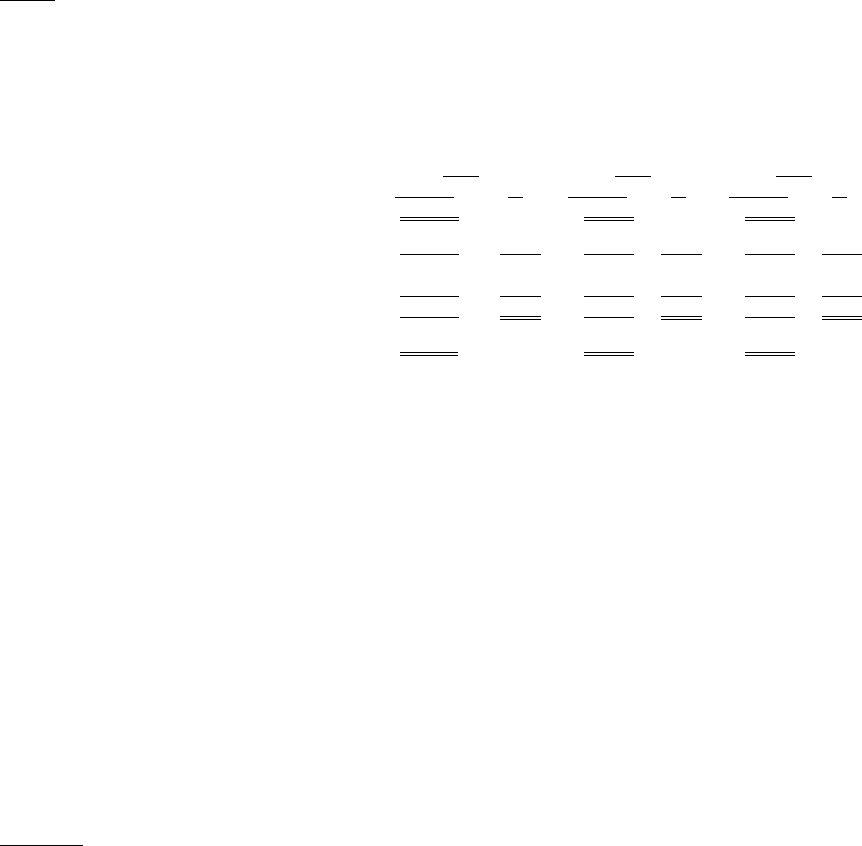

GEICO’ s underwriting results for the past three years are summarized below. Dollars are in millions.

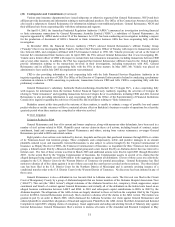

2005 2004 2003

Amount % Amount % Amount %

Premiums written ............................................................... $10,285 $9,212 $8,081

Premiums earned................................................................ $10,101 100.0 $8,915 100.0 $7,784 100.0

Losses and loss adjustment expenses ................................. 7,128 70.6 6,360 71.3 5,955 76.5

Underwriting expenses....................................................... 1,752 17.3 1,585 17.8 1,377 17.7

Total losses and expenses................................................... 8,880 87.9 7,945 89.1 7,332 94.2

Pre-tax underwriting gain................................................... $ 1,221* $ 970 $ 452

* Net of losses of $200 million from Hurricanes Katrina, Rita and Wilma.

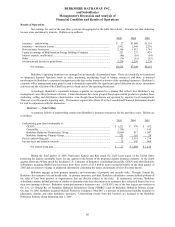

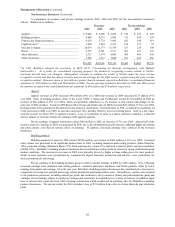

Premiums earned in 2005 and 2004 increased 13.3% and 14.5%, respectively, over the corresponding prior year amounts.

The growth in premiums earned in 2005 for voluntary auto was 13.3% and reflects a 12.4% increase in policies-in-force during the

past year. During the third quarter of 2004, GEICO began selling auto insurance in New Jersey which contributed to the policies-in-

force growth. Beginning in late 2004, rate decreases have been implemented in several states and underwriting guidelines have been

adjusted to better match prices with underlying risks which has resulted in relatively lower premiums per policy.

During 2005, policies-in-force increased 12.9% in the preferred risk markets and 10.7% in the standard and nonstandard

markets. Voluntary auto new business sales in 2005 increased 14.0% compared to 2004. Voluntary auto policies-in-force at

December 31, 2005 were 745,000 higher than at December 31, 2004.

Losses and loss adjustment expenses in 2005 totaled $7,128 million, an increase of 12.1% over 2004. The loss ratio

declined to 70.6% in 2005 compared to 71.3% in 2004 and 76.5% in 2003 primarily due to decreasing claim frequencies across all

markets and most coverage types. In 2005, claims frequencies for physical damage coverages decreased in the two to five percent

range from 2004 while frequencies for injury coverages decreased in the five to seven percent range. Injury severity in 2005

increased in the three to five percent range over 2004 while physical damage severity has increased in the five to eight percent range.

Incurred losses from catastrophe events totaled approximately $227 million in 2005 (primarily from the hurricanes in the third and

fourth quarters) compared to $71 million in 2004.

Underwriting expenses in 2005 totaled $1,752 million, an increase of 10.5% over 2004, which increased 15.1% over

2003. Policy acquisition expenses in 2005 increased 20.1% over 2004, reflecting increased advertising, underwriting and policy

issuance costs associated with the new business sales. Other underwriting expenses for 2005 decreased slightly from 2004.

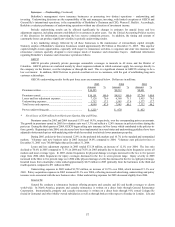

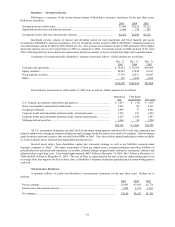

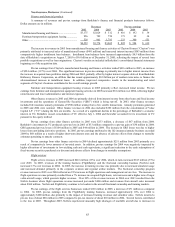

General Re

General Re conducts a reinsurance business offering property and casualty and life and health coverages to clients

world-wide. In North America, property and casualty reinsurance is written on a direct basis through General Reinsurance

Corporation. Internationally, property and casualty reinsurance is written on a direct basis through 91% owned Cologne Re

(based in Germany) and other wholly-owned subsidiaries as well as through brokers with respect to Faraday in London. Life and