Berkshire Hathaway 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

Management’s Discussion (Continued)

Property and casualty losses (Continued)

General Re (Continued)

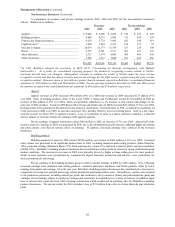

Loss triangles are used to determine the expected case loss emergence patterns and, in conjunction with expected loss

ratios by accident year, are further used to determine IBNR reserves. Additional calculations form the basis for estimating the

expected loss emergence pattern. The determination of the expected loss emergence pattern is not strictly a mechanical process.

In instances where the historical loss data is insufficient, estimation formulas are used along with reliance on other loss triangles

and judgment. Factors affecting loss development triangles include but are not limited to the following: changing client claims

practices, changes in claim examiners use of ACR’ s or the frequency of client company claim reviews, changes in policy terms

and coverage (such as client loss retention levels and occurrence and aggregate policy limits), changes in loss trends and changes

in legal trends that result in unanticipated losses, as well as other sources of statistical variability. These items influence the

selection of the expected loss emergence patterns.

Expected loss ratios are selected by reserve cell, by accident year, based upon reviewing indicated ultimate loss ratios

predicted from aggregated pricing statistics. Indicated ultimate loss ratios are calculated using the selected loss emergence

pattern, reported losses and earned premium. If the selected emergence pattern is not accurate, then the indicated ultimate loss

ratios will not be correct and this can influence the selected loss ratios and hence the IBNR reserve. As with selected loss

emergence patterns, selecting expected loss ratios is not a strictly mechanical process and judgment is used in the analysis of

indicated ultimate loss ratios and department pricing loss ratios.

IBNR reserves are estimated by reserve cell, by accident year, using the expected loss emergence pattern and the

expected loss ratios. The expected loss emergence patterns and expected loss ratios are the critical IBNR reserving assumptions

and are generally updated every year-end. Once the year-end IBNR reserves are determined, actuaries calculate expected case

loss emergence for the upcoming calendar year. This calculation does not involve new assumptions and uses the prior year-end

expected loss emergence patterns and expected loss ratios. The expected losses are then allocated into interim estimates that are

compared to actual reported losses in the subsequent year. This comparison provides a test of the adequacy of prior year-end

IBNR reserves and forms the basis for possibly changing IBNR reserve assumptions during the course of the year.

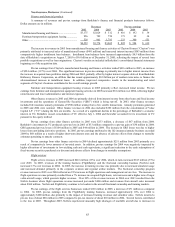

In certain reserve cells (such as excess directors and officers and errors and omissions) IBNR reserves are based on

estimated ultimate losses, without consideration of expected emergence patterns. These cells typically involve a spike in loss

activity arising from recent industry developments making it difficult to select an expected loss emergence pattern as has been

experienced from the recent wave of corporate scandals that have caused an increase in reported losses. Overall industry-wide

loss experience data and informed judgment are used when internal loss data is of limited reliability, such as in setting the

estimates for asbestos and hazardous waste claims. Unpaid environmental, asbestos and mass tort reserves at December 31, 2005

were approximately $1.8 billion gross and $1.3 billion net of reinsurance. Such reserves were approximately $1.6 billion gross

and $1.3 billion net of reinsurance as of December 31, 2004. Claims paid attributable to such losses were about $93 million in

2005.

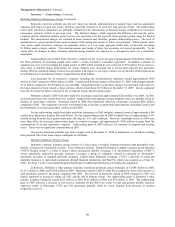

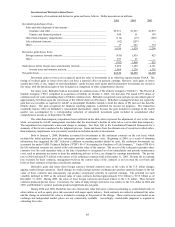

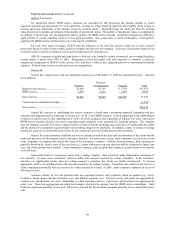

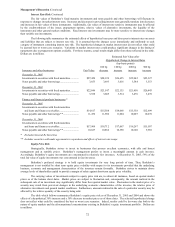

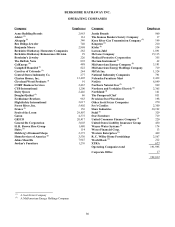

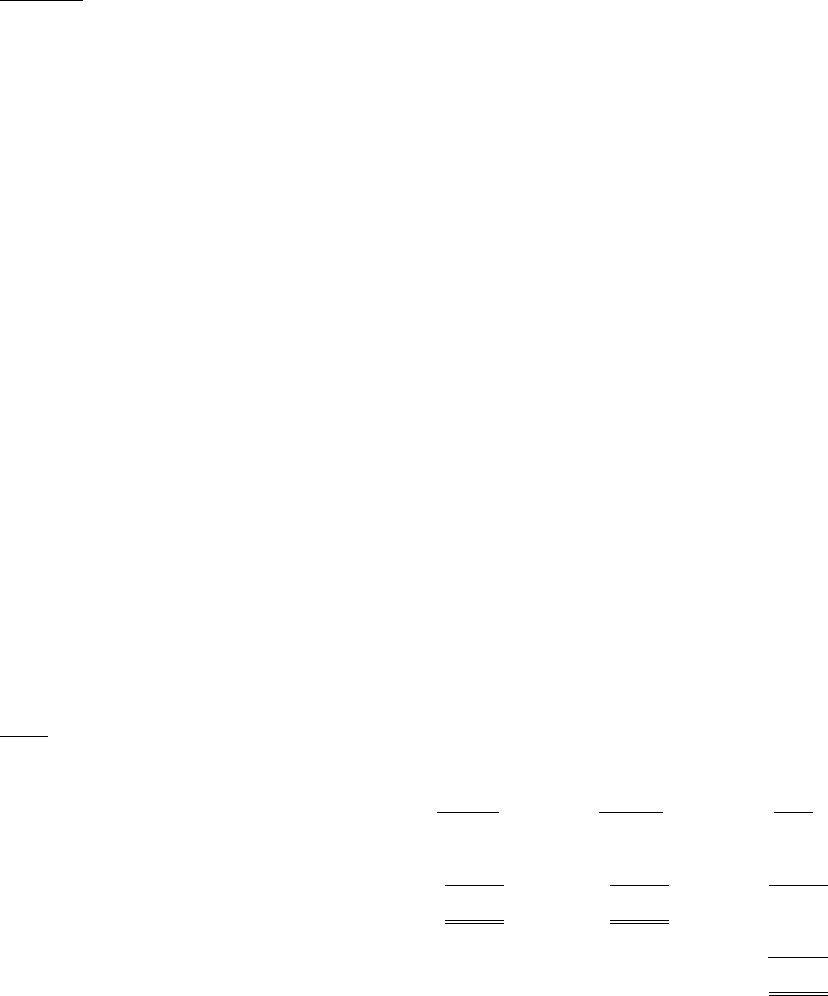

BHRG

BHRG’ s unpaid losses and loss adjustment expenses as of December 31, 2005 are summarized as follows. Amounts

are in millions.

Property Casualty Total

Reported case reserves .......................................................... $ 3,860 $ 1,476 $ 5,336

IBNR reserves ....................................................................... 997 1,900 2,897

Retroactive ............................................................................ — 8,969 8,969

Gross reserves ....................................................................... $ 4,857 $12,345 17,202

Ceded reserves and deferred charges..................................... (2,625)

Net reserves........................................................................... $14,577

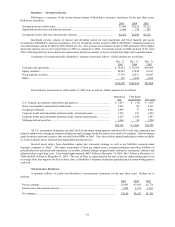

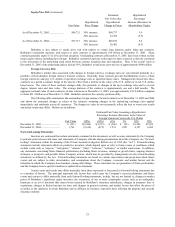

As of December 31, 2005, BHRG’ s gross loss reserves related to retroactive reinsurance policies were attributed to

casualty losses. Retroactive policies include excess-of-loss contracts, in which losses (relating to past loss events) above a

contractual retention are indemnified or contracts that indemnify all losses paid by the counterparty after the policy effective

date. Retroactive losses paid in 2005 totaled $969 million. The classification “reported case reserves” has no practical analytical

value with respect to retroactive policies since the amount is derived from reports in bulk from ceding companies, who may have

inconsistent definitions of “case reserves.” Reserves are reviewed and established in the aggregate including provisions for

IBNR reserves.

In establishing retroactive reinsurance reserves, historical aggregate loss payment patterns are analyzed and projected

into the future under various scenarios. The claim-tail is expected to be very long for many policies and may last several

decades. Management attributes judgmental probability factors to these aggregate loss payment scenarios and an expectancy

outcome is determined. Due to contractual limits of indemnification, the maximum losses payable under retroactive policies are

approximately $11.5 billion as of December 31, 2005.