Berkshire Hathaway 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 25

BERKSHIRE HATHAWAY INC.

ACQUISITION CRITERIA

We are eager to hear from principals or their representatives about businesses that meet all of the following criteria:

(1) Large purchases (at least $75 million of pre-tax earnings unless the business will fit into one of our existing units),

(2) Demonstrated consistent earning power (future projections are of no interest to us, nor are “turnaround” situations),

(3) Businesses earning good returns on equity while employing little or no debt,

(4) Management in place (we can’ t supply it),

(5) Simple businesses (if there’ s lots of technology, we won’ t understand it),

(6) An offering price (we don’ t want to waste our time or that of the seller by talking, even preliminarily,

about a transaction when price is unknown).

The larger the company, the greater will be our interest: We would like to make an acquisition in the $5-20 billion range.

We are not interested, however, in receiving suggestions about purchases we might make in the general stock market.

We will not engage in unfriendly takeovers. We can promise complete confidentiality and a very fast answer —

customarily within five minutes — as to whether we’ re interested. We prefer to buy for cash, but will consider issuing stock

when we receive as much in intrinsic business value as we give. We don’t participate in auctions.

Charlie and I frequently get approached about acquisitions that don’ t come close to meeting our tests: We’ ve found that if

you advertise an interest in buying collies, a lot of people will call hoping to sell you their cocker spaniels. A line from a

country song expresses our feeling about new ventures, turnarounds, or auction-like sales: “When the phone don’ t ring, you’ ll

know it’ s me.”

_____________________________________________________________________________________________

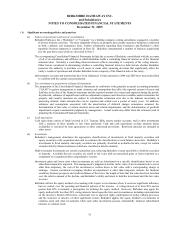

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Berkshire Hathaway Inc.

We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the

“Company”) as of December 31, 2005 and 2004, and the related consolidated statements of earnings, cash flows and changes

in shareholders’ equity and comprehensive income for each of the three years in the period ended December 31, 2005. These

financial statements are the responsibility of the Company’ s management. Our responsibility is to express an opinion on

these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United

States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the

amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe

that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of

Berkshire Hathaway Inc. and subsidiaries as of December 31, 2005 and 2004, and the results of their operations and their

cash flows for each of the three years in the period ended December 31, 2005, in conformity with accounting principles

generally accepted in the United States of America.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States),

the effectiveness of the Company’ s internal control over financial reporting as of December 31, 2005, based on the criteria

established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the

Treadway Commission and our report dated March 2, 2006 expressed an unqualified opinion on management’ s assessment of

the effectiveness of the Company’ s internal control over financial reporting and an unqualified opinion on the effectiveness

of the Company’ s internal control over financial reporting.

DELOITTE & TOUCHE LLP

Omaha, Nebraska

March 2, 2006