Berkshire Hathaway 2005 Annual Report Download - page 14

Download and view the complete annual report

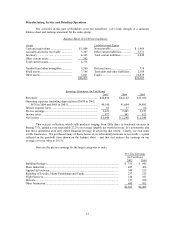

Please find page 14 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• In both our building-products companies and at Shaw, we continue to be hit by rising costs for raw

materials and energy. Most of these operations are significant users of oil (or more specifically,

petrochemicals) and natural gas. And prices for these commodities have soared.

We, likewise, have raised prices on many products, but there are often lags before increases be-

come effective. Nevertheless, both our building-products operations and Shaw delivered respect-

able results in 2005, a fact attributable to their strong business franchises and able managements.

• In apparel, our largest unit, Fruit of the Loom, again increased earnings and market-share. You

know, of course, of our leadership position in men’ s and boys’ underwear, in which we account

for about 48.7% of the sales recorded by mass-marketers (Wal-Mart, Target, etc.). That’ s up from

44.2% in 2002, when we acquired the company. Operating from a smaller base, we have made

still greater gains in intimate apparel for women and girls that is sold by the mass-marketers,

climbing from 13.7% of their sales in 2002 to 24.7% in 2005. A gain like that in a major category

doesn’ t come easy. Thank John Holland, Fruit’ s extraordinary CEO, for making this happen.

• I told you last year that Ben Bridge (jewelry) and R. C. Willey (home furnishings) had same-store

sales gains far above the average of their industries. You might think that blow-out figures in one

year would make comparisons difficult in the following year. But Ed and Jon Bridge at their

operation and Scott Hymas at R. C. Willey were more than up to this challenge. Ben Bridge had a

6.6% same-store gain in 2005, and R. C. Willey came in at 9.9%.

Our never-on-Sunday approach at R. C. Willey continues to overwhelm seven-day competitors as

we roll out stores in new markets. The Boise store, about which I was such a skeptic a few years

back, had a 21% gain in 2005, coming off a 10% gain in 2004. Our new Reno store, opened in

November, broke out of the gate fast with sales that exceeded Boise’ s early pace, and we will

begin business in Sacramento in June. If this store succeeds as I expect it to, Californians will see

many more R. C. Willey stores in the years to come.

• In flight services, earnings improved at FlightSafety as corporate aviation continued its rebound.

To support growth, we invest heavily in new simulators. Our most recent expansion, bringing us

to 42 training centers, is a major facility at Farnborough, England that opened in September.

When it is fully built out in 2007, we will have invested more than $100 million in the building

and its 15 simulators. Bruce Whitman, FlightSafety’ s able CEO, makes sure that no competitor

comes close to offering the breadth and depth of services that we do.

Operating results at NetJets were a different story. I said last year that this business would earn

money in 2005 – and I was dead wrong.

Our European operation, it should be noted, showed both excellent growth and a reduced loss.

Customer contracts there increased by 37%. We are the only fractional-ownership operation of

any size in Europe, and our now-pervasive presence there is a key factor in making NetJets the

worldwide leader in this industry.

Despite a large increase in customers, however, our U.S. operation dipped far into the red. Its

efficiency fell, and costs soared. We believe that our three largest competitors suffered similar

problems, but each is owned by aircraft manufacturers that may think differently than we do about

the necessity of making adequate profits. The combined value of the fleets managed by these

three competitors, in any case, continues to be less valuable than the fleet that we operate.

Rich Santulli, one of the most dynamic managers I’ ve ever met, will solve our revenue/expense

problem. He won’ t do it, however, in a manner that impairs the quality of the NetJets experience.

Both he and I are committed to a level of service, security and safety that can’ t be matched by

others.

13